A volatile blend

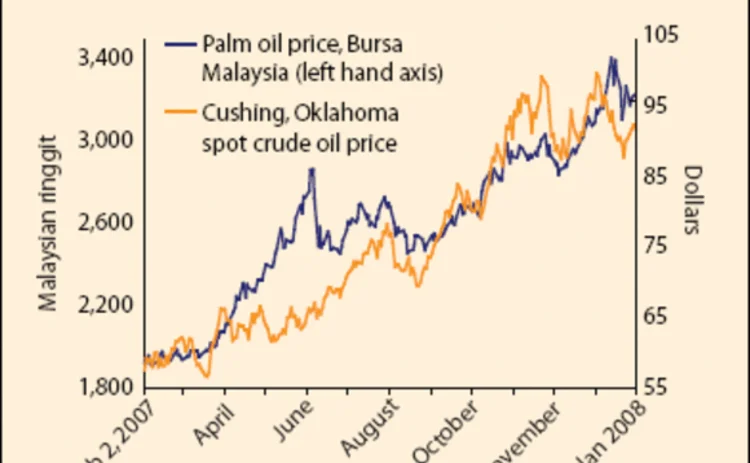

How will Malaysia's palm oil plantation owners be hedging in 2008, given the record-breaking run of crude palm oil prices, mixed international views on biofuels and a likely US slowdown affecting demand for commodities? By Kathleen Kearney

Palm oil producers across Malaysia and Indonesia have adopted very different hedging strategies, but few have been consistently active in the commodity's futures market during the palm oil price bull run of the past eight years. But with improvements in liquidity, greater interest in the commodity by funds and the toppy chart picture for crude palm oil prices, this market could undergo major

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Environment-Renewables

European Parliament vote on carbon market reforms seen as bullish

Energy traders welcome reforms seen as shoring up ailing EU carbon market

Modelling the financial risks of wind generation with Weibull

The manner in which wind generation can affect the half-hourly APX price is discussed

EU TSOs need carrot to tackle congestion – EEX's Reitz

Power grid operators and capacity mechanisms seen as impeding cross-border trade

Q&A: Ercot's Doggett on wind power surge and EPA rules

Outgoing president and CEO discusses challenges posed by renewables in Texas

EU power traders rail against national interventions

Capacity and renewables schemes deterring investment, say panel participants

Weather house of the year: Munich Re Trading

Weather derivatives specialist wins praise for consistent, high-quality service

Emissions house of the year: CF Partners

Specialist knowledge of carbon market is crucial to company's success

Asian emissions markets seen as step in right direction

China and South Korea emissions schemes show promise, say industry groups