This article was paid for by a contributing third party.More Information.

Libor will not transition quietly – What you need to know now

Liang Wu, vice-president of financial engineering and head of CrossAsset product management at Numerix, discusses the scope of the transition from Libor to alternative reference rates – also known as risk-free rates (RFRs), including their characteristics, considerations for curve building and valuation modelling, liquidity issues, as well as the IT challenges associated with the transition

Entrenched in the markets since 1986, Libor is currently tied to approximately $400 trillion of financial contracts for derivatives, bonds, mortgages and retail and commercial loans. As Libor is so integral to the capital markets, the shift to RFRs could very possibly be the greatest challenge facing financial institutions today.

How large an undertaking will it be for market participants to transition from Libor to RFRs?

Liang Wu: For the past 30 or more years, Libor has been used in so many financial contracts that it is arguably the most important number in finance today. Despite the announcement that the sustainment of Libor will end in 2021, there remain new Libor-based contracts being issued in the market with maturities beyond 2021. As you can imagine, it will be a huge effort for the industry to transfer from such a well-known rate to RFRs.

This transition will involve undertaking some very complicated tasks, such as contract renegotiations, correctly placing fallback language in legacy contracts, new curve modelling and IT systems upgrades, among others. It will take significant time and effort to perform these tasks.

With 2021 closing in, there is also an urgency to build-up sufficient liquidity for the RFR market. We are just getting started in this regard, but there is a long way to go to help support a smooth transition.

What are the differing characteristics between Ibors and RFRs?

Liang Wu: Ibors and RFRs are very different. Ibors are often term rates that cover many different tenors, while RFRs are all overnight rates. In addition, Ibors are proxy rates for AA rated credit risk, while RFRs have minimum credit risk. RFRs are also based on actual transactions, while Ibors follow the ‘waterfall methodology’, which uses eligible transaction data where available before resorting to expert judgement.

Even though RFRs are intended to eventually replace Ibors, it is possible that, initially, a number of different benchmarks will co‑exist – such as RFRs being used together with Ibor rates or other overnight rates such as the Federal funds rate for the transition period.

New RFRs need robust curves. How do market participants go about building curves when underlying derivatives and cash markets may still be relatively illiquid?

Liang Wu: Liquidity for RFR derivatives is improving but, overall, is still rather weak. The most progress has been made in the sterling overnight interbank average (Sonia) market. Sonia swaps have been trading for a couple of years now, and Sonia futures have also been trading for a while – the number of contracts for both continues to increase, so liquidity there is good overall. Liquidity is not as good in the secured overnight financing rate (SOFR) swaps market, which is still very small, with just dozens of billions of dollars notional outstanding. The trading of SOFR futures, on the other hand, continues to grow in both the CME and LCH exchanges.

However, it largely remains the case that liquidity for the other RFRs – the Swiss average rate overnight (Saron) and the Tokyo overnight average rate (Tonar) – is lacking, and the euro short-term rate (€STR) is not scheduled for publication until early October. There are, however, things market participants can do in terms of curve building for them. There is not currently good liquidity in SOFR swaps, for example, but market participants can adopt a multi-curve approach. The idea is that you can prepare a Fed funds curve using liquid Fed fund-related instruments and then define your SOFR curve as a spread curve with respect to the Fed fund curve. In this way, the low-liquidity issue is addressed by extrapolating the short-end spread to the longer time horizon. Once the liquidity of SOFR swaps picks up, there will be more choices for curve instruments.

That said, liquidity is only one aspect when considering the building of robust RFR curves. What should also be reflected in the curve construction exercise is the ability to capture any potential jumps or drops in interest rates associated with central bank meeting dates, as well as being able to handle the turn effect, which happens at the end of the month, quarter or year based on supply and demand.

How does the International Swaps and Derivatives Association’s (Isda’s) fallback methodology impact contracts from a valuation perspective?

Liang Wu: It will bring in new valuation practices at the time of fallback triggering. Generally, for derivatives contracts, Libor projections and overnight index swap (OIS) discounting were previously already used in the valuation. When it comes to the new RFRs, replacing OIS discounting with RFR discounting is more or less straightforward, although you do need to have a robust RFR curve behind that.

