Structured Products Technology Rankings 2016: Flexible friends

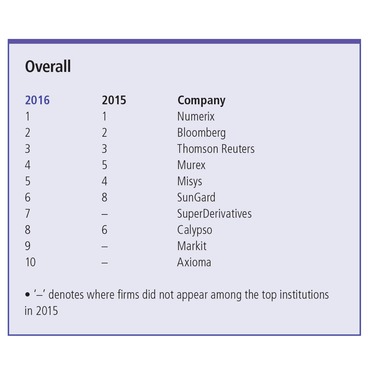

Numerix tops rankings as choppy markets place onus on sound risk analytics and vendor flexibility

The 2016 Structured Products Technology Rankings demonstrate the impact of choppy markets on dealers' risk management of their derivatives books, with firms demanding ever more granular risk information from vendors, coupled with greater platform flexibility.

Click for full rankings breakdown

At the same time, maturing markets and a more diversified range of participants than ever before offer greater possibilities to both issuers and buyers, argues Steve O'Hanlon, chief executive of Numerix, the New York-based quant technology firm which secured pole position overall in this year's rankings, as well as being ranked number one in three pricing and analytics categories, two risk management categories and the systems implementation efficiency and support category.

"As the equity market has been in a state of flux, questions have been asked about the sustainable performance of equities, so diverse equity strategies and structured products such as equity baskets have become more popular in investment portfolios," he says. "At the same time, a lot of regulatory agencies have been promoting increased education, creating a better-informed investor base."

"As the equity market has been in a state of flux, questions have been asked about the sustainable performance of equities, so diverse equity strategies and structured products such as equity baskets have become more popular in investment portfolios," he says. "At the same time, a lot of regulatory agencies have been promoting increased education, creating a better-informed investor base."

In part, technology is facilitating this learning curve, says Pontus Eriksson, head of strategy for global trading at FIS, which acquired SunGard at the end of 2015. SunGard was ranked sixth overall this year, up from eighth position in 2015. Eriksson reports that simplifying the issuance process is helping broaden the appeal of the market.

"We are starting to see firms provide structured products in a very easy-to-understand way. So, where an investor might not know what an accumulator is, they can instead identify the payout they need and the system calculates what components they need in order to achieve that kind of exposure," he says. "When you have done that in an automated, low-cost way instead of going to a trading desk that adds a lot of basis points for the service, you have a structured product that is much more appealing to a broader market because it is much cheaper."

Steve O'Hanlon, Numerix

Steve O'Hanlon, Numerix

Investors in key jurisdictions have begun to broaden their horizons when it comes to structured products. Though autocallables, reverse convertibles and basket options continue to dominate, says Jose Ribas, global head of derivatives, risk and treasury at Bloomberg, more complex structures and hybrid plays are also gaining traction in some quarters.

"We have seen a lot of target redemption forwards, dual-digitals and accumulators in the foreign exchange space, while zero-coupon callables are becoming popular in Asian markets," says Ribas.

Rick Phillips, principal product manager for interest rate derivatives at Calypso, which ranked in the top five for credit trading and for several risk management categories, says the firm has also seen evidence of this trend. "The increased usage of the solution by our existing clients has been primarily in the area of hybrid structures. We have also expanded our list of new clients in this area over the past 12 months – again mostly with an emphasis on hybrid structures," he says.

Murex, which took fourth place overall in this year's rankings, up from fifth in 2015, reports that average ticket size continues to shrink, while there has been a greater concentration of more commoditised structured payouts. Margins are thinner, the firm adds, which is proving more painful when combined with high regulatory pressure on costs, in particular on capital charges.

Tackling inefficiency

Technology providers broadly agree that the cost pressures faced by market participants have led to a process of transformation and silo reduction across their businesses. Firms have instigated the consolidation of systems and are increasingly asking for greater transparency across the product life cycle. Tackling inefficiencies across issuance, trading, risk management and capital allocation is an increasing focus among issuers, many report.

"We are seeing sell-side institutions work with us to put together very ambitious end-to-end plans which don't necessarily involve ripping out their whole existing systems, but often [involve applying changes] in a more surgical way [and] in a phased manner," says FIS's Eriksson.

He notes that in addition to the capacity to manage a structured products book, the design of graphical user interfaces to enhance the user experience and the ability to package products and manage all the relevant risk components is just as important for some houses as pure pricing capabilities. "A lot of the firms we deal with trade back-to-back, so they are just a conduit for [structured] products. The risk is not unimportant, but they need the workflow and they need a nice user interface. Many of the Swiss banks are offering these products to the retail market via their own web interfaces, where potential buyers can select products from a long list and then further define the end-date and the strike - nothing too complicated."

