New UK anti-corruption unit plans close ties with banks

The International Corruption Unit, created this year by the UK government, has unveiled ambitious plans to enlist banks to help in the fight against global corruption. Nick Kochan reports

The UK government has streamlined its fight against corrupt foreign politicians and their advisers, who use the City of London to launder stolen assets. It has created a new body, the International Corruption Unit (ICU), within the UK’s National Crime Agency. The ICU brings together branches of each of the police forces that cover London: the City of London Police’s Overseas Anti-Corruption Unit; and the Metropolitan Police’s Proceeds of Corruption Unit.

The new force is making an unprecedented bid for the assistance of the financial community. Jonathan Benton, head of the ICU, says: “Financial institutions have enormous resources of information and expertise. We are looking to harness this to fight against corruption.”

The unit’s goal is to anticipate criminality before it has been perpetrated, replacing what it sees as the retrospective approach taken by law enforcement to white collar crime. Benton says the unit will have a covert intelligence capability. “Traditionally, white collar crime and money laundering has been a follow-the-money exercise. But now we’re in the NCA, I am moving us from being a paper-based, follow-the-money sort of investigative agency to [one that is] totally proactive, looking forward and using all the capabilities the NCA brings, including its international network, as well as the fantastic relationships we have with forums within the industry. To achieve this objective, we are continuing to talk to trade-based forums and conferences”.

This approach mirrors that of the Serious Fraud Office whose director, David Green, has drawn attention to the need to develop intelligence networks inside the financial community.

The new unit has an ambitious remit, says Benton. “We will take on the difficult cases that will have a huge ripple effect. We will target individuals that are committing crimes here in the UK. Many of these corrupt individuals are so powerful, influential and well-resourced that they are highly unlikely to face justice in their own country.” He cites the case of James Ibori (see box, James Ibori: The exposure of a corrupt PEP using the UK) as a success story that illustrates UK efforts to bring those who move corrupt assets through the UK to justice.

Regions targeted by the unit include Nigeria, the Middle East, east Africa and central Asia. The merged unit is expected to grow from its current headcount of 35 to a staff of 50 over the course of the next year. It will draw on the NCA’s global reach, the Metropolitan Police’s contacts with UK government departments – particularly the Department for International Development, which sponsors the new agency – and the City of London Police’s contacts inside financial institutions.

Information exchange

A key tool for the new unit will be Section 7 of the Crime and Courts Act 2015. The legislation facilitates contact between law enforcement and financial institutions, without having to resort to highly complex and time-consuming “production orders” and “mutual legal assistance” treaties. The Act is particularly useful in allowing for the informal exchange of information between the financial community and police. Benton cites a situation where officers have information that points to criminality but need corroboration or extra evidence that can only be found in a financial institution. Section 7 of the Act enables the ICU to provide confidential information to the business, and this can serve as the basis for investigation within the company.

Benton comments: “It is about saying: ‘How do we do this together?’ ‘How do we solve the problem together?’ in what are always very complicated problems. The Crime and Courts Act Section 7 is a very useful gateway.” The ICU liaises with money laundering reporting officers when working with the private sector, using the Joint Money Laundering Intelligence Taskforce [see box, The Joint Money Laundering Intelligence Taskforce]. Benton adds: “Through our Section 7 legislation we can share information that can be developed into one more piece to the jigsaw puzzle”.

Internal systems failures can cause banks to fail to provide information. Benton points to a lack of understanding of customers’ “footprints” inside the bank. He cites cases in which banks are unaware of connections between multiple accounts of individuals servicing the corrupt needs of a politician: “Financial Institutions are not always putting two and two together to see how accounts are linked. We understand financial institutions are approaching their intelligence capabilities in the same way that we have done for many years. This is proving helpful in understanding the global exposure financial institutions have, particularly in cases of politically exposed persons. Some financial institutions are growing their business intelligence and building charts to get an understanding of how it all works together. Bigger institutions are getting there. The problem is with smaller institutions that do not have the capacity to deal with complex clients.”

Police observe the disparity in scale of compliance between anti-money laundering (AML) staff in a global institution, which may number up to 3,000 employees, and a small bank with no more than an AML officer.

Piecing the puzzle

The challenge facing banks is to see through schemes devised to obscure links between corrupt politicians and their advisers laundering the politician’s corrupt assets. Advisers bring sophisticated accountancy, an understanding of the banking system and legal tools to structure secret relationships. Benton refers to one financial institution that “did not know how many accounts it had that were linked to family members. They hadn’t asked themselves: ‘What does this person look like to us?’”

Some banks have gone to law to resist supplying information requested by the authorities. In one case, law enforcement obtained a production order requesting information from a bank. One part of the bank agreed but other parts of the company, located offshore, were also required to hand over information. One subsidiary resisted, arguing local privacy laws prevented it passing on the information required officers, even though the bank as a whole was co-operating with police. “One part of the bank was fighting another part,” said an observer.

Benton questions the use of the Suspicious Activity Report (SAR) regime, which he says provides information that is retrospective and too often defensive. “In complex corruption, SAR reporting is not achieving what we need it to, it has not been as successful as we would like it to be.”

