This article was paid for by a contributing third party.More Information.

Creating business value: Measuring the return of improved data management

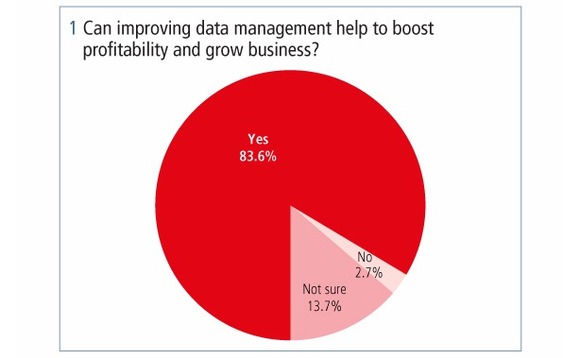

Enhancements to data management were previously driven by regulatory concerns, but eight out of 10 banks believe better data management could benefit their business and boost profitability, according to a Risk.net survey sponsored by Oracle Financial Services.

Introduction

From the front office to the back office, data lies at the heart of almost every process in the financial services industry, and regulation has added considerably to the data burden facing banks. Improving data management offers the potential not just to increase banks’ efficiency in a more tightly regulated environment, but also to boost their underlying profitability.

This detailed survey of C-level executives, risk managers and data management professionals highlights the value that can be gained from more effective data governance and management, but it also reveals that many firms are not there yet. As banks continue to address the demands of regulation in the years to come, the survey shows that the benefits of placing robust data at the centre of every project go well beyond compliance – but banks don’t feel they are there yet.

Regulation requires not just that banks report in much more granular detail, but also that they show an audit trail for their decision-making. That means the industry needs to take control of its data to ensure that it can always be trusted. As part of this process, banks should realise that data is an asset that can be used to run businesses better and raise profitability

Ambreesh Khanna, Oracle Financial Services

Articulating the business case

The survey results show that banks largely recognise the business case for improving data management. An overwhelming 83.6% of respondents agreed that improving data management could help to boost profitability and grow the business (see figure 1). While data might historically have been seen as a burden, it is becoming clear that, by increasing the granularity and accuracy of data across the organisation, banks will have greater trust in that data and should be able to make business decisions with more confidence.

One example of this might lie in the risk and finance data relating to individual businesses. Once senior managers can access that data easily and have greater trust in its reliability, they can make more informed decisions about where to allocate budget going forward, which could ultimately increase profitability.

“Redeploying financial and human resources to the profitable parts of a business is an important process that might previously have taken three or four months but, by putting proper data governance in place, performance can be compared much more easily and business decisions can be made instantly,” says Howard Mather, principal consultant at Oracle Financial Services.

The potential benefits do not stop at the initial deployment of resources, however. Once business decisions have been made, a robust data architecture should allow banks to monitor their impact on an ongoing basis, and to react quickly to changes made internally and by competitors.

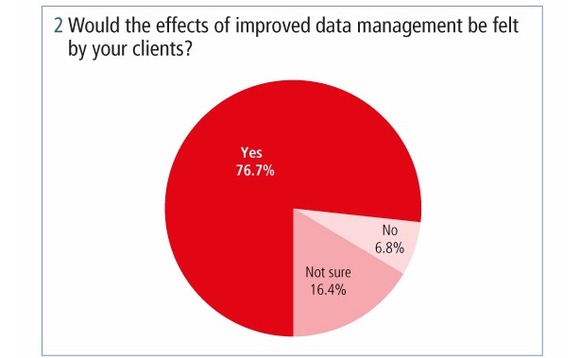

As banks reap the rewards of more effective data management, 76.7% of respondents felt that clients should also see the effects (see figure 2). That might happen in several ways – in some cases it may be evident simply in an improved level of service provision, but some banks may also be able to offer better services at lower cost, presenting a win-win to their clients.

