Looking out for LBOs

Just when bond investors were getting comfortable that the economy is growing but not booming, that credit quality is rising and that demand for bonds is strong, someone had to spoil it by mentioning leveraged buyouts. Glenn Reynolds and Louise Purtle look at the likelihood of a wave of leveraged buyout activity

Ever since Cox Enterprises, owner of a 62% interest in Cox Communications, announced that it was making a bid for the 38% in publicly held shares that it does not own, rumors have abounded of an imminent wave of leveraged buyout (LBO) activity. There are many aspects of the Cox transaction, such as the singular concentration of such a large block of voting shares, which are not widely mirrored in the market. For that reason, the deal has limited application as a precursor for a rise in transactions that take public companies private. But the almost certain downgrading of ratings that occurs in any leveraging transaction and the fact that the financial conditions are ripe for LBOs has ensured that the corporate bond market is highly sensitized to their possibility.

Equity investors may view LBOs as transactions that release entrapped asset value, but the debt markets have always considered them in a harsher light. Bond investors would argue that LBOs skew the risks toward the unsecured creditor while offering windfall gain potential to the holders of a thin layer of equity.

At best, LBOs represent an immediate transfer of value between stakeholders, with shareholders being the beneficiaries, again largely at the expense of bondholders. Hence the periodic paranoia about LBOs that captures the market’s attention. This is particularly notable at the moment because of the abundance of cash residing in buyout funds, the stagnant state of the stock market and reasonably robust demand for leveraged loans.

The last major flurry of LBO paranoia came after the infamous “new Mike Milken” cover story in Forbes back in the spring of 2000, when the assumption flew around that any company where the Ebitda was anything less than four or five times the equity valuation was headed for the LBO debt heap. The implication was that there would, of course, be no limit to the size of deal that could get done—the number $100 billion had even been tossed around. Despite the great expectations, the new Mike Milkens of the world got old fast, an LBO wave reminiscent of the 1980s binge did not happen, and the lists of so-called candidates got shredded along with the theoretically unlimited demand for leveraged credit exposure.

Despite the failure of the LBO rainmakers to produce even so much as a sprinkle four years ago, investors are once again reviewing portfolios, trying to assess who might devise and execute spin-off moves that abuse bondholders in order to enhance shareholders. Such analysis usually breaks down when the conclusion has to move from ‘who could’ and ‘who should’ to the far more pressing ‘who would’. However, the exercise is one worth doing just to frame the debate on which names are undervalued and what actions they might take to extract that value.

A company has a number of alternatives to turn to: share buybacks, dividend hikes, spin-offs and asset sales, among others. The LBO option for the entire company always has to be viewed as a more extreme solution. Remember, the market might actually recognize that the company is undervalued and therefore not require management to take such an extreme measure. Further, assessing potential targets is as much a qualitative exercise as a quantitative one. The irony is that some of the traditional attributes for a good LBO (free cashflow, predictability of cashflows, discrete saleable assets) are also good reasons to buy a bond and not to avoid one.

Where this rationale falls down is that you can never rule out a merchant banker doing a deal that makes no sense or one that does not fit the traditional LBO 101 criteria. After all, merchant bankers individually get a cut of the equity tranche in the deals they do, so there is often an impulse to simply do more deals to maximize the equity gains later. LBOs generate advisory and origination fees early, and the bulk of those risks can be sold down and/or hedged.

The upside for the banker is that if they hit on even a few deals, they can get very rich very quickly. Tremendous leveraged upside is available to the individual bankers and the merchant funds that they use as part of key employee incentive programs. Doing a lot of deals therefore makes sense from the standpoint of personal financial stakes. In effect, if they can do them, they will, and generally the motto is ‘unsecured fallen angel bondholder be damned’.

The LBO cycle on the street has thus often been one of generating fees up front, selling the risk down before any negative deal risk blows up, and then holding the de facto free call option for longer-term windfall gains. This cycle has historically encouraged deals even if they are not prudently structured and even if they have created major areas of tension with high-grade bondholders. The fact that bankers aren’t assessing LBOs objectively means it is impossible for investors to accurately predict them by looking at the numbers.

