This article was paid for by a contributing third party.More Information.

Emir countdown raises cost questions for the buy side

European buy-side firms have until December before the largest derivatives users are required to start clearing their trades, but some say the deadline has already arrived. Under so-called frontloading provisions, all trades executed from this week onwards will be subject to the clearing requirement when the mandate kicks in – a fact that is raising questions about the sector's preparedness, and could have an immediate impact on pricing and liquidity.

Some banks and asset managers have been warning clients for months that they could face higher costs during the frontloading period if they are not yet able to clear – and quotes at any level may be harder to come by.

"I don't think anybody on the buy side or the sell side is very keen to carry on doing bilateral trades when we know they will have to be cleared by December 21. We briefed our affected clients on this some time ago and have been working towards May 21 as the mandatory clearing date," says Barry Hadingham, head of derivatives and counterparty risk at Aviva Investors in London.

The European Market Infrastructure Regulation (Emir) requires that category two derivatives users – generally big buy-side firms – must retroactively clear transactions entered into during a seven-month period prior to the start of the clearing obligation. As mandatory clearing for interest rate swaps takes effect for category two firms on December 21, the frontloading window during which swaps will have to be cleared began on May 21.

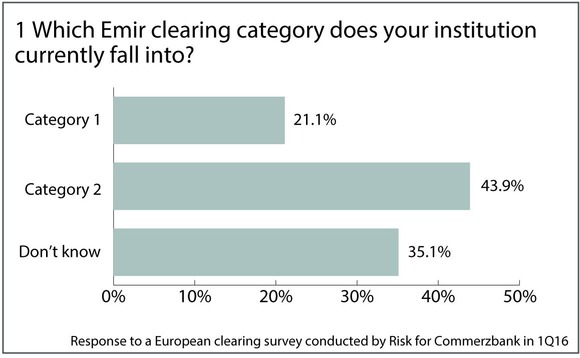

It is not clear exactly how many firms will fall into category two, but estimates range from the low hundreds to somewhere north of 1,000. Category one clearers, for which frontloading began on February 21 and mandatory clearing will start on June 21, are only those banks that are members of an authorised central clearing counterparty (CCP). Category two includes counterparties with an average of more than €8 billion in outstanding gross notional of non-centrally cleared derivatives during the first three months of this year.

Entities already clearing should see no impact from the start of the category two frontloading window, but those that have not yet made the necessary preparations may find it more difficult to trade clearing-mandated swaps in the coming months.

Spreads may widen, for example, as dealers begin to price in the risk of trading uncleared derivatives that will have to be cleared before the year-end. And as the start of the formal clearing obligation edges closer, buy-side firms may have a tough job getting signed up with clearing brokers in time.

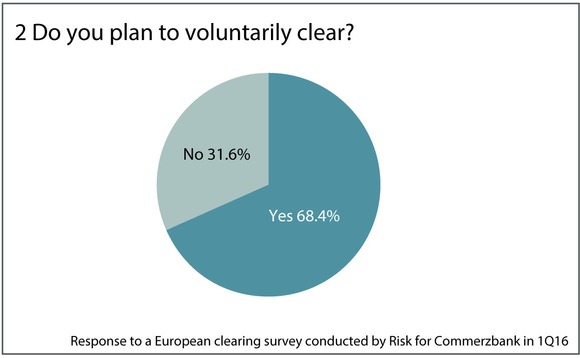

"Theoretically, transactions can still be traded on a bilateral basis during this frontloading period, but given they will have to be cleared before December 21, there is little rationale for not clearing immediately. It's not yet evident what proportion of category two firms are ready to clear, but frontloading could create a fundamental split between cleared and uncleared business," says Nick Chaudhry, head of derivatives execution and clearing services at Commerzbank.

I don't think anybody on the buy side or the sell side is very keen to carry on doing bilateral trades when we know they will have to be cleared by December 21. We briefed our affected clients on this some time ago and have been working towards May 21 as the mandatory clearing date

Barry Hadingham, Aviva Investors

Pricing power

The new costs and workload associated with central clearing are off-putting for some on the buy side. Unless a firm faces a CCP directly – a service currently on offer at Eurex only – it will need to find an existing member to act as an intermediary, known as a clearing member or clearing broker; legal contracts have to be signed, and initial and variation margin posted. All of this can generate significant costs, depending on the size and nature of a firm's swaps book.

But putting it off could also now come with a cost.

"As dealers prepare for the start of the clearing obligation, they will want to focus on managing the clearing business as it comes in, rather than trying to backload a large number of trades. It's quite likely that bilateral swaps will become more expensive for that reason, or that dealers might reject trades with smaller firms that are not ready to clear," says Aviva's Hadingham.

