European distressed debt hedge fund managers eye prospects of massive refinancings in 2012

European distressed debt hedge fund managers are optimistic about the prospects of tapping into a €140 billion leverage loan market in 2012 while investors worry about a lack of skilled managers.

Distressed debt fund managers are upbeat as companies in continental Europe face having to refinance €140 billion ($198.6 billion) of leveraged loans starting from 2012. Allocators do not share their enthusiasm, mainly because they believe too few skilled managers exist to run the money they want to put in the strategy.

The opportunity is large but there are many challenges facing hedge funds.

The optimism stems from the sheer volume of loans expiring, coupled with the fact that banks, which historically provided up to 90% of Europe’s leveraged loans in recent years, face significant challenges of their own as lending activities are curtailed due to restrictions imposed by Basel III as well as weakened balance sheets.

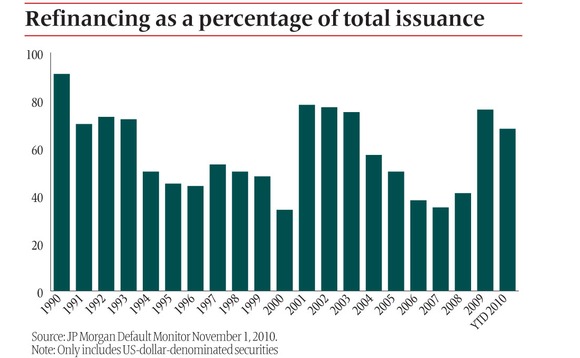

Galia Velimukhametova, manager of GLG’s European Distressed Fund, says a “robust” high-yield market and healthy primary issuance mean the volume of loans needing refinancing by 2016, dubbed the ‘wall of maturities’, is about 15% lower than it once was as European companies have managed to refinance some borrowings. “In Europe the market is still largely broken and we have not seen many new leveraged loans,” notes Velimukhametova.

“We are not bullish on the high-yield market. We still have zero interest rates, artificial liquidity created by central banks and low default rates. It is important not to be too excited by that and not just go long because we all know the music will stop and then there will be fantastic opportunities for patient investors,” she says.

“The problem will be widely spread, and many leveraged loans will hit the wall. Some companies may be able to refinance, but a big chunk of them will have to be restructured,” Velimukhametova adds.

Stress trigger

The strict bank provisioning imposed by Basel III regulations could be a stress trigger for non-investment grade or unrated loans from 2013. The rules, she says, will pressure capital ratios and “may force sell-offs of loans which will exacerbate and speed up restructuring for some companies”.

Nevertheless, the opportunity set is great.

“We do not know whether it will be a quarter from now or one year on but we are confident there will be distressed debt opportunities in Europe in the next few years,” says Jeff Majit, managing director, head of European investments on Neuberger Berman’s fund of hedge funds investment team.

“It may be triggered by some combination of sovereign issues, banks having to sell large volumes of non-performing loans as a result of Basel III requirements or interest rates rising,” he continues. “Given the high proportion of floating rate debt in company capital structures, a rise in short-term rates could become a problem in terms of a firm's ability to service its debt. A rise of only a couple percentage points can turn a lot of cashflow-positive companies negative, and can accelerate their need for debt restructurings.”

Majit and his peers suggest the number of European managers able to exploit it is too small.

GLG, Sothic Capital Management and Fortelus Capital Management are among high-quality exceptions they mention. Some US funds, including Apollo Management and King Street Capital Management, are also poised to take advantage of the onslaught.

“There are still only a handful of true European distressed experts up and running,” Majit says.

This could be disappointing for allocators in hedge funds who said distressed debt was their second favourite strategy, according to a Deutsche Bank survey of allocation plans in January.

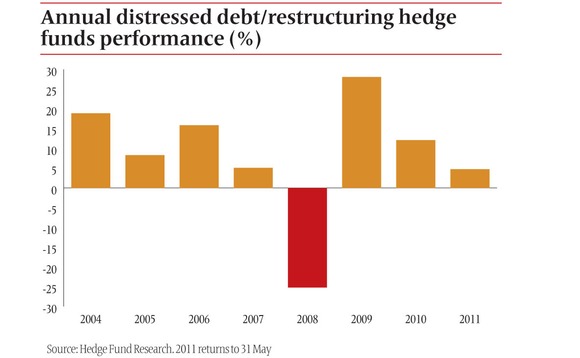

So far this year the style – investing in securities of companies entering into or recovering from financial trouble – received $3.2 billion fresh money. The managers made 4.8% this year to May, according to data from Hedge Fund Research.

