Quant Guide 2017: City, University of London

Bayes Business School (formerly Cass Business School), London, UK

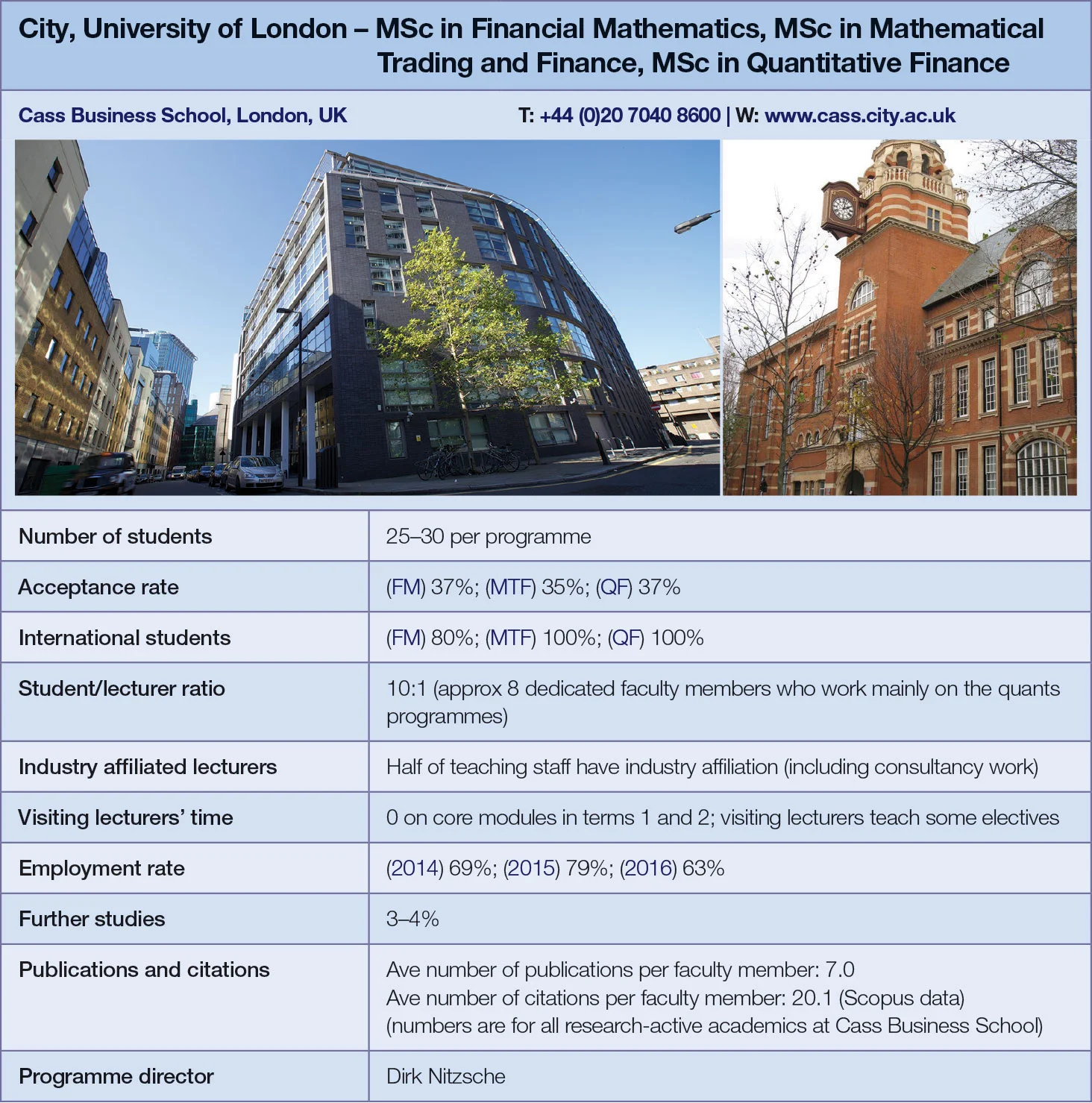

MSc in Financial Mathematics, MSc in Mathematical Trading and Finance, MSc in Quantitative Finance | metrics table at end of article

Cass Business School has three master’s programmes, offering students a breadth of options unavailable at most other institutions. The school also maintains a fruitful relationship with the City of London, providing graduates with an edge in a competitive jobs market.

