Preparation is everything

Compliance with the November deadline for Mifid is what firms are focusing on. Business opportunities come second, reports Ellen Davis

DESPITE the lip service firms are paying to the potential business opportunities created by the EU's Markets in Financial Instruments Directive (Mifid), the fact is that most European financial services firms are viewing Mifid as a compliance project at the moment.

This is the core result of the latest OpRisk & Compliance Intelligence survey, conducted in co-operation with IT services firm Logica CMG.

At first blush, the results of the survey might suggest that respondents are looking at Mifid as a business opportunity. A healthy 38% of respondents said the impact of the changes that Mifid will have on their organisation will be positive. Also, 24% of respondents said it is a major opportunity for their firms, while another 26% said it is a "minor opportunity".

Requirements

However, some 37% regard it as a "business issue" and 13% said that they only think of Mifid in terms of the compliance requirements that will be necessary. Also, 27% of respondents said their organisation viewed Mifid as a "very significant" regulatory requirement, and another 45% viewed it as a "significant" regulatory requirement.

When asked about which areas of their business Mifid compliance will affect, the top answer was "regulatory compliance", with 73% of the responses. Trading was the next most popular answer, with 63%. Customer management ranked third with 59%, pulling even with regulatory reporting at the same score.

Even more damning is the fact that a whopping 32% of respondents said that between 0% and 20% of the total spend on the Mifid project for their firm would be focused on operational improvement. Another 42% indicated that operational improvement would take up 20% to 40% of the budget. Most Mifid consultants and vendors say Mifid should be used as an opportunity to implement new systems and controls to improve business processes in Mifid-affected businesses.

However, this line of thought doesn't seem to have been taken up by the financial services industry. One respondent wrote that Mifid is "mostly seen as a cost of doing business – minimal benefits have been driven out through our internal analysis and participation in industry groups."

"It's extremely disappointing that so few respondents see significant business benefits coming out of Mifid," says Ian Larkin, head of the risk and compliance practice at Logica CMG in London. "It's especially disappointing, given the intent of Mifid, which was driven politically with the idea that it would shake up the EU and create a Europe-wide market for financial services. Very few people seem to have identified the business opportunities or business benefits. Most people seem to see it as a compliance exercise."

However, Larkin says there may be a very good reason for the focus on compliance – the November 2007 deadline for implementation. With the UK's Financial Services Authority's publication of the final Mifid regulatory text at the end of January, firms are now forced to face up to the fairly quick turnaround time for changing their systems and controls across a wide range of areas to meet the implementation deadline. Larkin says the classic approach to projects like this – and which many firms have used for their Basel II, Sarbanes-Oxley, and anti-money laundering programmes – is to first work towards compliance with the regulations by the deadlines required. Then and only then, compliance executives and business unit executives consider how to achieve benefits from the programme. For example, many firms are now re-examining their AML programmes to find ways to integrate them into their customer relationship management programmes, or else to use the system to combat fraud.

"The smarter banks will put in a foundation to suit the regulation, and then build on that in a two or three step approach," Larkin says.

Not surprisingly, regulatory systems topped the list of areas that will be affected by Mifid, with operational processes coming in second. Operational applications registered third, while operational data took fourth place, ahead of management systems.

Additionally, firms are relying on internal resources for much of their Mifid work, and say that the cost of Mifid will be borne mostly by the resources (staff) already in place, with a score of 3.3 out of 5. A close second place was held by modified systems (3.2) in this ranking. External resources scored 2.7, while new systems earned a 2.6. However, Larkin says this shows that some firms are willing to invest in Mifid by bringing in new tools and techniques, and that the score is relatively high compared with many other compliance projects.

Most firms also have just one Mifid programme – despite the wide range of coverage the directive has, including best execution, conduct of business rules, financial promotions and other communications with clients, and a new systems and controls regime. Some 68% said they have just one programme, while 32% said there are multiple programmes in place.

But of firms with more than one Mifid project, some 16% said they had seven or more Mifid teams at work. Some 21% of respondents said they had two teams, and another 21% said they had three. Sixteen percent said they had four teams, and 5% said they had five. Larkin says this may reflect some firms' decision to push Mifid down to the individual business lines for implementation decision-making, especially in large firms that might have, for example, a retail bank, and investment services division, and a sales and trading operation.

Other respondents indicated that their firms had divided up the project differently. One firm looks at execution policy, conflict of interest policy, practice of good conduct, reporting, organisation and processes. Another says it has "separate project streams around client management, trading and regulatory issues. These all report up to one overall project." Still another firm says there are three programmes – client order handling, best execution, and archiving. However, says Larkin, "the challenge of splitting the Mifid project up is getting it to dovetail back."

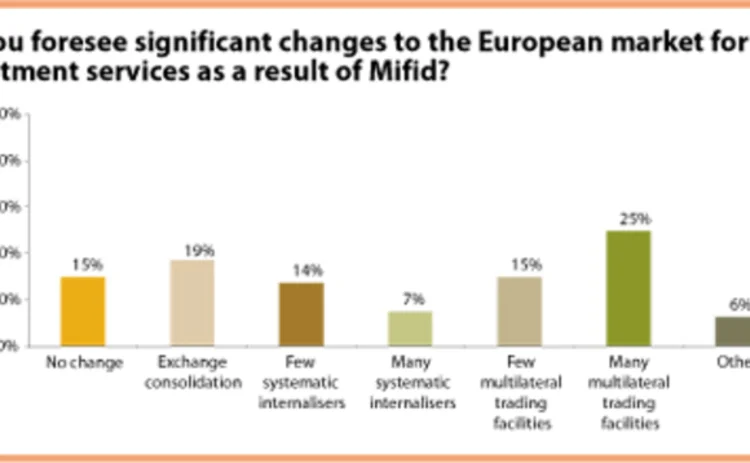

Most firms also see Mifid having a substantial impact on the market for investment services within the European Union. About 25% of respondents said they expected a substantial growth in multilateral trading facilities, and 19% are expecting exchange consolidation. Only 7% think the systematic internaliser approach is going to catch hold. "Firms are wary of putting their own capital at risk", says Larkin. "They would rather pool their liquidity through an MTF. That is the preferred model. It is complimentary to view that there will then be consolidation among the exchanges. And that view has had a major boost by the announcement of Turquoise." Turquoise is a secondary trading platform that is being developed by seven banks, including Deutsche Bank, Merrill Lynch, and Goldman Sachs.

So clearly the jury is still out on Mifid, with most firms deciding to focus on compliance with the directive and a handful looking beyond the November 2007 deadline date. Once November comes, however, will some firms have missed the Mifid boat? OR&C

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

BPI says SR 11-7 should go; bank model risk chiefs say ‘no’

Lobby group wants US guidance repealed; practitioners want consistent model supervision and audit

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralised supervision

Industry frowns on FCA’s single-sided trade reporting efforts

Buy side warns UK attempt to ease Mifir burden may miss target; dealers aren’t happy either

One vision, two paths: UK reporting revamp diverges from EU

FCA and Esma could learn from each other on how to cut industry compliance costs

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

FCMs warn of regulatory gaps in crypto clearing

CFTC request for comment uncovers concerns over customer protection and unchecked advertising

UK clearing houses face tougher capital regime than EU peers

Ice resists BoE plan to move second skin in the game higher up capital stack, but members approve

ECB seeks capital clarity on Spire repacks

Dealers split between counterparty credit risk and market risk frameworks for repack RWAs