Geographical considerations

Competition and the cost burden of dealing with so many different sets of regulations have tempered the ambitions of many banks, with some global players pulling back from smaller jurisdictions and leaving local and regional banks to clean up.

Eriksson observes that in contrast to cash equities, the market remains highly regionalised. Structured products growth is still being seen in markets where investor choice can be more limited, such as the Middle East and certain Asian jurisdictions, he notes.

Catherine Marin-Verger, head of product marketing at Murex, says a broader trend is toward the development of a two-tier market based on institution size and geography. "A number of local, mid-sized banks, often in emerging markets, see structured products as an area of expansion, as they hold key customer relationships but haven't built the human, organisational or technical infrastructure to issue such products," she says. "They are facing the challenge of building the capability to issue structured products themselves, balanced against the cost of equipment and the risk of losing that investment if it doesn't provide the necessary time to market for new products."

By contrast, larger players with established global structuring businesses are pushing either to increase flow at a faster pace than the overall market's expansion or to find new niches.

"Among local, mid-sized banks, we see increasing demand for real-time, deal-by-deal hedging of trades, which can require complex pre-trade workflows with interlinked real-time request-for-quote workflows, customer and automated hedging workflows, and possibly multiple liquidity providers," says Marin-Verger.

More sophisticated risk management

The capacity to risk manage structured products effectively throughout their life cycle has seen greater demands placed upon issuers to accommodate more sophisticated risk management technology.

Bloomberg, ranked second overall in 2016, has seen its position in pricing and analytics categories increase across the board, while it retained the number one spot in equities. Ribas believes pressure from dealers to better manage product performance has led to innovation.

"The need for more robust risk management instruments has driven growth in the derivatives space, and likewise the regulatory frameworks and technology solutions needed to govern and facilitate trading in this market," he says. "For example, market players need to monitor on an intra-day basis how much they can lose if market conditions change or a counterparty defaults. In the past, this task was done less regularly."

We are seeing sell-side institutions work with us to put together very ambitious end-to-end plans which do not necessarily involve ripping out their whole existing systems

Pontus Eriksson, FIS

Brian Traquair, executive vice-president at FIS, concurs, and says that within firms, certainty is increasingly perceived to be supported by risk calculations performed separately by each function. "Most banks have to take a holistic view of risk, and structured products are part of that. There is an increasing demand for banks to have an independent risk framework, no longer relying on the front-office model," he says. "They need frameworks that allow them to independently value the risk within the portfolio. So when you talk about limits, collateral, market risk and market capital, all those various aspects are the things that are surrounding people trying to manage a structured products portfolio."

Numerix's O'Hanlon says the firm has seen buy- and sell-side clients asking for more sophisticated ways of managing valuation adjustments (known as XVAs) - including credit, debit and funding valuation adjustments - making them a critical driver of investment in technology. Longstanding relationships and deep insights into the operations of the institutions it works with have been an advantage, he says, helping the firm to secure second place in the XVA risk category for the second year running.

"[Management of] XVAs itself is a deeply rooted quantitative issue, and given our DNA it has been a natural extension for us," says O'Hanlon.

Thomson Reuters ranked third overall, with top five placements across all pricing and analytics categories, several top five placements in risk - including the number one spot for XVAs - and, for the first time, a top five placement in a trading system category (equities).

Jayme Fagas, Thomson Reuters

Jayme Fagas, Thomson Reuters

Jayme Fagas, global head of evaluated pricing at Thomson Reuters, says transparency of process has been key to the success of the Thomson Reuters Pricing Service (TRPS) Plus, the firm's over-the-counter derivatives pricing analytics suite. End-investors want ever greater visibility of risk, she says. "[The platform] offers customers 100% transparency into how prices derive, and therefore the risk associated with that instrument. They are able to see the pricing methodologies, the assumptions, the cashflows, and then all of the market data, volatility, greeks, and so on down the line. We've arrived here as a result of increased regulation and the need to be incredibly transparent and accurate when valuing instruments and their risk."

Demand for greater processing speeds is also spurring technology providers to increase their investment in platforms in order to meet customer requirements, according to Bloomberg's Ribas.