From September 2017, all three courses will share a series of core modules, including asset pricing, derivatives, stochastic calculus, econometrics, risk analysis, fixed income, and MatLab and VBA programming. Those specialising in financial mathematics will then round off their studies with advanced stochastic modelling and simulation techniques; quantitative finance students with numerical methods and the econometrics of financial markets; and mathematical trading and finance enrollees in quantitative trading and advanced derivatives.

“Our philosophy is that we teach with a very applied angle – we cover theory and I would say we’re theoretically rigorous, but we know our students want to get positions in the City, so we show them how those theoretical concepts are applied and how they’re going to be used in the real world,” says Dirk Nitzsche, director of the three programmes.

Practical skills are also taught – particularly in computer programming. Optional modules on C and Python are available alongside the compulsory MatLab and VBA components.

Though the one-year duration of the programmes does not leave time for an off-campus internship, students can accrue real world experience by participating in selected projects assembled by Cass’s various industry partners that run alongside the formal degree programme.

“Last year and the year before we worked with Deloitte, and they had some projects in the quantitative risk management area. This year, there’s a small Russian bank with some projects in the same field. These smaller companies often have interesting questions that they would like to get answers to but they haven’t got the time,” says Nitzsche.

The programmes’ practical bent has been to the benefit of Cass graduates. As of 2014, 83% of MSc quantitative finance graduates found employment within six months of leaving in a wide variety of roles – from the interest rate derivatives trading desk at Bank of Tokyo-Mitsubishi to the risk analyst team at Standard & Poor’s. Mathematical trading and finance graduates, meanwhile, have found homes in multi-asset structuring at Citigroup, investment optimisation at American Express, and risk and performance at BNY Mellon, among others.

The three courses can accommodate around 90 students in total, with 70 currently enrolled. A UK upper second class degree or equivalent in a quantitative field – such as mathematics, physics or engineering – is the key entry requirement.

The allocation of students to the three programmes fluctuates each year, says Nitzsche. “In the last couple of years, we’ve seen a very high demand for financial mathematics, [but] about four or five years ago quantitative finance was very in demand; our new structure gives us the flexibility to react to the market,” he adds.

The programme sets great store on innovation. For example, the quantitative trading module, introduced this year, will include deep dives into market microstructure – a growing field of enquiry – as well as cutting edge trading strategies.

“We feel this is something quite topical, and a lot of students who will work for hedge funds, asset management companies or even in risk management might find those strategies quite useful,” explains Nitzsche.

In the near future, Nitzsche plans to identify which modules appeal most to part-time students and package these into an evening programme to suit time-poor working professionals with an eye on career progression.

George Shepperd graduated with a master’s degree in quantitative finance in 2012. He currently works as a product controller in the rates business at Deutsche Bank. “The degree helped me understand how the various pricing models work, as we deal with very exotic trades. It’s very dynamic and exciting if there’s a big move like Brexit or an election.” Shepperd came to Cass with an undergraduate degree in economics and sociology.

Even though maths, IT, computer science and engineering are the most typical student backgrounds, these programmes also accommodate economists with more technical degrees. “We learned calculus and statistics in economics, but what I found was that the engineering and math graduates were much more confident with calculus, and when it came to the statistical side of finance, the economists were more familiar with that. That didn’t put me off,” Shepperd says.

“There’s a good level of collaboration – if you’re doing a group project there would be an effort to mix up students from the different disciplines,” he adds.

Click here for links to the other universities and an explanation of how to read the metrics tables

Please note: Cass Business School was renamed Bayes Business School in 2021.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director