Quant Guide 2017: Columbia University

New York City, USA

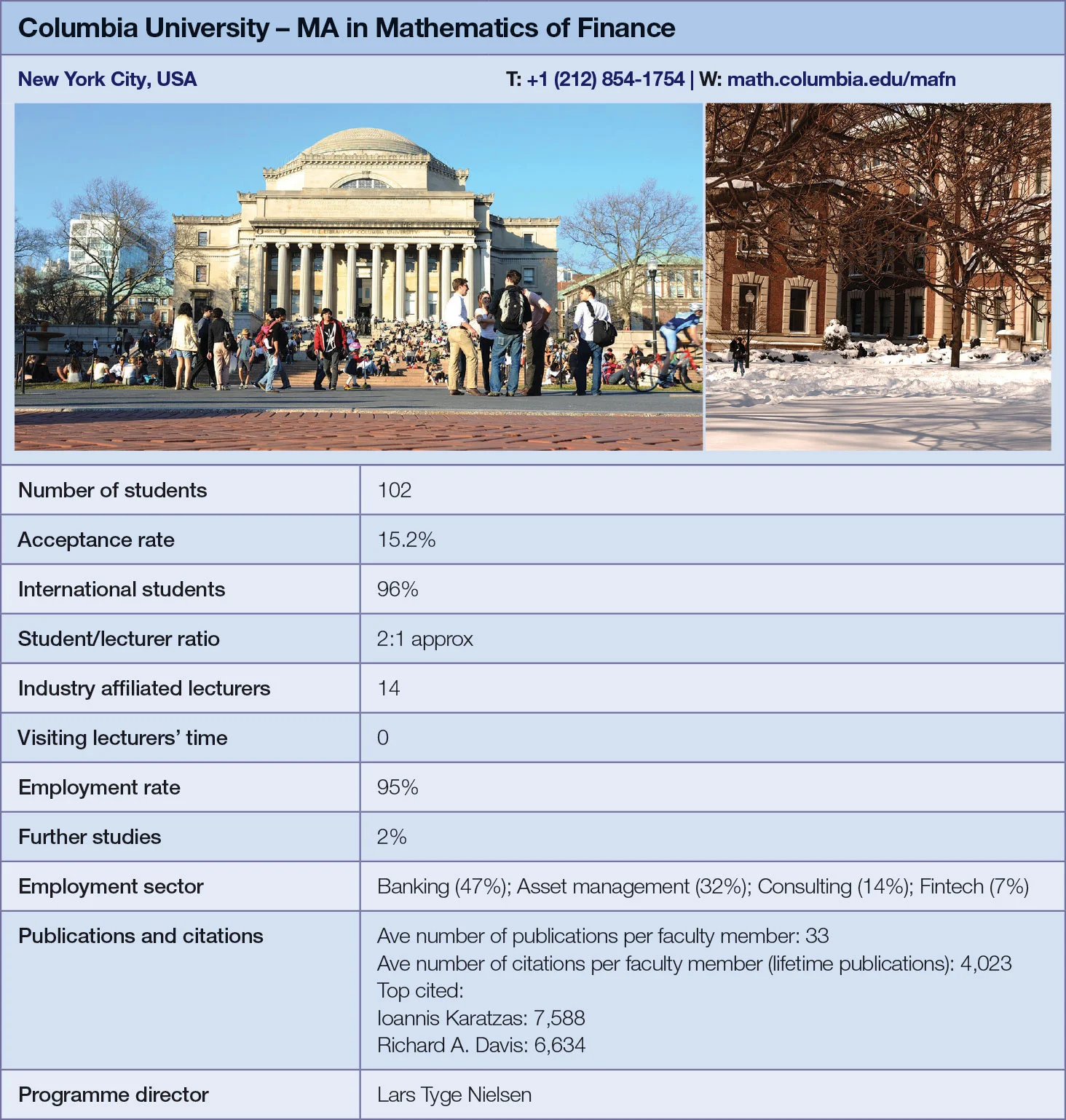

MA in Mathematics of Finance | metrics table at end of article

Columbia’s master’s in mathematics of finance – co-sponsored by the university’s mathematics and statistics departments – is one of the oldest programmes of its kind, according to its director, Lars Tyge Nielsen.

In the past, the mathematics department used to offer only a limited choice of electives. However, over the past three years the department has added around seven new electives to the curriculum. Now students enrolled on the programme can choose from up to 10 courses offered by the maths department. These are usually taught by part-time faculty members who typically have another job in the financial services sector. This adds an applied angle to the material presented to students.

The latest course offered by the mathematics department is an elective on non-linear options pricing, for instance.

Today, students can also select optional courses from the statistics department, such as statistical methods in finance, statistical machine learning, linear regression models and advanced data analysis, as well as various electives offered by the business and engineering schools.

The core components of the programme include modules on time series modelling, stochastic processes, introduction to mathematics in finance, as well as practitioners’ seminars. The most recent practitioners’ seminar took place during the spring of 2017. The last presentation on trends in dispersion and correlation trading, open to the public, was delivered by Jonathan Assouline, a senior equity derivatives trader at JP Morgan in New York.

The programme has reaped the benefits of Columbia’s close links with industry, as well as its physical proximity to Wall Street. “I did capital calculations for a large US bank as part of my internship,” says an alumnus who graduated from this programme in 2015 and currently works in model risk at one of the largest US banks. “It was related to what I’d learnt. I used numerical methods, stochastic calculus and derivatives knowledge from the programme; they’re quite useful to quickly adjust to work.”

“During the programme we learned about linear logistic regressions, which can be applied to credit risk; stochastic calculus is used for the pricing, hedging and the market risk side of banks,” he adds.

The programme aims to keep pace with the changing roles quants play in the financial sector, Nielsen says. For instance, the post-crisis shift in favour of passive, quant-driven investment strategies has led to several changes in the curriculum.

“What’s less important is the pricing of the derivatives securities. On the buy side, the business is becoming quantitatively driven and less discretionary; judgements made by people are now a smaller part of the strategy, whereas quantitative strategies are becoming more important.

“People who want to learn and succeed in asset management firms and hedge funds need statistics, time series analysis and data science.”

This programme doesn’t place an emphasis on derivatives pricing like some of its competitors, but it retains a substantial statistical component. A number of courses are taught on algorithmic trading and quantitative investment management.

Recently, the master’s programme adopted a new structure that allows international students to study on the programme for three instead of two semesters. This was enabled by the introduction of an additional fieldwork course, which allows foreign students to do a summer internship as part of their degree; the 2015 alumnus was among the first to do so, he says.

“This is something really exciting for international students,” he adds.

Students typically undertake their internships in banks, asset management firms, hedge funds and consulting firms. They choose areas of activity closely related to quantitative finance in order to put their knowledge into practice – for example, research, statistical, financial or economic analysis, financial model development or coding of financial models and systems.

The degree is available in both full-time and part-time formats; however, international students on F-1 (foreign residence) or J-1 (exchange visitor) visas are only admitted to the full-time programme.

Full-time students take two or three semesters to complete the programme, whereas those who study part-time usually need two to three years. In order to accommodate the needs of employed part-time students, the core courses of the part-time programme and a number of electives are taught in the evening, in either the spring or the autumn semester.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director