This article was paid for by a contributing third party.More Information.

A passive play that’s here to stay

Now in its fourth year, the Asia Risk and Deutsche Asset & Wealth Management Asian exchange-traded funds (ETFs) survey examines key investor trends to enable distributors to provide better service to their clients. This year the survey focuses on the institutional investor segment.

After years of rapid growth in Asia, the ETF business has seen some consolidation this year, and while assets under management (AUM) continue to grow, the pace is slower than it has been in previous years. Nevertheless, investor appetite for ETFs remains healthy and a series of regulatory changes could herald the next big wave up.

Total AUM for ETFs in Asia-Pacific reached USD180 billion in June 2014, representing a 6.5% increase from last year. Investor appetite for passive investment remains strong, and a number of drivers such as an expanded Renminbi Qualified Foreign Institutional Investor (RQFII) programme are encouraging fund flows into ETFs.

Diversification

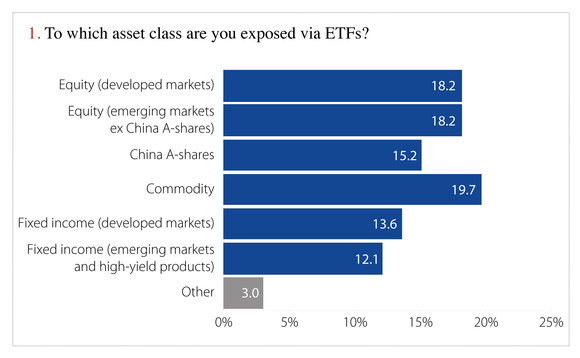

Interestingly, investors are exposed to a very broad range of assets via ETFs with no bias towards a particular market or asset class. Exposure to both developed and emerging market equities is 18.2%, while commodity exposure stands at nearly 20%. This compares to investor exposure to developed market fixed income at 13.6%, and high-yield and emerging market fixed income at a slightly lower 12.1%, which is to be expected given the relatively less mature stage of the Asia bond markets (figure 1).

“Investor awareness to gain diversified ETF exposure is encouraging. Last year, the majority of respondents said they had exposure to developed market equities, but this year it has changed to a more balanced split among China A-shares and fixed-income products. Not only is this trend prevalent among institutional investors, but can also be seen among retail investors and private bank clients. It is a positive step towards sustainable growth of the ETF market,” says Anson Chow, Vice President, Passive Asset Management Asia Pacific at Deutsche Asset & Wealth Management.

Asian advantage

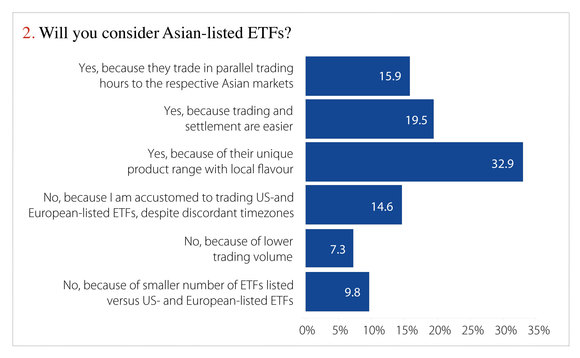

When asked why they choose Asia-listed ETFs, respondents gave a broad set of reasons, which include parallel trading hours (15.9%), easier trading and settlement (19.5%) and local product range (32.9%) (figure 2).

“There is more diversity around why investors are choosing ETFs in Asia. In previous years, most investors have traded in Asia because of the parallel trading hours, but now investors are more aware of trading and settlement being easier in Asia, and there is more recognition of the unique products in Asia that are not available in overseas markets,” added Chow.

“There is more diversity around why investors are choosing ETFs in Asia. In previous years, most investors have traded in Asia because of the parallel trading hours, but now investors are more aware of trading and settlement being easier in Asia, and there is more recognition of the unique products in Asia that are not available in overseas markets,” added Chow.

Tracking performance

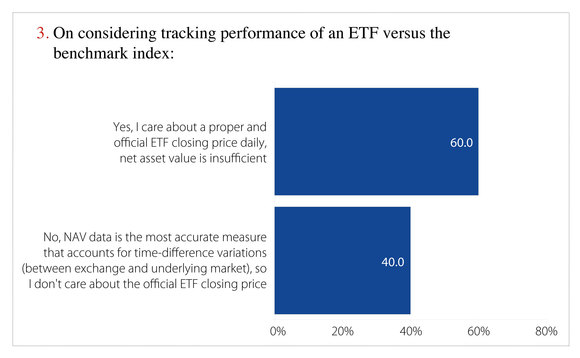

Despite investors now using ETFs for a range of strategies, tracking performance of an ETF versus its benchmark is still a significant issue for investors, with 60% of those surveyed expressing a preference to see an official daily closing price (figure 3).

The good news is that the Singapore Exchange (SGX) took investor feedback on board earlier this year. On February 24, the SGX started publishing a daily closing price for all SGX-listed ETFs based on a predefined methodology at the end of each trading day to provide investors with an up-to-date closing price to facilitate market investment decision and portfolio valuation.

This helps to efficiently and promptly value portfolios even when other major European and US markets are closed. Asset managers using ETFs in their investment portfolios can rely on the ETF closing price as an alternative to net asset value (NAV) for daily valuation, especially since ETF NAVs may only be available a few days later.

“In Singapore, previously the closing price was absent if there was no turnover for a particular instrument. Consequently, we see some investors expressing concern as the valuation infrastructure at their companies requires a closing price, which means they are unable to obtain compliance approval to invest. This step by SGX removes another barrier to ETF investment,” says Chow.

He adds that, while a closing price may be an important factor for some investors, NAV is a more accurate valuation metric as the closing price is subject to local closing time frames. For example, an India fund listed in Hong Kong would have a closing price of 16:00 in Hong Kong, but it wouldn’t reflect the total market movement as the India market closes two hours after the Hong Kong market closes.

“Mutual fund investors do not have this problem, as such investors only refer to the NAV of the fund. However, since ETFs trade on an exchange, investors may like to see a closing price, but in the end ETFs are funds. There are also instances, however, where on-screen activity drives the ETF price. In these circumstances, the closing price from an exchange has more value,” says Chow.

Liquidity

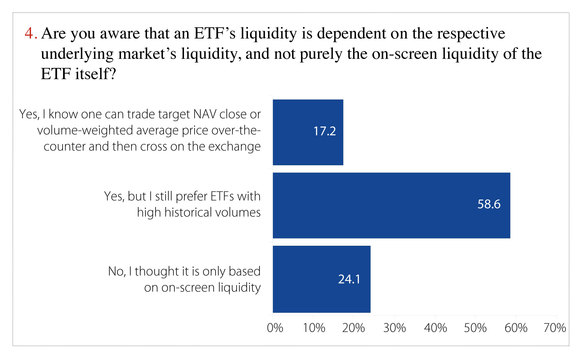

One of the main reasons affecting investment decisions in ETFs relates to liquidity. The survey revealed 58.6% of investors prefer ETFs with high historical volumes, and 24.1% of respondents believe that on-screen liquidity determines an ETF’s liquidity, rather than the liquidity of the underlying (figure 4).

“This is clearly a gap where investors treat ETFs like stocks, assuming that liquidity just lies in secondary market activity of the ETF and nothing else, but we explain that liquidity is also based on the underlying constituents and is not just determined by on-screen turnover,” says Chow.

He elaborates that, as there are only a few actively traded ETFs in the market, ETFs are relatively more transparent in that investors can buy/sell index funds on an open platform and know what the price of the ETF is at the point of transaction. “However, for investors to neglect ETFs based solely on turnover is a pity,” says Chow.

