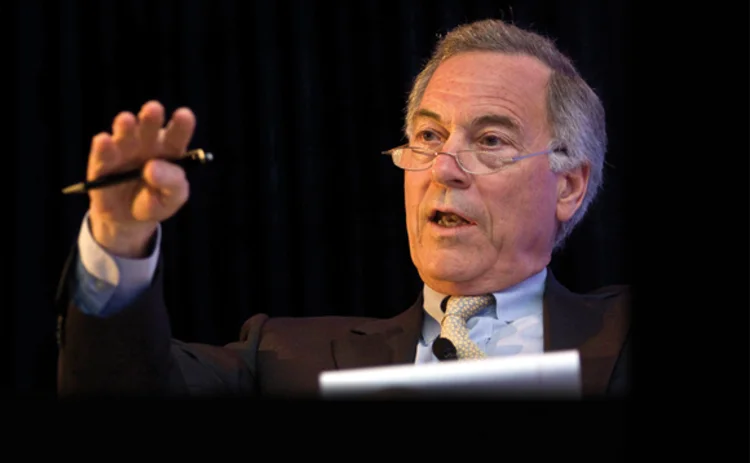

‘US monetary policy is abnormal and deviant’: Steve Hanke profile

Government adviser of 30 years’ standing; academic; currency and commodity investor; published author: Steve Hanke has a long and varied CV. He talks at length about what he sees as irresponsibility on the part of the US Federal Reserve, and his run-in with former president Bill Clinton

To some observers, the US Federal Reserve has got pretty much all the big calls right since the financial crisis; whether injecting liquidity into the financial sector to prevent a systemic meltdown, making emergency loans to individual institutions, introducing quantitative easing, or adopting a near zero interest rate policy.

But while others praise, Steve Hanke, professor of applied economics

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Central banks

Global investment outlook: 2026 and beyond

Broadening, steepening and weakening: Franklin Templeton’s top investment ideas for 2026 and beyond

Central bank watch: Biased to ease, for now

A mid-year review of the monetary policy outlook for G10 central banks, India, China and South Korea

Adopt FX code or face regulation, warn central bankers

Global code of conduct must be adopted, Schiavi and Debelle insist

Malaysia central bank: credit reporting could unite Asean markets

Asean Economic Community faces challenges, says deputy governor Muhammad bin Ibrahim

BoE's Carney: liquidity support for CCPs is a 'last-resort option'

BoE governor insists clearing houses must have enough liquidity to cope with default of two big member firms

BoE deputy governor Paul Tucker quits after 33 years

Deputy governor is bound for academia in the US after helping with transition to new Carney regime

Local regulators push for consistent standards across Asean region – Thai SEC interview

Underpinning the integration of regional capital markets is a major concern for Vorapol Socatiyanurak, secretary general of Thailand's Securities and Exchange Commission

New governor signs revised policy target agreement in New Zealand

The Reserve Bank of New Zealand’s policy targets agreement will come into effect on the same day Graeme Wheeler takes over as governor; document includes "stronger focus" on financial stability