Investigators handling SARs also face onerous constraints. “The ways of reporting and legislative tools are making my job very difficult,” Benton says. “We need new ways to deal with large-scale, and very complex, grand corruption. We are dealing with people who have abused the power of public office for private gain. They will have often engaged in this corrupt activity for a very long time, perhaps decades. We have to unpick the money around an individual to see if it is the proceeds of corruption in the 31 days allowed to us.”

Scrutiny of a suspicious individual is painstaking. The examination starts by looking at the answers he gives to due diligence questions about the sources of funds used to open an account. “You have to ask where the original money came from. That is where he is likely to tell the first lies. So we will ask the bank for all the information it can provide on the client, going back seven years. You need to conduct hundreds – if not thousands – of Egmont enquiries, where we are ask Financial Intelligence Units (FIUs) around the world to check out the target [the Egmont Group is an informal network of 132 national FIUs]. A whole host of our investigations will involve 20 or 30 different jurisdictions. Because of privacy legislation in force in some jurisdictions, the international bank may find that it cannot see what is happening on the other side of the world.”

The unit is working with non-governmental organisations such as Transparency International to develop new routes to pursue corrupt money. These include following up proposals for new enforcement tools, such as the corrupt enrichment orders already in place under Irish law, and the “unexplained wealth orders” outlined in a recent Transparency International report. Benton says: “These are tools that may help. They are based on civil process and this is a very different regime. This is a technically different process than the criminal route.”

The Joint Money Laundering Intelligence Taskforce

The Joint Money Laundering Intelligence Taskforce (JMLIT), established by Section 7 of the Crime and Courts Act 2015, facilitates the transfer of between UK law enforcement and financial institutions. Launched in October 2014, the JMLIT has three sections. The Strategic Group, chaired by Lloyds Banking Group, is composed of 25 UK and international banks, as well as representatives of government agencies. The group provides strategic direction and promotes the sharing of information of anti-money laundering typologies, focusing on four key strategic risks: trade-based money laundering; money laundering linked to human trafficking and organised immigration crime; money laundering linked to bribery and corruption; and terrorist financing.

The Operations Group is composed of vetted representatives from 10 banks, the National Crime Agency, the City of London Police, as well as other Government agencies and is “active in tactical intelligence and data sharing”. An introduction to the JMLIT, not previously published, states that the JMLIT Operations Group “assists banks and law enforcement to fill intelligence gaps where suspected money laundering crosses multiple financial institutions.” The document also says the group helps to speed up enquiries in the context of a formal information sharing agreement.

The third section, the Alerts Function, which comprises smaller banks and building societies, circulates assessments, trend reports and non-sensitive intelligence.

James Ibori: The exposure of a corrupt PEP using the UK

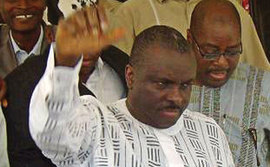

The conviction of James Ibori (pictured), the Nigerian state governor accused of stealing $250 million from the Nigerian public purse, provides the model for the successful functioning of the new International Corruption Unit. According to Jonathan Benton, head of the National Crime Agency’s International Corruption Unit, the key to the case was Ibori’s home country could not deliver justice, but the UK authorities had the legal framework to pursue the case. Ibori, who worked in the UK for many years prior to going to Nigeria, had stolen millions from his own country when he was a Nigerian state governor between 1999 and 2007, much of which was invested in expensive London property. He was subsequently charged in Nigeria with corruption but, armed with contacts inside the government of president Sani Abacha, Ibori waged a lobbying campaign that resulted him being cleared of 170 charges in 2009.

Ibori, who worked in the UK for many years prior to going to Nigeria, had stolen millions from his own country when he was a Nigerian state governor between 1999 and 2007, much of which was invested in expensive London property. He was subsequently charged in Nigeria with corruption but, armed with contacts inside the government of president Sani Abacha, Ibori waged a lobbying campaign that resulted him being cleared of 170 charges in 2009. Following a further unsuccessful attempt in Nigeria to charge Ibori, the UK authorities, led by the Metropolitan Police’s Proceeds of Corruption Unit, took up the case and investigated how the UK was used to absorb his corrupt funds. The UK authorities, working in conjunction with the Nigerian Economic and Financial Crimes Commission, had Ibori extradited from Dubai. In 2010, the former governor pleaded guilty to 10 counts of money laundering and conspiracy to defraud at Southwark Crown Court in London. Ibori received a 13-year prison sentence, which he is currently serving in the UK. His nine co-conspirators have also been convicted in the UK of corruption-related offences.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Prop shops recoil from EU’s ‘ill-fitting’ capital regime

Large proprietary trading firms complain they are subject to hand-me-down rules originally designed for banks

Revealed: the three EU banks applying for IMA approval

BNP Paribas, Deutsche Bank and Intesa Sanpaolo ask ECB to use internal models for FRTB

FCA presses UK non-banks to put their affairs in order

Greater scrutiny of wind-down plans by regulator could alter capital and liquidity requirements

Industry calls for major rethink of Basel III rules

Isda AGM: Divergence on implementation suggests rules could be flawed, bankers say

Saudi Arabia poised to become clean netting jurisdiction

Isda AGM: Netting regulation awaiting final approvals from regulators

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

CFTC chair backs easing of G-Sib surcharge in Basel endgame

Isda AGM: Fed’s proposed surcharge changes could hike client clearing cost by 80%

UK investment firms feeling the heat on prudential rules

Signs firms are falling behind FCA’s expectations on wind-down and liquidity risk management