Rather than being a huge corporate chore, data management is fast becoming an essential tool that is needed to retain clients and stay alive in the market. If done properly, it should allow banks to risk- and profit-weight business lines, products and services and become more competitive and innovative in the creation of new products and services, which clearly benefits clients

Howard Mather, Oracle Financial Services

Grappling with BCBS 239

Notwithstanding the compelling business case that can be made for addressing data management within an organisation, much of the impetus for change in recent years has inevitably come from regulation rather than internal rationale. Every regulation that has been drafted since the financial crisis carries significant data implications, not least the onerous reporting requirements embodied in new trading rules driven by the Group of 20.

But a set of principles for effective risk data aggregation and risk reporting – finalised in early 2013 by the Basel Committee on Banking Supervision and now widely known as BCBS 239 – has become the focus of much of the industry’s effort on data management in recent years. The 14 principles cover issues ranging from governance, data architecture and IT infrastructure, to accuracy, completeness and timeliness of data generation and reporting.

Global systemically important banks were given until this year to comply with the principles, but a second progress report, published by the Basel Committee in January 2015, found that 14 of the 31 participating banks expected to be unable to comply by 2016. Establishing strong data aggregation governance, architecture and processes had proved particularly difficult, the Basel Committee reported.

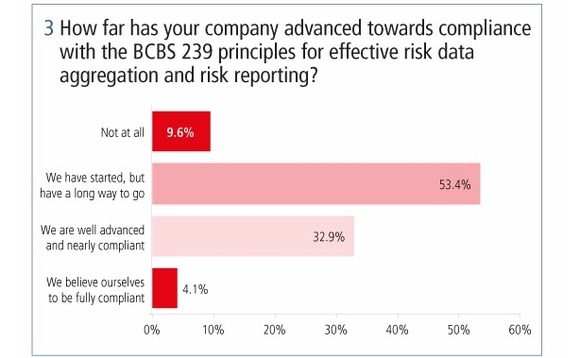

While banks should have made further progress in the 18 months that have elapsed since the progress report was published, many appear still to be struggling with the provisions of BCBS 239. A majority of 53.4% of survey respondents indicated they had started on BCBS 239 compliance but still have a long way to go, while just 4.1% believe themselves to be fully compliant at this stage (see figure 3).

“These principles are proving to be really challenging, because they require banks to go all the way back to show the source of where the data has come from and how particular numbers have been calculated. For most firms it is still a work in progress that could take some time to complete but will ultimately be needed to deal with the demands of other regulations,” says Mather.

As well as setting out requirements for governance and aggregation of data, the Basel Committee principles also deal with reporting practices, on the basis that good data alone does not constitute good practice – it needs to be presented to the right people at the right time to ensure risk is managed effectively.

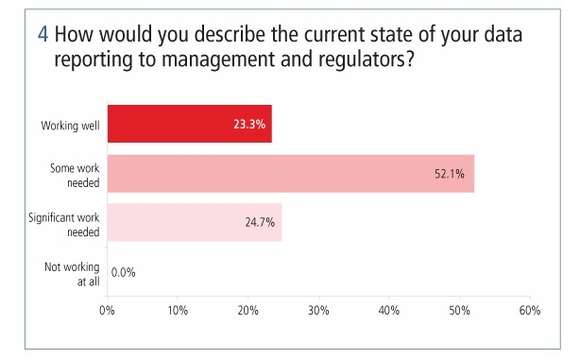

Among other requirements, BCBS 239 demands that risk management reports must accurately and precisely convey aggregated risk data and must cover all material risk areas within an organisation, communicating the information clearly and concisely. Reporting is also a work in progress, however, as just 23.3% of respondents indicated that data reporting to management and regulators is working well at this stage (see figure 4).

Clear and transparent reporting to management is essential if banks are to realise the goal of raising profitability, but generating the relevant outputs to deliver the necessary insights requires firms to deftly handle massive historical data sets in real time. It’s no surprise that many banks are still struggling with this”

Howard Mather, Principal Consultant, Oracle Financial Services

Addressing governance

The first principle of BCBS 239, which requires that banks’ risk data aggregation and reporting practices should be subject to strong governance arrangements, is likely to have been the first step for many banks, and should theoretically help to create an infrastructure through which other requirements can be met.