Tim Beck, senior research analyst in charge of relative value and event-driven strategies at Stenham, says some large global distressed fund managers increased allocations to Europe relative to the US recently. More US managers are seeking opportunities.

Bill Bassin, managing director of UBP Asset Management, says quality distressed managers are worth holding. “The strategy typically involves investing in less efficient markets where skilled investors can add significant alpha through knowledge of bankruptcy proceedings, experience with financing documents and understanding complicated securities.” A company’s liquidation value limits the downside, he adds.

Neuberger Berman’s Majit currently expects European distressed managers to make high single or occasionally low double-digit returns.

Targeting much higher returns now requires them to take “a decent amount of risk” either through borrowing money to invest or through high levels of directional equity exposure, he says. Majit prefers idiosyncratic trades driven by events at a company, whether refinancing or asset sales to adjust a balance sheet.

Internal rates of return on unleveraged European distressed opportunities earlier this year averaged over 15%.

Idiosyncratic opportunities

Hermes BPK Partners says Europe’s best opportunities now are in idiosyncratic situations. These can include event driven catalysts – companies looking for near-term exits in refinancings, mergers, bankruptcies and value situations – bank debt and high-yield bond carry, although not necessarily to maturity. Distressed corporates and liquidations, litigation and restructured equity are other opportunities investors mention.

Investors should expect rewards “commensurate to the added risks of illiquidity and complexity managers are taking”, according to Hermes BPK. While the allocators say some illiquidity risk is inherent in the strategy, all agree managers have largely now matched their funds’ redemption terms with market liquidity.

Hermes BPK says credit and distressed typically produce their best returns following periods of extreme spread widening. Annual double-digit returns, sometimes over 25%, came over three years following the 1991 and 2003 credit downturns.

Nearly three years on from 2008, and despite prolonged spread tightening and falling defaults, the investor says opportunities still exist for “meaningful returns”.

“Interestingly in this cycle, unlike previous ones, the deferral of credit problems through refinancings, extension of maturities and the ‘re-profiling’ of debt means the next up-tick in defaults is likely to take place before the last cycle has matured,” says Gregory Knott, co-chief investment officer (CIO) at Hermes BPK.

“Deferral means it is possible that we will see multiple vintages of paper becoming stressed at the same time, leading to a second wave of opportunity, but one likely to be characterised by significant complications and complexity.”

Partly because of this complexity, allocators including UBPAM, Hermes BPK Partners, Stenham and Neuberger Berman insist managers active in Europe have long-term real experience. Majit is keeping an eye out for inexperienced managers drifting into distressed debt. He cautions the strategy is not straightforward and “if you do not have expertise and networks for sourcing and negotiating distressed debt deals, it can be a minefield”.

Majit is keeping an eye out for inexperienced managers drifting into distressed debt. He cautions the strategy is not straightforward and “if you do not have expertise and networks for sourcing and negotiating distressed debt deals, it can be a minefield”.

He says some US managers with European offices did “reasonably well” with the opportunities in 2002 to 2005. However, after that distressed opportunities waned and some transformed into direct-lending businesses. This got them into trouble in 2008 with some forced to cut staff.

Understanding Europe

Stenham’s Beck agrees experience is crucial. “There are managers with a global focus who have been over here for a while and we would prefer to have a dedicated European team on a fund,” he notes.

“If you are not in Europe it is very difficult, not just in terms of understanding what the legal processes are surrounding restructurings and bankruptcies, but also sourcing of opportunities which is not as straightforward as it can be in the US.”

Allocators have several reasons for wanting experienced managers in this situation. For example, sourcing deals is one challenge. Coping with the details of at least 20 European bankruptcy laws and processes is another.

Restructuring solutions have been available to European companies for a relatively short period, according to Mark Barker, co-CIO at Hermes BPK Partners.

While several countries over the past decade have adopted rules similar to US Chapter 11 in order to provide a framework for restructurings, the rules vary from one country to the next, he says.

For instance, the UK ushered in a credit-friendly legal framework for bankruptcies in 2003 similar to America’s model. The French have a ‘safeguard procedure’ introduced in 2006 and reformed in 2009 following the Eurotunnel restructuring which highlighted many deficiencies in the structure. Italy and Spain have legal frameworks that Barker says “are now being seriously tested for the first time”.

“The resultant barrier to entry plays an important supply-demand dynamic in Europe, whereby there is a relatively small amount of capital being applied to corporate distressed situations,” he says.