"An interesting trend in the market is that post-trade analysis and measures such as value-at-risk and XVAs need to be computed on a pre-trade level before the deal is closed," he explains. "This has created challenges for our customers and requires advanced risk solutions."

Over the coming year, as products become standardised and the processes around them are more established, vendors have seen a trend towards the simplification of technology – either in its usability or in its architecture.

Numerix was rated first overall for systems implementation efficiency and support – something the firm believes it owes to a number of technological innovations on its platform. Removing the pain of version upgrades and providing the capacity to easily add new functionality has been a clearly successful strategy, it says.

Regulatory imperatives

Looking ahead, the obvious pain point for issuers and investors - beyond general cost concerns – is that of compliance with a seemingly never-ending onslaught of new regulations, most obviously the incoming Packaged Retail and Insurance-based Investment Products (Priips) framework and the revised Markets in Financial Instruments Directive (Mifid II).

Bloomberg is planning to offer a holistic suite of solutions that will enable users to comply with Mifid II, including best-execution and reporting tools. "For structured retail products players in Europe, the need to generate the key information document (KID) as part of the Priips rules is a challenge that all market participants are facing, and we have a cutting-edge analytics and document-generation engine to help clients produce KIDs in order comply with [the regulation]," says Ribas.

The looming threat of regulation will drive even tighter valuation and risk management practices, according to Peter Farley, senior strategist for capital markets at Misys, which took fifth place overall in this year's rankings and polled strongly in the trading systems and risk management categories. Farley says there will be a corresponding impact on the technology resources that are required.

An interesting trend in the market is that post-trade analysis and measures such as value-at-risk and XVA need to be computed on a pre-trade level before the deal is closed

Jose Ribas, Bloomb

"Big dealers can't afford to overallocate capital against trades," he says. "So, not only must they be very precise, they must also demonstrate that capital is properly allocated. They need to understand trades, and the risks involved in those trades, in far more precise detail. This means much more pre-trade calculation and demand for analytics products. A lot of the guys are only [just] waking up to how onerous those calculations are going to be."

The level of pre-trade stress testing over "an incredible range of scenarios" is likely to be used by many market participants as an opportunity to re-examine which markets they stay in, according to Farley, with a correlation between the increased granularity of testing and the exiting of markets by some big firms.

"At the moment, I can only see statements of confidence from one or two big players that are committed to universal offerings in all markets. All the others are already reconsidering positions," he says. "If you look at the top 12 or top 15 players, they are deciding where their areas of expertise lie and where their opportunities are."

Vendors say they are also seeing tighter due-diligence practices becoming more important among clients. While this trend is more prevalent in the US, the level – and the detail – of such requests in Europe is growing. "Our clients will come on-site and spend somewhere between two and four hours with us," says Thomson Reuters' Fagas. "They want to make sure that when we say we have 100-plus valuators in our staff, they are sitting there. Clients want to review our methodologies; they want to review any enhancements we have made in the past year; they want to go through business continuity plans; and they want to look at road maps and timelines."

The opportunity to engage with clients is a huge advantage when many large clients demand oversight of vendor procurement at board level, she notes.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Rankings

TP ICAP: leveraging a unique vantage point

Market intelligence is key as energy traders focus on short-term trading amid uncertainty

GEN-I: a journey of ongoing growth

GEN-I has been expanding across Europe since 2005 and is preparing to expand its presence globally

Bridging the risk appetite gap

Axpo bridges time and risk appetite gaps between producers and consumers

Axpo outperforms in the Commodity Rankings 2024

Energy market participants give recognition to the Swiss utility as it brings competitive pricing and liquidity to embattled gas and power markets

Hitachi Energy supports clients with broad offering

Hitachi Energy’s wide portfolio spans support for planning, building and operating assets. Energy Risk speaks to the vendor about how this has contributed to its strong Software Rankings performance in 2024

Market disruptions cause energy firms to seek advanced analytics, modelling and risk management capabilities

Geopolitical unrest and global economic uncertainty have caused multiple disruptions to energy markets in recent years, creating havoc for traders and other companies sourcing, supplying and moving commodities around the world

ENGIE empowers clients globally to decarbonise and address the energy transition

In recent months, energy market participants have faced extreme volatility, soaring energy prices and supply disruptions following Russia’s 2022 invasion of Ukraine. At the same time, they have needed to identify and mitigate the longer-term risks of the…

Beacon’s unique open architecture underlies its strong performance

Recent turmoil in energy markets, coupled with the longer-term structural changes of the energy transition, has created a raft of new challenges for market participants