Quant Guide 2017: Massachusetts Institute of Technology

Sloan School of Management, Cambridge, USA

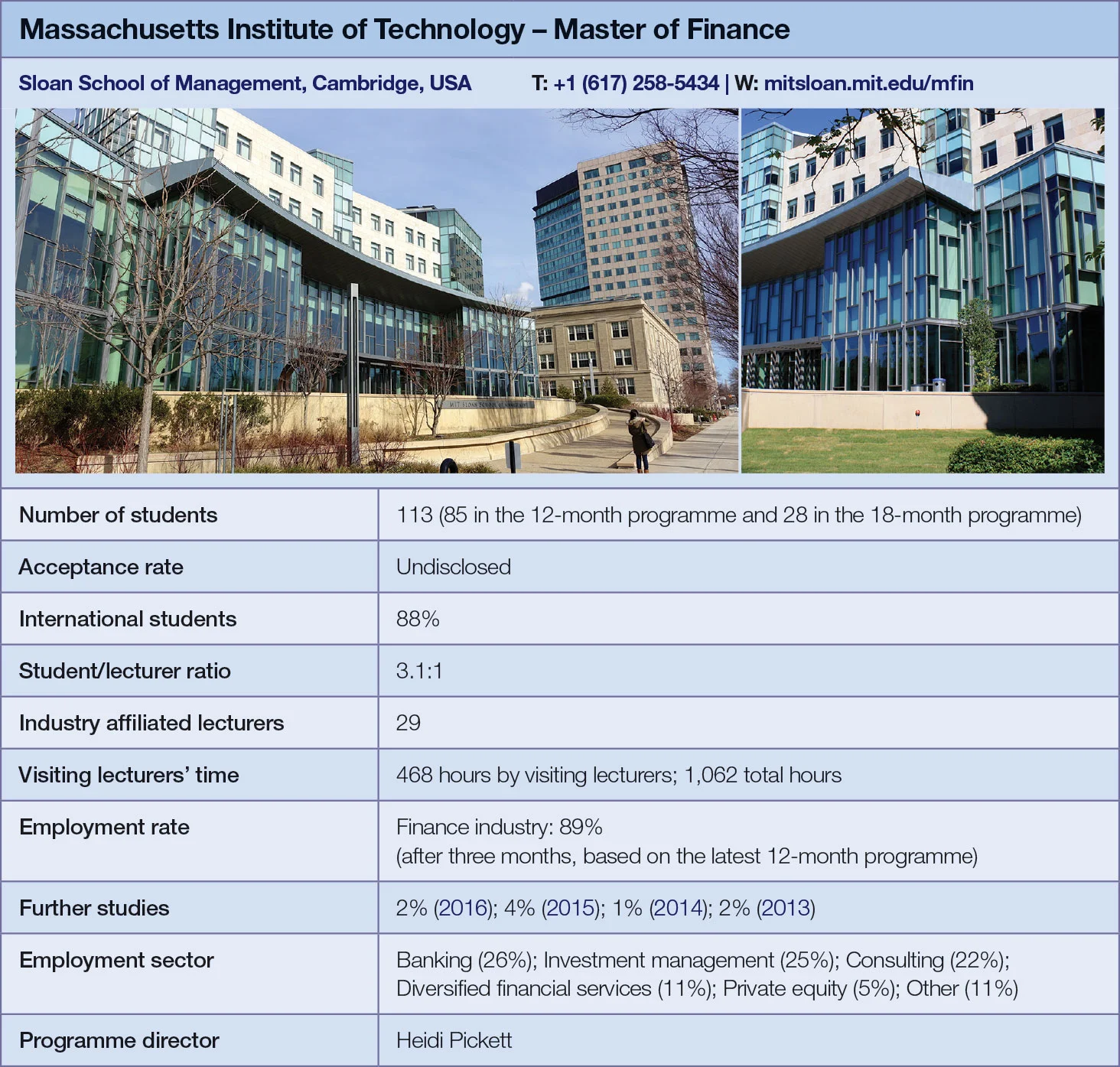

Master of Finance | metrics table at end of article

One of the younger quant finance-focused degrees on offer in the US, MIT Sloan School of Management’s master of finance programme accepted its first intake of students in 2009. It accommodates around 120 postgraduates, who have the option of specialising in one of three different non-compulsory tracks – capital markets, corporate finance or financial engineering, the latter being the newest and the most popular choice – in addition to the core programme requirements.