In addition, in the case of the Isda fallback mechanism for a Libor rate being confirmed as a combination of one of the proposed adjusted RFR approaches and one of the proposed spread adjustment approaches, an immediate requirement in valuation would be to use this information in the forward Libor projection in the case of sudden discontinuation of the Libor rate. As a result, the forward-looking Libor fallback projection will consist of a projected adjusted RFR plus a spread.

Do you think applying a euro overnight index average (Eonia) spread to €STR will provide a stable platform to facilitate a smooth transition from Eonia to €STR?

Liang Wu: In my opinion, it will. The benefit should come in the form of a higher volume of €STR, because Eonia will be based more on actual transactions. Applying the spread to €STR would also provide the ability to leverage the existing Eonia derivatives market in the temporary transition period so the market can continue supporting Eonia curve construction as well as the valuation based on it.

Will the multi-curve approach incorporating €STR and the euro interbank offered rate (Euribor) still be applicable once €STR is published?

Liang Wu: Yes. If Euribor reform succeeds, the rate will not be discontinued at the end of the 2021 deadline. It is possible that demand for the Euribor term rate will remain. By following a multi-rate approach, people can still refer Euribor rates in various terms, while treating the €STR rate as the new overnight rate index.

How great an IT challenge does the transition to RFRs present to market participants?

Liang Wu: The IT challenge could be very significant. Becoming IT-ready will be a large project that will be handled, for most firms, under the duress of resource limitations and tight timelines. The legacy systems in use today likely have hard-coded curve instruments that were specifically designed only for Libor and/or the OIS rate. These cannot be used for RFRs and it is very likely these systems do not have the flexibility to evolve along with this pending market change.

Curve stripping will certainly become more challenging as key reference rates move from Libor to RFRs. This means the introduction of new curve instruments based on RFRs, in addition to new functionalities that will need to be implemented into existing instruments. It will therefore be essential to have technology that can accommodate new curve member instruments – there is no avoiding this.

From a high-level viewpoint, there are four core capabilities new technology must accommodate:

- On the trade-definition side, newly introduced RFR contracts should be able to be defined and recognised in an analytics library, and the legacy contract valuation should be able to be conducted if fallback is triggered in the event of Libor’s sudden discontinuation

- On the curve side, there should be a multi-curve framework that can easily connect with the existing Libor and OIS curves; various curve features should be available or integrated into the updated system. These include:

- Solving globally multiple curves simultaneously, and for different currencies

- Accommodating central bank meeting dates by being able to capture any associated potential jumps or drops in interest rates

- The capability of handling the ‘turn effect’, which usually happens at the end of the month, quarter or year based on supply and demand

- Allowing curves to be defined as spread curves, meaning one curve is defined via spread with respect to another curve

- Allowing different interpolation methods to be used for different segments of the same curve.

- The valuation module should be upgraded to be able to perform valuation on the new types of RFR contracts as well as on legacy contracts in the case of the discontinuation of Libor

- On the risk management side, exposure calculation, credit valuation adjustment and value-at-risk modules should all be upgraded to accommodate new RFR-based trades.

What is your primary message to firms regarding the transition journey?

Liang Wu: The time to start planning for the transition is now. Conduct your Libor exposure analysis to get an idea of how much you may be impacted by the transition, review the fallback language for current contracts and determine the robustness of the language as well as how the language can be amended to incorporate the latest fallback language proposed by Isda and/or working groups. Additionally, begin the communications process in both internal and external settings. Internally, create awareness of your firm’s Libor transition plan and generate consensus among key stakeholders. Externally, prepare a client outreach strategy and collect inputs from customers, partners and regulators.

Market participants should also recognise that the transition from Libor to RFRs could present significant difficulties in certain markets and products that are currently linked to Libor. Planning sooner rather than later could help establish a smoother transition.

