This article was paid for by a contributing third party.More Information.

The benefit of a dynamic approach in making hedging decisions

Most corporates have hedging policies in place, typically stipulating the types of instruments and tenor – and possibly the style of hedging – that can be used as part of corporate hedging activities. Unlike in a trading book, corporates need to take a view upon hedging activity, for example, choosing whether to have floating or fixed interest payments in a loan book entails a view that can be strategic and/or tactical. The exposures held will impact the company over a long-term period and, as a result, a need to incorporate market cycles arises. Awareness of generally greater cycle lows and highs often provides the impetus for a shift to a more extreme position within the set policy stipulated range.

There seems to be additional value in being more precise in determining when to adjust hedging and when to use different hedging instruments at different times, as llustrated by the two real-life case studies set out in this article. The author studies and reports some observed results using variability and mean reversion in financial markets (‘what goes up, must come down’) and variability in company results, for creating this additional value. Mean reversion can be observed, for example, in most unpegged currency and interest rate spots, forwards, implied volatilities and skews. The interval during which mean reversion takes place varies; the EUR/USD foreign exchange spot means reversion takes place more often than in EUR 10-year interest rate spot or EUR/RUB forex skew. The corporate cycles vary depending on corporate and industry, some being more cyclical with market trends than others.

Case study 1 – European corporate and variable level of optimal percentage and maturity of fixed rate of debt

The first case study looks at a European corporate with earnings before interest, tax, depreciation and amortisation (EBITDA), which is mildly positively correlated with interest rate cycles and a high level of indebtedness. The mild positive correlation allows the company to benefit from higher earnings, typically when interest rates rise. The high level of leverage/indebtedness means interest costs bear a high weight in earnings, and reducing the risk from floating interest rates can have a directly minimising effect on the corporate earnings risk. At the low levels of EUR interest rates at the end of 2013, the company is tempted to extend its duration from the existing five years to 15 years.

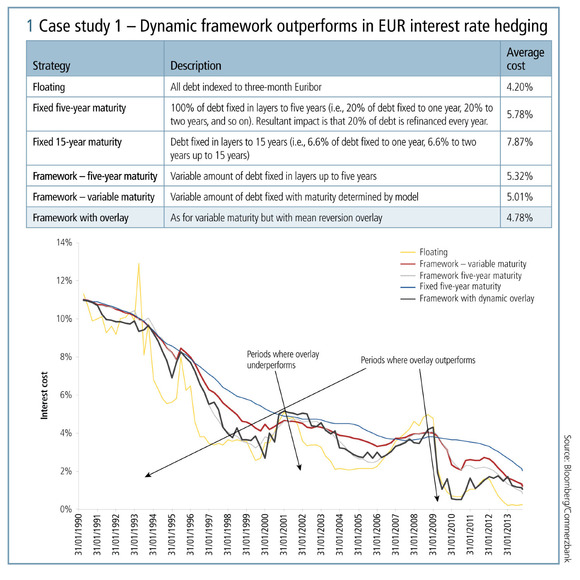

An optimisation based on the level of historic risk to the company’s earnings, including consideration for EBITDA volatility, leverage, as well as current and possible future levels of interest rate curves – using Commerzbank Corporate Solutions’ earnings-at-risk (EaR) model – however, shows an optimal fixed percentage and maturity for the business’s debt portfolio would currently be 65% fixed for two years only. A back-test is additionally performed, illustrated in figure 1, comparing the cost of debt from having had debt in fully floating rates (“floating”), to constantly holding the debt duration at five years (current, “fixed five-year maturity”) and 15 years (considered by company, “fixed 15-year maturity”). Additionally, the portfolio is tested using the results from the EaR model on a yearly basis: either keeping the five-year maturity and varying the level of fixed-rate debt in the portfolio (“framework – five-year maturity”); or varying both the maturity and level of fixed-rate debt in the portfolio, as per the results of the model (“framework – variable maturity”).