Background

The typical LBO candidate has changed considerably since the market’s heyday in the late 1980s. Back then LBOs often served as an existing management’s defense against a potential hostile takeover or came on the back end of a protracted takeover battle, with the hostile party bringing in its own team to run the post-LBO entity. An LBO is just part of a process where shareholders can get a quick premium on an undervalued company. To simplify an otherwise very complicated story, the acquiring entity gets to layer in some hefty tiers of secured and unsecured debt (senior and subordinated) above a relatively thin slice of equity. This slice is usually fairly concentrated in the hands of the private equity/LBO firm, the merchant bankers and/or management to a lesser extent.

The transaction is essentially looking to capitalize on a gap. This is the gap between a company’s enterprise value under current market conditions and what the longer-term expected value would eventually be to the new class of stockholders once the newly incurred leverage has been reduced and/or assets have been redeployed or divested.

In the 1980s the market was characterized more by hostile takeovers or takeover defenses as a plethora of factors combined to provide a fertile breeding ground for these deals. Equity valuations were comparatively low and in general businesses had yet to adopt the extreme focus on near-term shareholder returns that would later typify US management style. The age of the shark was upon the market, and conditions were ripe for deals. Deregulation was still in its early stages and structural change was accelerating in numerous mature businesses, from capital-intensive industries such as automotive/capital goods, to infrastructure-based industries such as power/energy and transportation, to the service sector such as in retailing.

The prevailing political climate dictated a laissez-faire approach to antitrust concerns and legal developments struck down state takeover laws. This left many inefficient conglomerates as ideal LBO candidates and a ready flow of finance from the junk bond market was there to see that the transactions got financed. Deals got done that were dependent on asset sales and that had high valuations built into the models. Pro forma cash interest was often not covered, amortization schedules were suicidal and generous capital markets were the cornerstones of the refinancing assumptions.

The leverage boom ended with a sea of hung bridge loans, seized thrifts, securities house bailouts and indicted bankers. The bank system was further stressed by commercial real-estate loan problems that arose just as the oil patch crisis was tailing off and emerging market loans had been getting marked-to-market. The recession of the early 1990s then hit, and the junk bond market had fundamental stress added to a healthy dose of refinancing risk that arose from the closure of the capital markets window. The LBO boom gave way to the restructuring implosion.

Developments were already underway that limited the number of prime LBO candidates going forward. Some were specific, such as the Supreme Court’s move to uphold the constitutionality of state takeover laws, most importantly Delaware’s merger moratorium. This moratorium prohibits a hostile acquirer from merging with its target for three years after buying a controlling interest unless it can acquire more than 85% of the stock.

The majority of medium to large public companies in the US are Delaware-incorporated companies. Since the law was passed, these companies have moved en masse to lock up 15% of their stock in friendly hands, rendering them more or less impervious to hostile takeovers. The same is the case with the frequent use of dilutive, ‘poison pill’ defenses. A ‘poison pill’, when triggered, enables the target firm to penalize the predatory shareholder by giving other shareholders favorable terms to buy more shares. The target company can rely on this strategy if it wants to block a hostile takeover.

Other trends were less immediately responsive to the rise in takeover activity but have altered the LBO landscape nonetheless. The new economy was characterized by rising productivity, wide deregulation, increased competitiveness, incentive-based compensation schemes and a shift to a strong equity-oriented culture. These factors forced a higher level of operational discipline on US corporations as they strove to survive and expand, and went hand in hand with increased balance sheet leverage. The tactics that once characterized the typical post-LBO strategy were now being broadly embraced as the optimal management strategies.

Hence, in the 1990s the value creation aspect of the LBO was less about financial engineering and more about strategic fit in a complex world as there were fewer candidates available that would benefit purely from the adoption of what had become mainstream management practices. Before the first LBO wave hit it could be said that US corporations generally operated at a suboptimal leverage level. In more recent times, however, they have so readily embraced borrowing that finding candidates with the balance sheet capacity to take on a further dramatic increase in debt has become extremely challenging.

It is not surprising therefore that the next wave of LBO activity, which took place in the late 1990s, came against the backdrop of an M&A boom. This was an environment where the inflated level of equities in ‘new economy’ sectors provided a powerful acquisition currency while multiples for ‘old economy’ companies remained moribund. When compared with the multiples that existed for ‘new economy’ companies, many ‘old economy’ companies looked cheap and investors saw the opportunity for profitable exit strategies in the booming IPO market. The resulting transactions were classic leveraged deals with a strategic twist.