Political influence around some European restructurings has made the process “politically motivated and coercive. We should expect the unexpected when it comes to regulatory pressures,” notes Barker.

“The behaviour of policymakers with regard to the use of credit default swap (CDS) protection on sovereigns and financial institutions, for instance is a significant factor that needs to be considered. It is currently manifesting itself as Greece goes through the discussions about reprofiling its debt,” he says.

Political threats

GLG’s Velimukhametova says she has kept away from some situations where political influence was a potential threat. She adds there are signs the diversity of European bankruptcy laws and processes, which tend to confuse and deter inexperienced managers, may be lessening. This is because a growing number of European companies are having proceedings conducted in the UK, a far more efficient and well-established bankruptcy system, in her opinion. Germany’s Schefenacker and Deutsche Aluminium as well as Greece’s Wind Hellas are examples of this happening.

This is because a growing number of European companies are having proceedings conducted in the UK, a far more efficient and well-established bankruptcy system, in her opinion. Germany’s Schefenacker and Deutsche Aluminium as well as Greece’s Wind Hellas are examples of this happening.

In Germany, she says, getting rid of shareholders can be hard and the process can be “very politically driven”. In France going hostile “can get you nowhere”. Spain is “a little bit of an unknown territory” which Velimukhametova has avoided for just this reason.

“The benefit of being completed quickly in the UK outweighs by far the benefits you may get from knowing a local process. The difference in the time it takes on the Continent could be massive, and the destruction of value could be enormous,” explains Velimukhametova.

She emphasises the importance of having active short positions in a fund and identifying idiosyncratic opportunities that are not dependent on the broader market’s direction.

Sothic’s €262 million ($371.6 million) fund had short exposure in seven of 10 market sectors and six of 13 European countries in May, according to its factsheet. The managers noted gains from two renewable energy businesses in Germany and a trucking and trailer company. Sothic is up 7.6% this year including an estimated 0.95% fall in May following 3.18% in 2010 and 24.39% in 2009.

Neuberger’s Majit appreciates shorting skills, and he will look for managers willing to exercise them for risk protection at least. He recognises the size of a short book will change at different times in the economic cycle.

Presently he describes his ‘ideal vehicle’ as “mid-sized, with multiple investment professionals with experience investing through different cycles”.

Velimukhametova says it is not yet the best time to go long. In mid-June her fund was 100% net short on a notional basis.

“It still looks like more pain will come from the periphery in terms of fiscal adjustment. It is difficult to see Portugal or Spain as super-attractive now. Things will get worse before they get better and we prefer playing them from the short side. Our shorts are not yet distressed, and our longs are quite distressed,” she reveals.

Finding opportunities long and short helped GLG’s fund post flat returns in 2008 while her strategy rivals fell 25.2%. She then made 110% gross returns in 2009 versus competitors’ 28.1%. In 2010 as markets rose one quarter of her 35.5% gains came from short positions while its longs outperformed, too.

“We prefer dispersion trades guaranteeing us positive returns both long and short and to try to pick up idiosyncratic credits that will outperform. Our preference is to buy when all the risks and unknowns are priced in on the negative side, and hopefully then to create significant upside once we invest.

“For shorts we try to find future distress opportunities early in the cycle and short things trading at around par levels and close to notional where what we have to lose if we are wrong is the premium we pay up or coupon we miss if short credit. So effectively, carry,” explains Velimukhametova.

GLG’s fund holds some German and UK banks securities that have had their equity and debt restructured post-crisis. “We found some attractive new holdings needing restructuring this year or next, and we are slowly building positions,” Velimukhametova says.

For her, peripheral Europe presents “the perfect storm” with “companies unable to refinance because nobody wants to lend to companies in those countries. Costs of financing are high with a sharply deteriorating domestic environment”.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Strategy

CTAs beat hedge fund rivals in 2014

Investors hope that CTAs’ fortunes have changed for good

Multi-strategy hedge fund assets surpass $400 billion

Investors flock back to strategy after years of trickling inflows

Hedge funds cautious on Argentina

How might hedge funds take advantage of opportunities in Argentina?

Hedge funds face growing risk, technology and data challenges

Sponsored feature: Broadridge Financial Solutions

A promising future

Sponsored statement: NYSE Liffe

Government bond traders see difficult markets heading into 2014

Your word is my bond

Hedge funds increase Asia quant investing risk capital by 50%

An improved Japan economy is ramping up quant investor activity across Asia

CTA trend followers suffer in market dominated by intervention

Return to normality

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- Filling gaps in market data with optimal transport