Specifically, the Basel Committee recommends that risk data aggregation and reporting practices should be fully documented and subject to high standards of validation and should be properly considered as part of any new business or IT initiative. Board executives and senior management are asked to review and approve risk data frameworks and to fully understand their intended coverage and limitations.

Such governance arrangements could be a fairly substantial change for those entities that have historically managed data within business silos, without a holistic view of risk data accessible to senior management. While it may be challenging to implement, most market participants appear to recognise the potential upside.

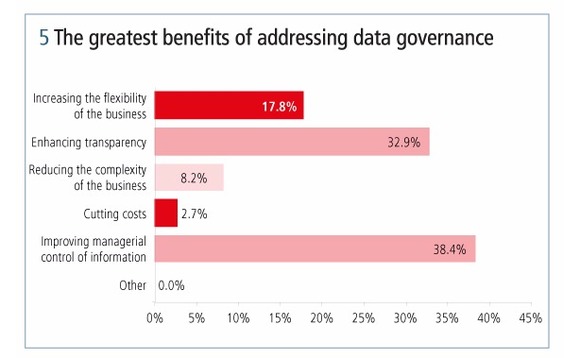

Asked what would be the greatest benefits of addressing data governance, 38.4% of respondents cited improved managerial control of information, while 32.9% opted for enhanced transparency and 17.8% said it could increase the flexibility of the business (see figure 5).

Other benefits of enhanced data governance include a reduction in the complexity of businesses and the potential to reduce costs, but these options attracted just 8.2% and 2.7% of the survey vote, respectively (see figure 5). From an accounting perspective, sound data should help to reduce complexity, but it is clearly trumped by the potential to increase transparency to senior management.

Knowing exactly where data is and having confidence that it is complete and accurate is really critical, because it effectively gives management 20:20 vision across the enterprise. If they’re not weighed down by the burden of data reconciliation and doubt, they can use the data in much more creative ways – indeed, data can be viewed as a reusable asset across the enterprise’s functions

Howard Mather, Oracle Financial Services

Bolstering risk management

Beyond the potential boost to profitability and client retention, an enhanced data architecture is also an essential component of effective risk management. The fourth of the BCBS 239 principles requires that banks must be able to capture and aggregate all material risk data across the bank, and that it should be available by business line, legal entity, asset type, industry and region.

In reality, that means banks need a single internal data repository that can be quickly sliced and diced according to the needs of a particular business. In an environment in which banks have had to raise their defences against cyber crime and market manipulation, as well as more traditional risk types, a single data set is often the foundation of those defences.

“It is, to some extent, common sense but, if banks trust their data and can bring together all sources of structured and unstructured data in one place, it allows them to protect themselves from attack on all fronts and, ultimately, to avoid the damaging loss of money or reputation,” says Mather.

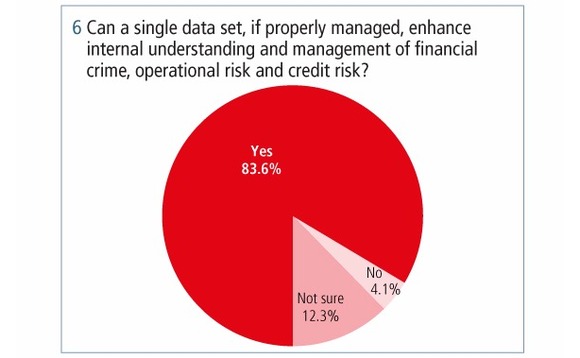

A clear majority of 83.6% of survey respondents believed a single, well-managed data set could enhance the understanding and management of financial crime, operational risk and credit risk (see figure 6). The benefits of taking an enterprise-wide approach to data could be wide-ranging, meaning data is not replicated many times across different businesses, and staff know where they need to go when they need a particular data attribute.