As several of its clients fall into category two, Aviva Investors has been operationally ready to clear since 2014, having started the process of selecting clearing brokers as far back as 2010. Up to now, there has been no economic incentive to start clearing ahead of the mandate, but that is likely to change during the frontloading period.

"There has not yet been any significant price differential between cleared and non-cleared transactions, and there have been various pieces of market infrastructure such as segregated accounts that needed further work before we were fully comfortable. Those are now falling into place, so we expect to begin clearing imminently," Hadingham says.

Other firms are already clearing. Royal London Asset Management has both category two and category three clients, and has been accessing CCPs for some time. The firm started the process in 2012 and is now connected to several clearing brokers, says derivatives operations manager David Brown, so the frontloading deadline has not been a major concern.

"We always knew clearing was coming, so we got ourselves ready early on. As early adopters, we have been able to influence the broker offerings to some extent to make sure we get reasonable pricing and reporting in the format we need it. The safest option is to clear everything we can during this frontloading period to avoid any unexpected impact on pricing," he says.

Not everyone is expected to be this well prepared. Those who have had other priorities or missed the significance of the frontloading requirement could be in for a shock in the coming months. While there is no legal requirement to use clearing before the December 21 deadline, frontloading means dealers may be reluctant to build up large bilateral exposures in products subject to the clearing obligation, particularly if the client shows little sign of operational readiness.

In June 2015, the International Swaps and Derivatives Association published an Additional Termination Event Amendment Agreement, giving dealers the right to terminate a contract if it was entered into during the frontloading window, but cannot be cleared prior to the start of the clearing obligation.

The Isda agreement gives dealers the protection they will need for contracts that cannot be immediately cleared, but they may still be wary of taking on such trades if they are not confident of the client being able to clear them reasonably quickly.

"It's very likely that we will see spreads widen between cleared and uncleared trades subject to the clearing mandates, incentivising the buy side to put clearing provisions in place quickly. Depending on the scale of that market shift, we could well see liquidity for uncleared pricing decline as a result of the frontloading requirement," says Commerzbank's Chaudhry.

It's very likely that we will see spreads widen between cleared and uncleared trades subject to the clearing mandates, incentivising the buy side to put clearing provisions in place quickly

Nicholas Chaudhry, Commerzbank

Capacity constraints

Clearing may have been a long time coming in Europe, with the first buy-side mandate arriving three-and-a-half years after its US equivalent, but there are still concerns about a race to the finish line later this year and the possibility of there not being sufficient capacity among clearing brokers to support all of the firms that fall into category two.

"The exact numbers are not certain, but if we assume there could be as many as 1,200 entities looking to frontload in this period and just around 12 clearing brokers that will be in a position to on-board business, then there is clearly going to be limited capacity to support those firms that are not yet ready," warns Chaudhry.

Capacity could become a more vexing issue as the clearing obligation extends to smaller firms over the next two years. While the swaps portfolios of the largest category two firms might represent worthwhile clearing business for the dealers, the potential revenue will be much more marginal when it comes to smaller customers.

Category three firms, which include financial counterparties and alternative investment funds with a gross notional outstanding below the €8 billion threshold, will not be subject to frontloading but will be required to begin clearing interest rate swaps from June 21, 2017. Some firms are already concerned their business might not be sufficiently lucrative to make it worthwhile for the sell side.

"We have been clearing interest rate swaps since late 2014, but finding clearers that are responsive to taking on our business has proven quite difficult – it's a challenge that a lot of smaller buy-side firms are facing, especially those in category three. When we originally started looking for a clearing broker, we were refused by a number of banks, based on the size of our outstanding portfolio and potential business flows," says Neil Turnnidge, head of treasury at Europe Arab Bank (EAB).

EAB is currently clearing with just one broker – Commerzbank – and would like to add a second to make its business more robust, but with an outstanding portfolio notional of under €1 billion, the bank has yet to find another firm that will take it on. This puts EAB and derivatives users of a similar size in the difficult position of being legally required to clear, but not being able to safely access the infrastructure.

"Our business is not seen as cost-efficient for most swap clearers and we are having to pay a flat monthly fee for these services, which is probably the only way it can be worthwhile for a small swaps portfolio," Turnnidge explains.

"I do think category three companies of our size or smaller will struggle to find clearing brokers, which is a concern for the regulators as well as the industry. In addition, the capital benefits of having cleared rather than bilateral swaps on our books are being eroded by the fees we are having to pay."

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net