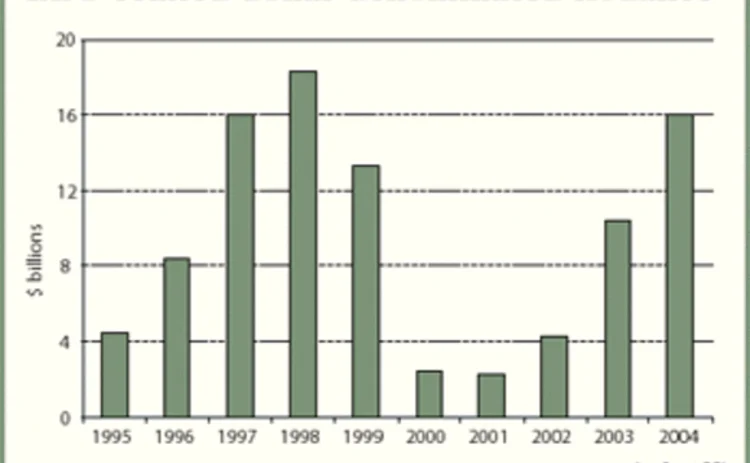

However, the high degree of risk associated with LBOs means that they flourish in stable or rallying markets that feature abundant risk appetite and ready liquidity. They are highly dependent on a free availability of leveraged loans and junk bond financing. In the wake of the 1998 Russian default and Long-Term Capital Management crisis, the junk bond market retrenched as defaults began to rise. In the meantime, risk appetites at the banks and securities houses were tightened. Then we rolled into the 2000–2001 recession and the credit crisis of 2002. Amid an evaporation of risk appetite, LBO volume collapsed.

Current conditions

The latest concern about an uptick in LBO volume is driven in large part by the conducive state of the financial markets. An ongoing trend here has been the diversification of savings away from the traditional banking system and the accumulation of large volumes of capital in a variety of investment vehicles (mutual funds, pension funds, hedge funds, etc). All of these vehicles adopt a competitive approach to delivering returns and thereby sponsoring asset growth. The low interest rate environment and an equity bear market for most of this decade have fostered demand for higher-return investments from institutional and individual investors alike. This demand has resulted in a considerable volume of capital directed to LBO funds, private equity firms and high-yield funds. The banks are also coming to the party and have recently increased their focus on leveraged lending after having largely eschewed corporate risk since the 2002 credit crisis. There is a ready pool of finance available to support LBO activities and a wealth of financial talent on the lookout for potential deals.

In 2004, the characteristics of those deals differ somewhat from the ‘typical’ LBO of prior times but many of the hallmarks are still in place. An ideal LBO candidate has a depressed equity valuation, a stable business history, healthy free cashflow generation and has the balance sheet capacity to absorb a considerable increase in leverage. In a typical LBO structure, less than 20% of the financing comes from the equity layers (common and preferred), and so a candidate’s relative debt level must be low enough to accommodate the layering in of 80% of the transaction in some combination of bridge and mezzazine financing, and subordinated and senior debt.

For those unfortunate enough to have long-dated unsecured debt in their hands before the deal and have weak structural protection in negative pledge language (as in most high-grade deals), you just end up coming along for the ride in a structurally subordinated position while operating as de facto equity risk for fixed-income returns.

The changing trends outlined above make for a diminishing pool of suitable candidates among publicly listed companies. Other long-term trends, such as the sectoral shift of the US economy away from asset-rich manufacturing industries and towards service industries that are harder to leverage because of their lower tangible asset base, are helping reduce the number of companies that would fit the traditional LBO mold. A further factor is that the degree of consolidation seen in many industries over the past decade means that antitrust concerns are now a more pressing consideration in many deals than they were previously. Hence a new set of deal characteristics is emerging:

• an increased focus on releasing intangible value rather than asset value;

• a rise of activity in younger companies in high-growth industries such as technology;

• a shift toward offshore companies, which tend to operate at lower leverage levels; and

• a greater concentration of smaller companies or divisions of larger corporations.

