This article was paid for by a contributing third party.More Information.

Collateral and counterparty tracking: Emerging initial margin requirements

Ongoing market uncertainty over the new and evolving margin regime for non-cleared over-the-counter derivatives has drawn many questions from firms, with too few reliable answers.

This global survey – conducted by Risk and sponsored by IBM – is one of the first, comprehensive attempts to shed some light on industry preparations and covers issues such as methods for computing initial margin, the increased collateral requirements and restrictions on rehypothecation, and the impacts on collateral operations. Questions focused on how industry practices are evolving under regulatory change, and the responses reveal where market participants are heading.

Finalised in September 2013, the Working Group on Margin Requirements’ (WGMR) rules for non-cleared derivatives outline a new paradigm for the over-the-counter (OTC) derivatives market. The initial margin requirements will be phased in annually from 2015 to 2019, impacting the largest entities first, as per the schedule devised by the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions (Iosco). The aim is to mitigate systemic risks by mandating central clearing of standardised OTC derivatives, and establishing a conservative global margining framework for non-cleared transactions, where firms must post initial margin on a regular, two-way basis, in addition to variation margin.

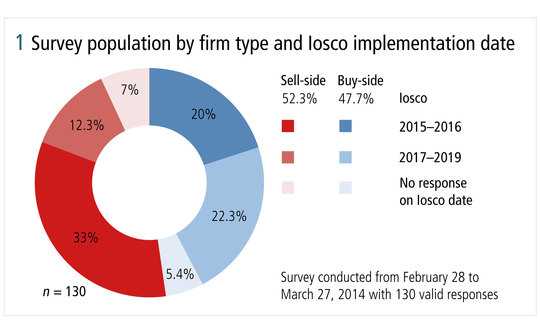

The first two phase-in dates of December 2015 and December 2016 will impact firms with a total outstanding gross notional amount on non-cleared OTC derivative contracts of €3 trillion and €2.25 trillion, respectively. Figure 1 shows that 53% of firms polled report that they are required to comply during these first two years, based on their current portfolio, and these firms are under the most pressure to transform their business practices.

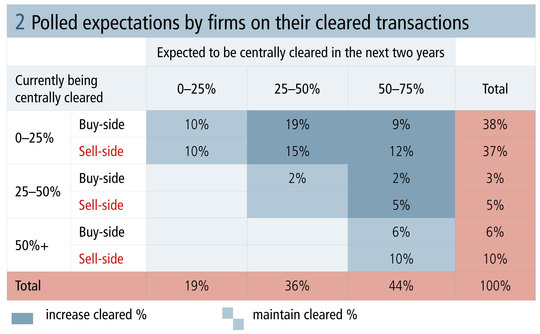

Under looming implementation dates, figure 2 shows that 62% of firms polled expect to notably increase the proportion of derivatives transactions that are centrally cleared. As trading patterns change, it is expected that new OTC derivatives transaction types will become available for central clearing. However, when asked to quantify what portion of transactions are likely to be too complex to be centrally cleared, 17% of firms reported that more than 30% of their transactions are expected to remain uncleared.

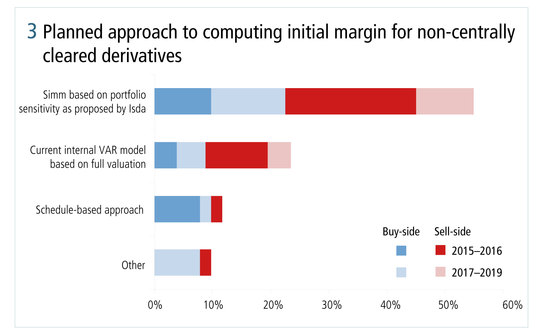

For non-cleared trades that fall within the WGMR scope, firms must decide how they want to calculate initial margin requirements – and quickly. As figure 3 shows, the prospect of computing the requirements using the standard initial margin model (Simm) under development by the International Swaps and Derivatives Association (Isda) is the most popular option among larger dealers, who will be the first to comply with mandatory initial margin requirements. This is an understandable preference given the tight timelines for these firms, where in the absence of a standard model, their alternatives are to either apply a punishing margin schedule drawn up by the regulators themselves, or rapidly muster the resources to submit models of their own for supervisory approval. The use of internal models, while likely the most capital-efficient, are what many fear will lead to an unmanageable number of disputes if proprietary calculation methodologies diverge in ways that prove too challenging for firms to reconcile effectively.

Despite high hopes that the Simm approach will become a standard risk-based methodology for initial margin calculation that is computationally light and yet still complies with WGMR requirements – when firms were asked if Simm will satisfy regulators, 21% polled thought approval was ‘not likely’ and 70% remained ‘undecided’.

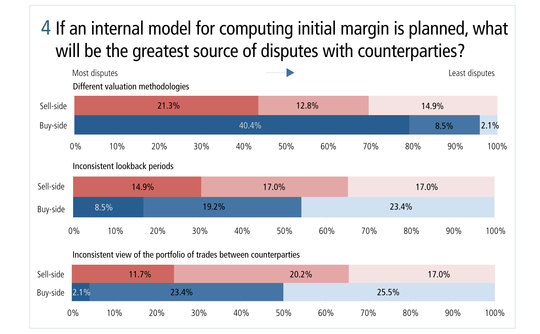

Internal models may then be the best option for firms, provided that a process can be put in place to efficiently manage disputes with counterparties. As figure 4 illustrates, 62% of all firms polled – 21% sell-side and 40% buy-side – ranked different valuation methodologies of internal models as the greatest source of disputes between counterparties versus the potential for disputes from inconsistent lookback periods or an inconsistent view of the portfolio of trades between counterparties.