ETF allocation

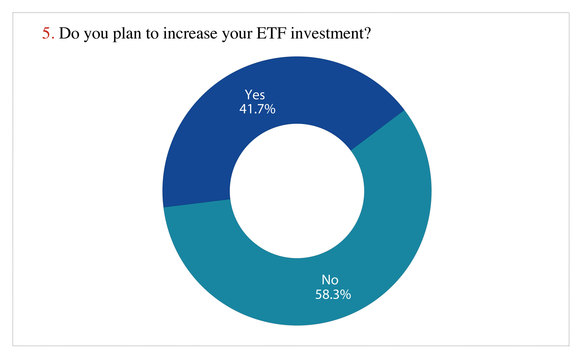

Despite the continuous growth in ETFs over the past several years, investor appetite remains strong, with 41.7% of respondents looking to increase their allocations over the next 12 months (figure 5).

“Last year, the figure was closer to 50%, but as ETFs have grown in prominence to become a USD2 trillion business globally, it is natural that investors have bought in already. As evidenced by this growth, interest in ETFs remains high,” says Chow.

China RQFII ETFs

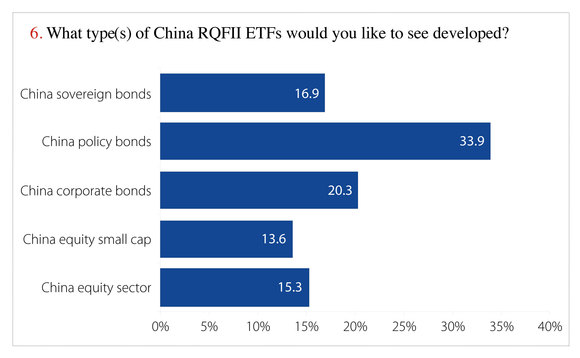

Following the relaxation of the Chinese government’s policy on RQFII quotas, respondents were asked which China RQFII ETFs they wish to see developed. They expressed a bias towards policy bonds (33.9%), with corporate bonds carrying strong appeal (20.3%) and interest in small cap equities is also high (13.6%) (figure 6). “It is encouraging to see a broad-based interest in new China products,” says Chow.

Physical or synthetic

Coinciding with the move to allow more investment into mainland equities via physical ETFs under the RQFII programme, Deutsche Asset & Wealth Management intends to convert the investment policy of some of its ETFs from synthetic to physical replication. Chow says this was in response to client demand, but both models still have their own merits.

“It is not a lack of confidence in the synthetic model as we preserve it for many products. In developed markets spreads are tight, so it doesn’t matter which model you choose in terms of tracking error, but for frontier or emerging markets it can be a significant challenge to convert the investment policy to physical replication, and this may also not provide the best solution for clients,” says Chow.

Clearly, ETFs still have room to grow in Asia. The product range is much smaller than in the US and Europe, yet Asia’s markets continue to become more liquid each year, providing further opportunities to develop innovative products.

A glimpse into future plans in Hong Kong also shows that policy-makers are keen to develop ETFs as a form of investment. Hong Kong’s financial secretary, John Tsang, gave a budget speech in February 2014 announcing a waiver of stamp duty for ETFs to make Hong Kong a more attractive place for the development, management and trading of ETFs. “We aim to develop Hong Kong into a regional hub for ETFs,” says Tsang.

Investment involves risks. Past performance is not indicative of future results. The above information is for general reference only. Before making any investment decision, investors should understand the details of the investment and to consult an independent financial adviser. This document is issued by Deutsche Bank AG (“DB”) acting through its Hong Kong Branch and may not be reproduced, distributed or transmitted to any person without express prior permission.

The distribution of this document and availability of these products and services in certain jurisdictions may be restricted by law. This document is intended for discussion purposes only and does not create any legally binding obligations on the part of DB and/or its affiliates. Without limitation, this document does not constitute an offer, an invitation to offer or a recommendation to enter into any transaction. Investors should read the offering documents for further details, including the risk factors, before investing. DB is not acting as your financial adviser or in any other fiduciary capacity. The transaction(s) or products(s) mentioned herein may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand the transaction and have made an independent assessment of the appropriateness of the transaction in the light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction. You should also consider seeking advice from your own advisers in making this assessment. If you decide to enter into a transaction with DB, you do so in reliance on your own judgement.

Read/download the survey analysis in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net