Quant Guide 2017: Princeton University

Bendheim Center for Finance, Princeton, USA

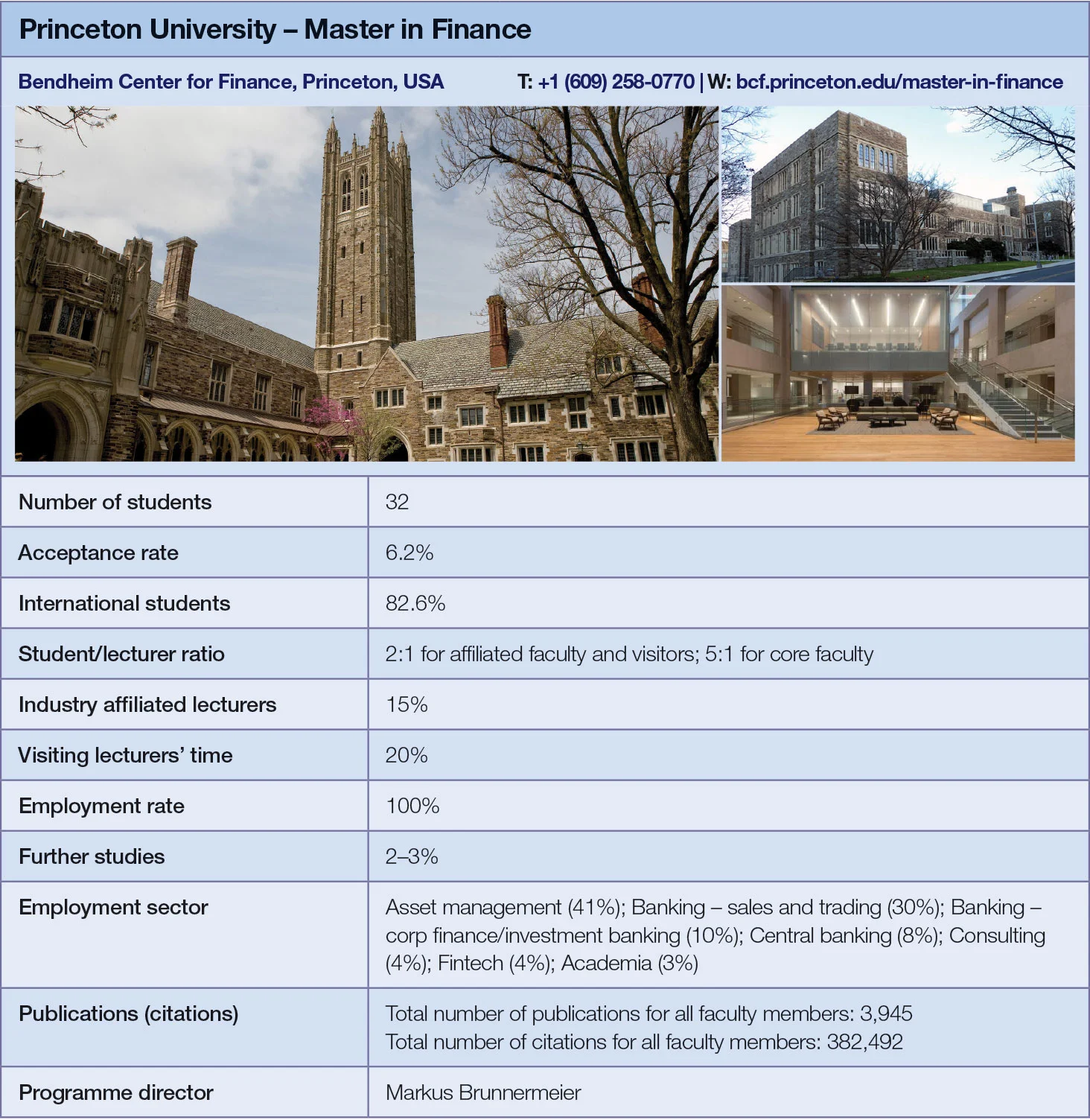

Master in Finance | metrics table at end of article

Princeton’s two-year master in finance programme was established in 1998. It is run within the Bendheim Center for Finance, the university’s interdisciplinary research hub. Its typical intake of students is around 30 – deliberately smaller than some larger rivals, says Wendell Collins, programme co-ordinator.

“We’re different in the size and scope. Princeton is a small university; so is the programme. There’s a customised collegial atmosphere where people really get to know each other: the faculty members, alumni mentors. That all translates into a strong alumni network which has been helpful to achieve a high level of career placements.”

An industry internship, completed in the summer between the first and second year of studies, is a core component of this degree. Another option is working on a summer research project under the supervision of a faculty member affiliated with the Bendheim Center.

“There’s great flexibility in terms of the types of electives students can take,” says Collins. “They have the five core courses, but then they can take machine learning, artificial intelligence, computer science, public policy, PhD workshops in econometrics.”

The programme draws on the expertise of a number of departments, including the departments of operations research and financial engineering, economics, and computer science. Courses that cover artificial intelligence and machine learning have traditionally been offered by Princeton’s engineering and computer science-focused programmes, but now they’re also available as part of the 11 elective courses offered by the master in finance programme.

The core courses are focused on economics, maths, finance, probability and statistics. Two weeks before the start of the programme, students must attend a mandatory maths refresher course which will help them adapt their existing knowledge of mathematics to the degree requirements.

The programme is regularly reviewed and updated to take account of emerging trends in the financial sector. One of the most recently added courses concentrates on venture capital and technology, with a focus on developments in the fintech field. Princeton held a fintech conference in April, covering topics such as roboadvising, blockchain and big data.

Chad Shampine, who graduated in 2003, is still involved in the programme as a boot camp speaker and an alumni mentor. He currently works as head of foreign exchange swaps and Asian non-deliverable forwards trading at Morgan Stanley in New York. Shampine found the breadth of Princeton’s master’s advantageous when he hit the trading floor.

“A course on corporate finance was very useful; it made it easier to understand things like balance sheets. A basic understanding of regulation was helpful too. Regulation’s not about models and programming: the rules tend to be blunt, and you have to understand how those things fit into the universe that we’re living in,” he says.

Students are expected to graduate with diverse programming skills: they get exposure to C++, R, MatLab and Python.

“During my internship after year one, I found that I was very well prepared; the internship was on a trading desk, where I still am. You learn the languages of the market, how swaps and fixed income work. Knowing how to program made it easier to hit the desk,” says Shampine.

Programming remains a fundamental skill that is essential for a quant role in an investment bank as well as in a buy-side firm, says Collins. “More and more students are interested in working on the buy side, given the regulation of banks. Considering the movement towards systematic and more electronic trading, having quantitative and programming skills has never been more important.”

The programme regularly sends students to the Rotman International Trading Competition at the University of Toronto. They also participate in contests organised by open-source quant fund Quantopian to design and backtest trading algorithms, for a cash prize.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director