This article was paid for by a contributing third party.More Information.

Leading the way in the risk management (r)evolution

In an ever-evolving regulatory environment for risk management requiring immediate reporting and decision-making, advanced technology and highly specialised services are crucial to being successful and reacting promptly to new business and regulatory needs.

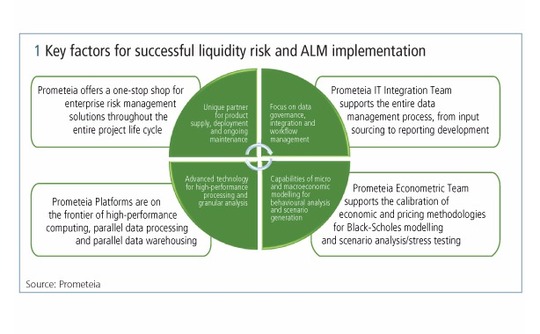

Italian consultancy and risk technology firm Prometeia is emerging globally as a leading risk management boutique, as evidenced by its recent rating as the best in the world for liquidity risk and asset/liability management (ALM) solutions (figure 1) in the 2016 RiskTech100 report compiled by Chartis Research.

Prometeia has been supporting financial institutions in the measuring and management of Interest rate risk in the banking book and liquidity risk since the early 1990s.

Prometeia has been supporting financial institutions in the measuring and management of Interest rate risk in the banking book and liquidity risk since the early 1990s.

“We owe this award primarily to our clients,” says Andrea Partesotti (left), head of Prometeia’s enterprise risk management division. “Our strong willingness to solve their business needs has been the most important engine of growth. We have shaped our delivery model, developed solutions and leveraged our in-house economic research department to reach what is our ultimate goal – to satisfy the customer and to build a long term ‘partner-like’ relationship.”

“We owe this award primarily to our clients,” says Andrea Partesotti (left), head of Prometeia’s enterprise risk management division. “Our strong willingness to solve their business needs has been the most important engine of growth. We have shaped our delivery model, developed solutions and leveraged our in-house economic research department to reach what is our ultimate goal – to satisfy the customer and to build a long term ‘partner-like’ relationship.”

In the 2016 RiskTech100 rankings, Prometeia rated among the top three companies for customer satisfaction, with the same score it achieved in 2015 when it won first place in this category. This rating confirms that Ermas, its modular and customisable solution for risk management, continues to make the client feel that it is at centre stage.

A unique business model

One of the key issues for financial institutions when investing in risk technology is that spending a lot of money does not always mean getting the expected result. There are no simple ‘plug-and-play’ solutions in the industry. On the contrary, they must be integrated into the bank’s IT framework and business processes. With this in mind, Prometeia has been implementing its solutions with in-house staff.

“This is a game changer,” continues Partesotti. “There is a ‘risk transfer’ from the client to us – we get paid when the solution works. The final result depends critically on our work. This is particularly important, especially in the emerging markets. A lot of money has been wasted in situations where the solution was good, but either it was impossible to make it work or the cost and duration of the projects became excessive.”

Prometeia also leverages the expert knowledge of finance and risk modelling provided by other units of the company dedicated to economic and financial research. “This means our solutions are not just ‘empty boxes’ to be filled in,”says Partesotti. “The company’s philosophy is to embed cutting-edge models and algorithms for ALM and liquidity risk management, in line with international best practices and compliant with evolving regulations.”

Nonetheless, the solutions are also highly flexible and customisable, so that every financial institution can integrate its own models, assumptions and parameters. The solutions are complemented by full customer support, including advisory services in the development and calibration of internal models and macroeconomic scenarios. These are then integrated into the ALM and liquidity solutions and support all types of static and dynamic simulations and stress testing.

The technological edge

Prometeia has increasingly been investing at the frontier of technological innovation – a crucial enabling factor to measure risk with complex algorithms and/or shared processes. Prometeia’s Ermas suite has been developed within three main pillars: performance, usability and flexibility. Using the most advanced techniques of high-performance computing, parallel data processing and parallel data warehousing, it provides the scalability and the performance necessary to meet the most challenging requirements for financial risk measurement production.

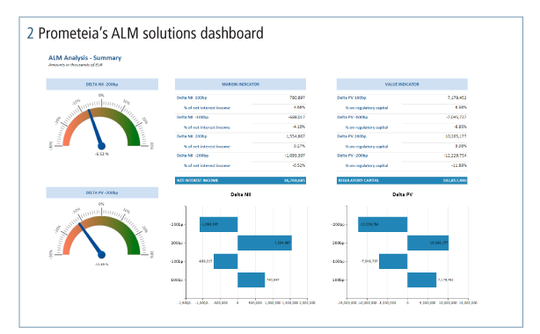

“Leveraging in-memory technology, we provide our end-users with powerful dashboards (figure 2) and an easy-to-use interface, enabling interactive visualisation, data enquiry, ‘what-if’ analysis and near real-time processing,” explains Partesotti.

The software development and delivery model, combined with the wide offering of system integration and extract, transform, load tools, allows Ermas to meet the client’s specific needs, while drastically reducing rollout and project delivery time as well as reducing the maintenance and application management costs. Regarding these last two points, the capability to support cloud distributions allows the provision of pay-per-use and turnkey solutions.

The future of risk

In the near future, financial institutions will take steps to remove the traditional separation between chief risk officer (CRO) and chief financial officer processes, systems and data. They will embrace a new paradigm where risk management and planning and performance management are effectively integrated. Partesotti says, “CROs need to combine forecasts and business plan assumptions into their processes for a full forward-looking analysis, while finance departments need to access all relevant risk information for consistent strategy, capital management and budgeting purposes.”

The ALM process is at the centre of this new framework, taking into account its traditional objectives of managing interest rate and liquidity risk exposures, and the new extended scope of steering the whole balance-sheet dynamics with the integration of credit/interest/liquidity risk drivers.

The future of the risk technology market

Once again, innovation will make the difference. Partesotti says, “Prometeia will continue to provide cutting-edge performance with our applications to satisfy new market requirements.”

The most interesting challenge today is the adoption of big data technologies to process huge, highly detailed amounts of financial data. Partesotti says, “The Hadoop Ecosystem will represent a real revolution in the financial application field, increasing scalability and performance while strongly reducing the total cost of ownership of software solutions.”

The international risk technology market is also changing as most of the historical vendors, in particular in the ALM and liquidity risk space, start merging or partnering with multinational IT companies.

Prometeia is focused on remaining independent while expanding beyond its core markets. Partesotti emphasises the pillars of Prometeia’s long-term strategy for global expansion: “We have trained a team of highly specialised advisers with multiple and complementary expertise (ALM and liquidity, credit risk modelling, risk integration), who represent our front line in all key projects abroad. Their goal is to collect the best practices developed by leading banks in Europe and propose them as benchmarks for emerging markets. Of course, all projects are deeply customised to meet the local regulatory requirements and managerial needs.”

The company’s foreign branches are the key second pillar, providing local market presence. After successful openings in Beirut, Istanbul, Moscow and London, Prometeia is planning to establish a direct presence in other countries. “The most important mission of our international offices is to train the local workforce, which is able to speak the language of our clients and interact effectively within their cultural environment,” says Partesotti.

The third pillar is Prometeia’s network of international partners, supporting the delivery of risk projects where local branches are not present. “We dedicate considerable resources to train our local partners and provide them with the capabilities needed to meet our high standards,” says Partesotti. “A local consulting company can qualify for delivering Prometeia’s solutions only after an intensive education programme, tailored by the Prometeia Academy, in line with their role in the project and the specific needs of the client, who is always at the heart of everything we do.”

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net