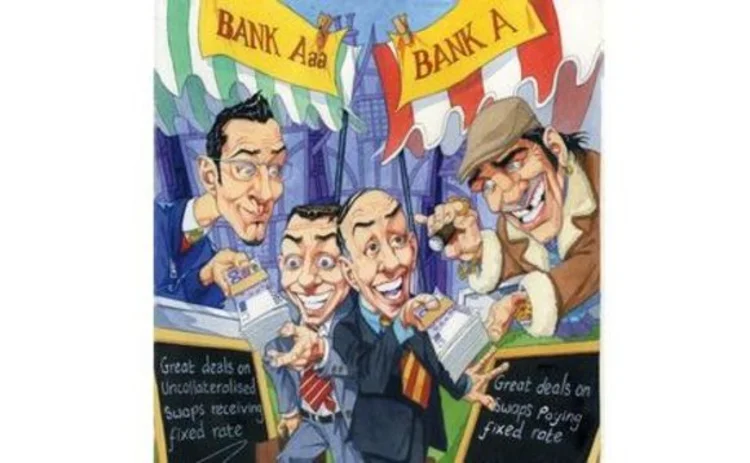

Dealing with funding on uncollateralised swaps

Many banks are now using their own cost of funding as a discount rate when pricing non-collateralised swaps trades. How are banks dealing with the difference in funding rates when quoting derivatives prices, and could this influence a client’s choice of dealer? By Christopher Whittall

Derivatives pricing has never been simple, but there were a few constants people used to be able to rely on. One of the most fundamental was the use of Libor as a discount rate to price derivatives trades. The financial crisis has caused this assumption to be thrown out of the window. The majority of banks now recognise that the overnight indexed swap (OIS) rate should be used to discount future cashflows on collateralised swap transactions (Risk March 2009, pages 19–22). Meanwhile, non

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Interest rate markets

SABR convexity adjustment for an arithmetic average RFR swap

A model-independent convexity adjustment for interest rate swaps is introduced

NatWest Securities US Treasury trading head departs

Jason Sable joined the UK bank in January 2022 from BNP Paribas

CME in talks to clear term SOFR basis swaps

US clearing house has held discussions with some dealers about clearing term SOFR-SOFR packages

Risky caplet pricing with backward-looking rates

The Hull-White model for short rates is extended to include compounded rates and credit risk

The curious case of backward short rates

A discretisation approach for both backward- and forward-looking interest rate derivatives is proposed

Cross-currency swaps will use RFRs on both legs, says JP exec

Despite slow start, all-RFR swaps will become the market standard within a year, according to Tom Prickett

June mid-month auctions – Coupon and yield trends

As Treasury issuance amounts set new records, coupons at the front end of the curve have marched downward, while back-end coupons have lagged. Yield spreads across each popular measure show a consistent steepening of the curve through the first half of…