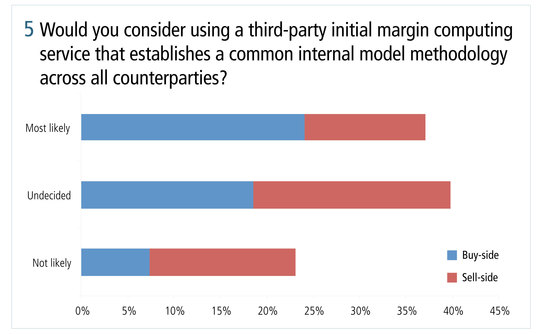

Resolving valuation disputes could involve counterparties adopting a third-party margin-computing service as an independent standard, and 37% of firms said that they would ‘most likely’ consider adopting such an approach, and 40% of firms remained undecided.

With the enactment of WGMR requirements for initial margin on non-cleared trades, it is clear that competing demands for liquid assets will drive collateral to become an increasingly scarce and expensive commodity. In addition to this collateral consumption impact, firms will be forced to make widespread operational changes around current margin collection and segregation processes in response to tightening rehypothication restrictions that will create additional collateral sourcing pressures. When polled on infrastructure plans, 44% plan to enhance existing systems only; 27% expected to add a new vendor solution to their enhancements; and 13% were considering a new vendor solution apart from their existing system.

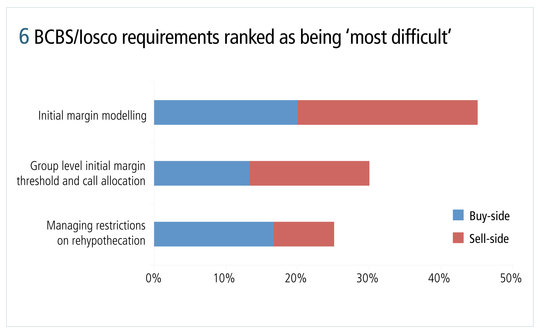

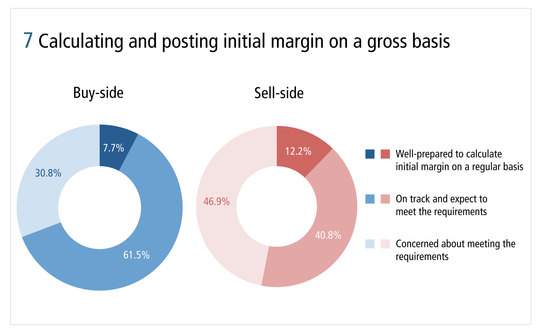

Of firms polled, 45% ranked initial margin modelling requirements as the most difficult aspect of meeting the rules, as shown in figure 6. Figure 7 shows that less than 10% of all firms polled feel they are well prepared to calculate initial margin on a regular basis, and 47% of sell-side firms reported being concerned with meeting the requirements, versus only 31% of buy-side firms, likely due to the relative complexities of their infrastructures and the number of counterparties each type transacts with.

Of the firms polled, 53% expected to support the calculation of initial margin with their existing risk system, while 38% expected to adopt a new risk system.

Rehypothecation of collateral has been made deliberately more difficult by the rules, with stricter eligibility criteria and collateral permitted to be reused only once between counterparties. It is unsurprising, therefore, that 61% of firms polled say that they are ‘not likely or undecided’ on whether they will rehypothecate under the new rules.

The chief concern related to rehypothecation seems to be the ability to track the qualifying conditions under which rehypothecation is allowed, with 27% saying they expected tracking to be very difficult, and 59% who said they felt some additional risk would accrue to their collateral security rights when receiving rehypothecated collateral under the new framework.

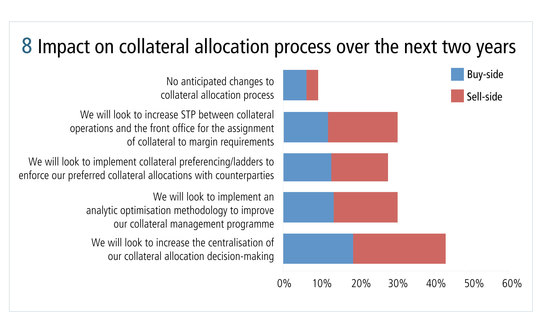

The vast majority of firms polled say that, over the next two years, they plan to make changes to their collateral allocation processes as a result of the WGMR rules, as figure 8 shows. Of the options presented, the most popular response, at 43%, was that firms will look to increase the centralisation of their collateral allocation decision-making, which is closely linked to investments in other priority areas; straight-through processing of collateral selection/booking at 31% and implementation of collateral optimisation methodologies at 28%. Collectively, this indicates that firms are looking to make investments in technology to improve operational efficiency in ways that can reduce the funding costs of collateral and improve their risk management capabilities.

Clearly then, even given the remaining uncertainty of the WGMR rules, firms are busying themselves with meeting the requirements. The question of whether firms will be ready in time depends greatly on when the requirements will be enacted. And, when asked, over half of firms expect the rules to be delayed – though most of them expect the delay to be less than 12 months.

Download/read the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net