Of these developments the last is most prevalent and has coincided with trends affecting both buyers and sellers. From the seller’s perspective, the degree of leverage incurred in the late 1990s proved to be imprudent when the 2000–2001 recession hit, and in the resulting credit down-cycle there was a wholesale focus on balance sheet repair and debt reduction. Companies looked to asset sales as a primary means of reducing leverage and protecting ratings; the prevailing winds shifted from a view that diverse revenue streams provided cyclical protection to one where non-core operations were viewed as a distraction from core competency.

The trend suited buyers well for two reasons. First, it kept deal sizes manageable as the issue of diversification among financiers continues to be of concern. The substantial consolidation in the financial services industry has left a smaller number of senior lenders available to lead the bridge financing and to commit to the senior lending portions of an LBO structure ahead of later syndication. And the LBO funds that take the equity and subordinated debt portions of the deals are keen to minimize risk via diversification, limiting the amount they are willing to commit to a single transaction.

The second reason is that although the credit downtrend of 2001–2002 led to reduced valuations and lower multiples, in many sectors prices remained above historical levels driven by the competition from strategic buyers. This has forced financial buyers to adopt a more aggressive approach with regard to exit strategies and many have looked to vehicles such as leveraged build-ups (LBUs) to maximize value creation.

In LBUs, funds buy smaller businesses with the intent of using them as a platform to which subsequent acquisitions can be added. The acquisitions are assessed with a view to their synergistic fit and the exit strategy is focused on the perceived value of the combined businesses, allowing for a higher valuation to be calculated at the time of purchase. This approach has helped financial buyers compete with strategic purchasers and move beyond the valuation constraints of the large-cap market. It is also bringing the benefit of sophisticated financing and other professional skills into the small- to mid-cap market.

Glenn Reynolds is CEO and Louise Purtle is corporate strategist at independent research provider CreditSights

| Betting on mortality When it comes to identifying LBO candidates, valuation screening is a necessary step. It is also a useful drill for highlighting companies that are potential victims of the elevated event risk that stems from equity underperformance. One way of approaching such an exercise is to select a broad group of corporations, assess a number of relevant credit metrics, and then apply select criteria to isolate those companies that appear to be legitimate LBO candidates. Such filters would likely focus on metrics such as: • EV/EBITDA ratio • Current market capitalization • Current market leverage • Current P/E They would be applied relative to relevant industry averages to identify underperformers. While this would identify a range of potential candidates, we would not advocate such a list be used as a definitive prediction of the likelihood of an LBO, but as a screening tool to identify instances where further analysis is warranted. While this is not the only set of financial criteria that could be used, the salient point is that however the quantitative screening process is undertaken, it will only get you so far. Beyond that the real work begins. When LBO funds are assessing a candidate, the quantitative and qualitative assessment process go hand in hand and encompass the following: • What is the current enterprise valuation relative to industry norms? • Does the business generate significant free cashflow and how volatile is that cashflow? • Is there room in the capital structure for a significant increase in leverage? • What amount of financing is necessary and where will it be available? Banks, other LBO funds, institutional investors? • Are there assets that could be divested to effect post-LBO deleveraging? How firm is the market for those assets? Are strategic buyers active in that sector? What are the multiples of recent transactions in the industry? • How will the state of incorporation in the US, the composition of share ownership and the existence of factors such as ‘poison pills’ affect a potential transaction? • How amenable is the management team to the LBO process? • Are there labor constraints on a possible deal? Is the company in a highly unionized industry? Are there significant pension or OPEB (other post-employment benefits) obligations that need to be considered? • What is the competitive industry environment? Are there antitrust concerns? • What is the history of LBOs in this industry? Have they been historically successful? Do LBO funds already have significant degree of exposure in this sector? • What exit strategies are available in the event of a deal? Could the business provide a platform for further acquisitions and an eventual roll-up and sale to a strategic purchaser? Is an IPO possible? • How does this deal fit into the existing portfolio? Does it offer industry diversification? Or does it fit well with an existing platform of assets? This is by no means an exhaustive list but it goes far enough to drive home the point that making an accurate assessment of the current state of LBO risk is a process that requires a considerable degree of analytical legwork. |

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes

Renminbi options volumes plummet as vol grinds lower

USD/CNH volumes fell 84% in 2025 as PBoC currency management took hold

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive