Benchmark misery will continue to plague banks

Index rigging caused $574 million of op risk losses in May, writes Megan van Ooyen from SAS

Megan van Ooyen is a senior associate business operations specialist in the OpRisk Global Data group at SAS in North Carolina

Benchmark manipulation losses dominated the news in May. As Citi can attest, banks continue to feel the sting for their role in manipulating interbank interest rates, years after the scandal first erupted. Such long-lasting effects do not bode well for the newest benchmark scandal – the impact of which has just begun to be felt by financial firms.

The Libor scandal started to unfold in earnest in June 2012, when Barclays admitted it had allowed interest rate derivatives traders to influence the submissions its treasury department made for Libor, the London interbank offered rate, and Euribor, the euro interbank offered rate.

Barclays’ settlement heralded an onslaught of joint agreements between banks and various regulatory agencies, including the US Department of Justice, the US Commodity Futures Trading Commission (CFTC) and the UK Financial Conduct Authority (FCA). Citi escaped the initial wave of settlements unscathed, but its reprieve was temporary. In 2010, the bank told the CFTC that it and two subsidiaries, Citigroup Global Markets Japan and Citibank Japan Ltd, had manipulated Libor and Tibor, the Tokyo interbank offered rate.

When the financial crisis broke in 2008, rising market instability led Citi to submit increasingly high dollar rates as part of its Libor submission. Somewhat ironically, executives worried the submissions would draw negative media attention: if the rate at which Citi could borrow was high, that meant the market considered it to have higher credit risk. So they ordered the bank’s treasury department to submit lower rates. At the same time, traders at Citigroup Global Markets Japan in Tokyo persuaded employees at Citibank Japan Ltd to submit favourable rates, instead of rates that reflected actual market conditions. The CFTC fined Citi $175 million in May for its actions. Judging from previous Libor settlements, there is a possibility Citi will have to answer to other regulators soon.

Although Libor refuses to relinquish the headlines, the new benchmark scandal du jour surrounds the US dollar IsdaFix – an index of benchmark rates for dollar interest rate swaps, which was originally set up by the International Swaps and Derivatives Association.

Prior to its reform in 2014, IsdaFix involved a panel of banks submitting swap spreads to London-based interdealer broker Icap every day at 11am New York time. Following the Libor scandal, suspicions soon arose about whether those spreads were accurate, and by early 2014 investors and regulators had begun pressing for more information. The floodgates opened in May 2015, when Barclays paid $115 million to the CFTC for manipulating dollar IsdaFix rates.

Libor has taught us that index-rigging cases are rarely one-bank operations, and it was only a matter of time until other firms found themselves nursing losses. In May this year, the dam burst, and banks handed over an additional $574 million in penalties and civil settlements. That included Citi, which received a $250 million civil penalty. The bank acknowledged its traders conspired to execute transactions in order to sway rate submissions one way or the other. Citi also admitted it intentionally submitted rates to Icap that favoured its own positions – not those it would have actually paid or received.

Not long after suspicions were originally raised about IsdaFix, a group of investors led by the Alaska Electrical Pension Fund filed a lawsuit against Icap and 13 panel banks. The investors accused the banks of using chat rooms and other methods to discuss the rates, before ‘banging the close’ – or rapidly executing trades just before the 11am fixing time in order to sway rates in their favour. After a failed attempt to get the lawsuit dismissed, Bank of America, Barclays, Citi, Credit Suisse, Deutsche Bank, JP Morgan and Royal Bank of Scotland (RBS) collectively agreed to settle for $324 million in early May. Icap and six other banks continue to dispute the allegations.

Megan van Ooyen

Megan van Ooyen

Click here to enlarge, or tap image on app

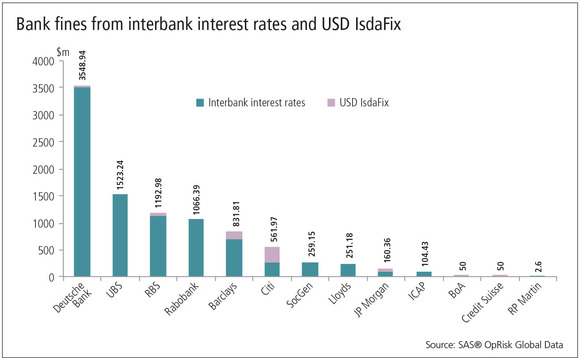

To date, some financial firms have suffered more than $1 billion in losses due to lawsuits and regulatory penalties for index manipulation. So far, Deutsche Bank has taken the biggest hit, at $3.55 billion, followed by UBS ($1.52 billion), RBS ($1.19 billion), Rabobank ($1.07 billion) and Barclays ($832 million).

Despite this, the pain is not yet over. If the Libor fallout is any indication, you can expect IsdaFix manipulation penalties to plague banks for the next several years.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Esma won’t soften regulatory expectations for cloud and AI

CCP supervisory chair signals heightened scrutiny of third-party risk and operational resilience

AI spend in US could be good for bonds in Europe – finance chiefs

Development of AI is capital-intensive, but adoption less so, which could favour EU

Climate risk managers’ top challenge: a dearth of data

Risk Benchmarking: Banks see client engagement and lender data pooling as solutions to climate blind spots – but few expect it to happen soon

BPI says SR 11-7 should go; bank model risk chiefs say ‘no’

Lobby group wants US guidance repealed; practitioners want consistent model supervision and audit

At BNY, a risk-centric approach to GenAI

Centralised platform allows bank to focus on risk management, governance and, not least, talent in its AI build

Many banks yet to factor climate into credit risk models

Risk Benchmarking: More than a third of banks do not quantify climate risk impact on credit portfolios, study finds

We’re gonna need a bigger board: geopolitical risk takes centre stage

As threats multiply, responsibility for geopolitical risk is shifting to ERM teams