“We have a very customisable curriculum, which is a differentiator from other programmes, such as a financial engineering degree. It’s a matter of advising students on the right selection of courses,” says Heidi Pickett, the programme director.

The core programme curriculum consists of four mandatory courses: finance theory, corporate financial accounting, fundamentals of financial mathematics, and advanced financial mathematics. These are supplemented by more advanced compulsory modules, such as financial markets, corporate finance and analytics of finance. Students then choose a number of elective courses.

Practical application of the knowledge acquired over the course of the programme is an important aspect of the degree. Every student must take at least one so-called “action learning” course, which involves working with an external financial organisation. These firms provide students with material in the form of real problems they’re currently trying to solve; students are required to work in small teams to come up with a solution.

Action learning courses are delivered as either a proseminar, or what MIT dubs a “finance research practicum”. The former involves a series of seminars with industry guest speakers in which students are assigned problems to solve. The team’s solution is subsequently presented at a seminar, which is open to the entire university. This course is completed in three weeks during term time alongside other required courses.

Finance research practicums, on the other hand, require students to work full-time in a team on one finance project or research question suggested by an external sponsor, which takes four weeks to complete, either on campus or on-site at their host companies. At the end of the project, students present their findings to the class.

The content of the practicums can offer significant variety: one recent investment research-focused practicum

saw students use skew modelling to develop a signal for options trading; in a risk management-focused practicum, students developed a method for incorporating news analytics into a covariance matrix estimation.

Another aspect that shows the programme’s commitment to marrying theory with practice is the availability of practice of finance seminars, where practitioners provide students with their business perspectives related to a range of topics.

“We bring in industry experts to talk about how they apply the methodologies that the students learn through their core curriculum into practice, so we have practitioners coming from banking, asset management and the government sector,” says Pickett.

As part of the seminar programme, students are exposed to a number of topical issues that the financial industry is currently dealing with through panel discussions featuring industry figures, some of whom are MIT alumni.

The degree is supported by MIT’s finance group advisory board, which is made up of senior industry experts across different fields. “We rely on them heavily in terms of advising us on what they’re seeing as the industry changes, and identifying the skill sets that are needed not just today, but five years from now and advising us on adjusting our curriculum to make sure our students are prepared,” says Pickett. “The board is global, which is helpful because it brings us that geographic perspective.”

Several lecturers hold affiliations with hedge funds, investment banks and consultancy firms. Among full-time academics, the programme counts names such as John Cox, co-author of a widely used interest rates model; author Andrew Lo; and Nobel prize winner Robert Merton, who contributed to the development of the Black-Scholes-Merton options pricing model.

Despite the preparedness of the programme’s administration to adapt to the needs of the market, the foundational elements of the programme have remained in place.

“The key finance components will always be used, but we’re also making sure our students have the skill sets to be successful in their careers in the long run,” says Pickett.

“Some of the roles are becoming more quantitative: students need programming skills.”

In 2015, the programme launched an extended duration format of 18 months. Whereas the 12-month option is still available, those who do an internship as part of their studies are able to remain on the programme for an extra term if they opt for the 18-month-long programme. They are required to submit an additional essay to complete their degree if they do so, however.

Click here for links to the other universities and an explanation of how to read the metrics tables

Correction, June 21, 2017: The further studies figure for 2016 in the table has been amended to 2% (from 22%) and the student/lecturer ratio has been changed to 3.1:1 (from 3.8:1).

Correction, June 23, 2017: The employment rate for 2016 in the table has been amended to 89% (from 62%) and more detail has been added to the number of students.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director