The author

Liang Wu, Vice President of Financial Engineering and Head of CrossAsset Product Management, Numerix

Liang Wu is a vice president of financial engineering and heads up CrossAsset product management at Numerix. He has previously served as director of financial engineering in the client solution group at Numerix. Prior to joining Numerix in 2015, Wu worked at CME Group and HSBC in pricing and valuation, and model review roles. He holds an MSc degree in financial engineering from Columbia University, an MSc degree in space physics from Rice University and a BSc degree in geophysics from the University of Science and Technology of China.

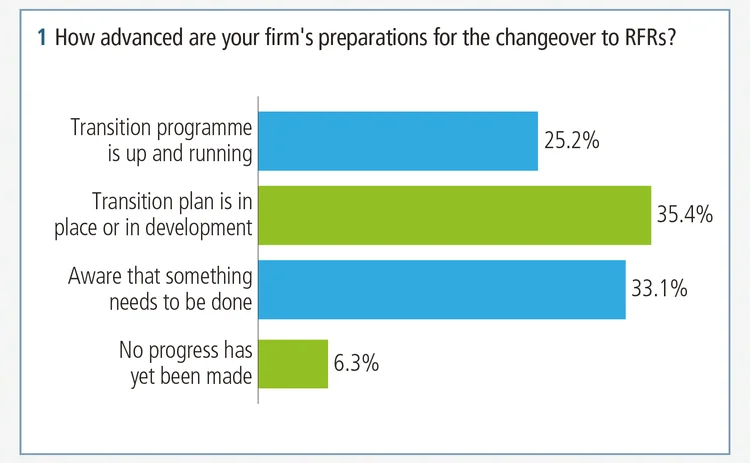

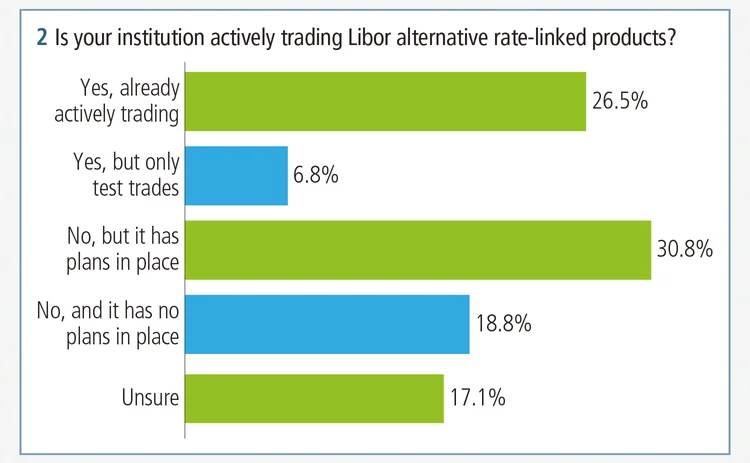

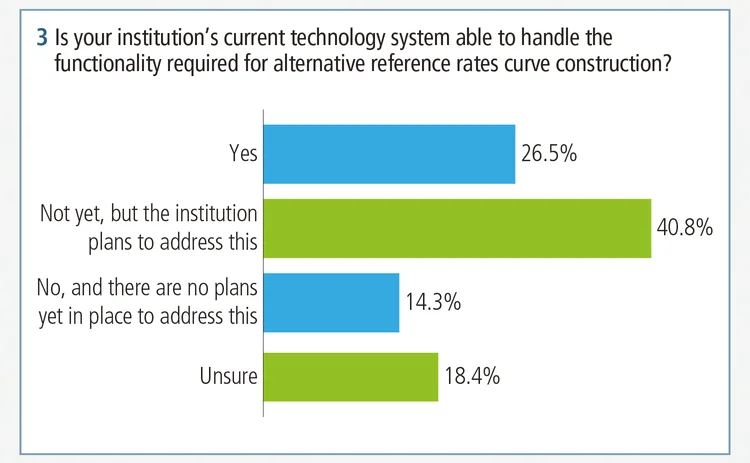

In a Risk.net webinar held in March 2019, participants were asked three poll questions related to their Libor transition progress:

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net