There is an important distinction that must be drawn, however, between structured and unstructured data. Structured data may be easier to manage and classify, but banks also need to find ways of dealing with the explosion of unstructured data, which is likely to require more refined systems and processes.

Traditional database structures and governance frameworks were not designed for the huge volume of unstructured data that now needs to be managed. It requires much greater diligence and governance to manage that data and use it to protect an institution from reputational risk or cyber crime

Howard Mather, Oracle Financial Services

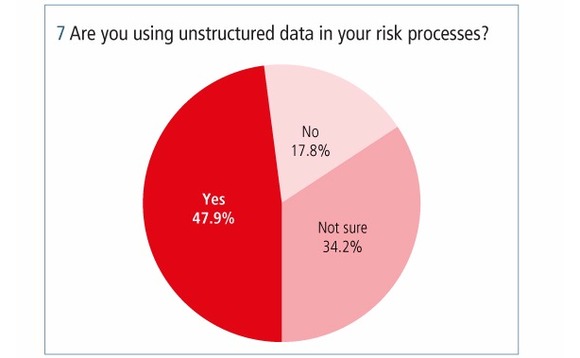

One example is in dealing with social media, as sophisticated data management can enable banks to monitor key channels such as Twitter and Facebook for any negative commentary about their business and protect themselves in real time. Market participants appear to recognise the need for such capabilities, with 47.9% of respondents already claiming to use unstructured data as part of their risk processes (see figure 7).

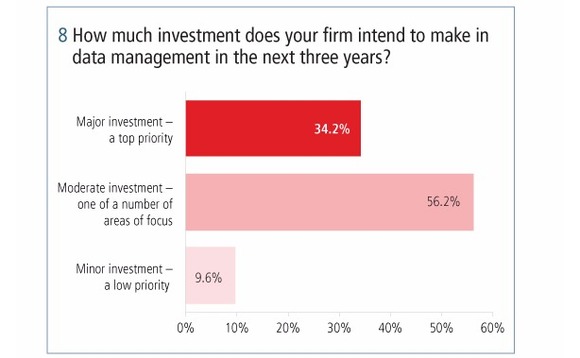

That proportion should rise close to 100% in the years to come, Mather believes, as banks have no option but to invest in their data management capabilities to remain competitive. Over the next three years, 34.2% of respondents expect to make major investment in data management a top priority, while 56.2% see it as one of a number of areas that will require moderate investment (see figure 8).

Data is an asset, and just like any other asset we need to monetise it. However, since we are one of the most regulated industries, the regulators want assurance that we have a handle on the governance of this asset. The trick is to make sure we don’t sacrifice one for the other – use data for regulatory purposes with a full governance structure in place, and yet exploit it to drive the bank’s profitability

Ambreesh Khanna, Oracle Financial Services

Conclusion – Not there yet

In summary, the survey clearly shows a widespread recognition of the need to address data management and the benefits of doing so. Driven not just by BCBS 239 but also by potential profitability gains, many banks have set out on a journey towards a more effective data governance framework and a unified data set that is easily accessible to senior management.

But there is still a long way to go, and banks will need to continue investing in data well into the future if they are to grow their businesses and attract new clients. The investment projections indicated by survey respondents suggest this will happen, but banks cannot afford to neglect their data management.

About this research

Oracle Financial Services and Risk.net received 100 valid responses to the survey, which was conducted during May 2016. Respondents were drawn from bank employees who work in risk, data management and technology. They were asked if they thought better data management could help boost profitability and grow businesses, if improved data governance could be beneficial to businesses, and whether the current state of data reporting to management and regulators is working well enough. The survey was carried out using SurveyMonkey and marketed through Risk.net. The results were collated from respondents who answered >80% of the survey. Respondents were drawn from the following regions: Africa (2.1%), Asia-Pacific (20.6%), Europe (39.2%), North America (37.1%) and South America (1.0%).

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net