The result of the complete back-test shows that varying the degree of fixed-rate and maturity of debt as the levels of corporate cyclicality, indebtedness and rates change would have resulted in better rates than either static five- or 15-year debt durations, or when five-year debt is kept constant but the amount of fixed-rate debt is varied. Additionally, when mean reversion signals from rates and implied volatility are used in the back-test, a further improvement in the results is observed. The back-test is further extended to 1972 through bond market data and shows also an improved result from the use of the dynamic models (not shown).

Case study 2 – European corporate adopting a variable instrument-hedging model for ruble hedging

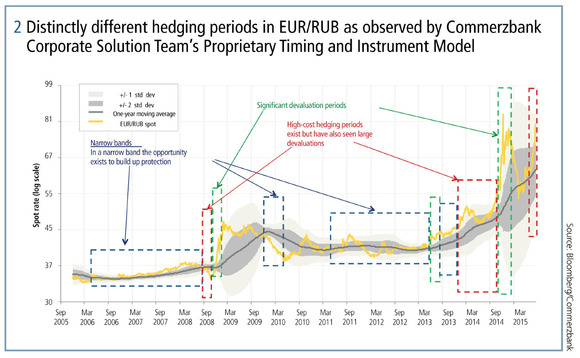

In this example, in autumn 2014, a European company with a sizeable equity investment and dividends in RUB observed a high likelihood for a large negative impact on its key performance metrics through a possible further devaluation in the currency. The company’s management had, in the past, decided not to hedge RUB risk due to the perceived high hedging costs. A variable hedging method, which uses different instruments at different times, is designed by Commerzbank Corporate Solutions for the client to put forward to the company’s board for approval. The basic idea in this case is the observation that risk premiums in emerging markets vary significantly more than in developed markets from period to period. This is due to two factors: perceived high risk premiums and relatively low liquidity. The former encourages risk-taking, even when risk premiums are negative – such as in 2007, when interest rates in RUB, for example, were at times lower than those in EUR. The latter means corrections are usually high in magnitude when they eventually take place, such as those observed in 2008–2009 and again in 2014–2015.

In this example, the company recognises four highly distinct EUR/RUB market conditions (figure 2) through the created Commerzbank Timing and Instrument Model (TIM). The periods are:

• those with narrow trading conditions combined with, typically, low-risk premiums;

• those with high-risk premiums;

• those with extreme volatility; and

• anything in between.

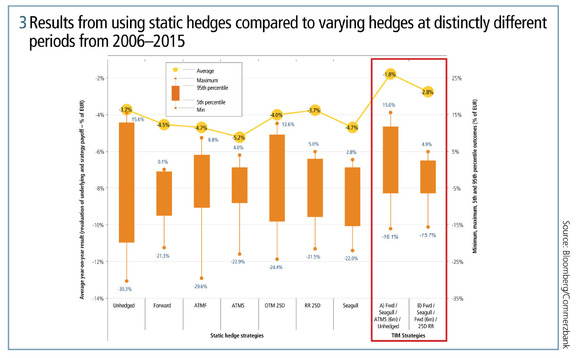

The TIM suggests value in using different instruments for hedging the risk accordingly at different times (figure 3). This compares hedging costs from using various static strategies – not hedging at all, forward hedging, hedging via options – to using the TIM for signalling which instruments to use at which time. The TIM strategies outperformed static strategies both in terms of average cost (yellow circles, left-hand scale) and in terms of maximum risk observed (orange circles, right-hand scale) in the back-test.

In conclusion – as per the studies and observations made by the Commerzbank Corporate Solutions – across various underlying risks, rather than keeping one hedging method in place consistently, there is value in adding variability to the method as market conditions change, in terms of degree, style, maturity and/or instrument for hedging. This reduces both the cost of hedging and the risk, simultaneously.

Read/download the article in PDF format

The views expressed in this article are those of the author and are not necessarily those of Commerzbank, and this communication has been prepared independently of Commerzbank. No representations, guarantees or warranties are made by Commerzbank with regard to the accuracy, completeness or suitability of the data.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net