Sponsored statement: The Royal Bank of Scotland

Online platforms allowing private banks, brokers and asset managers to design and price their own tailor-made structured products are playing an increasingly important role in the global structured products market.

The Swiss market has led the way, establishing itself as the world leader in automated pricing and trading systems. Now clients around the world are gaining access to the same tools.

RBS has invested heavily in its MarketDirect platform, and has a growing roster of clients in regions such as Switzerland, the UK, Ireland, Benelux, Sweden, Finland, Denmark, Poland, Germany, Russia, Taiwan, Singapore and China. The platform will soon be rolled out in the US.

“Private banks, brokers and asset managers increasingly want to design their own bespoke products, and MarketDirect not only gives them rapid pricing and execution, but also combines primary and secondary market trading on the same platform,” says Christian Kronseder, head of E-commerce for Investor Products and equity derivatives within RBS Markets & International Banking in London.

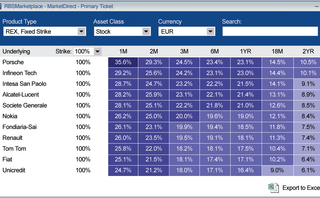

The RBS MarketDirect platform offers access to a wide range of more than 300 underlyings. With the recent addition of a number of less liquid Finnish and Norwegian stocks, it shows that electronic systems such as these can increase client service where manual processes cannot. Complementary to plays on single stocks, the platform can quickly price payoff structures on baskets of stocks or indices including the popular worst-of structure. Asset classes offered include equity indices, commodities, exchange-traded funds and foreign exchange.

A mass pricing function generates a grid of coupon yields for reverse exchangeables and barrier reverse exchangeables across all underlyings on the platform, with advanced filtering and search capabilities. It offers a visual cross-colour comparison of underlyings, tenors, strikes and barriers. This mass pricing grid is used by many clients as the entry point after logon, scanning for the latest market opportunities.

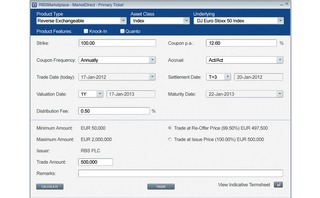

Professional advisers at brokerages and private banks can discuss the needs of their high-net-worth individual clients and design a structured product with exact tailored parameters such as underlyings, tenor, capital protection and currency hedging features. The adviser can typically price a tailored product, such as a bonus certificate, discount certificate or capital protected note (CPN), in less than 20 seconds.

For small asset managers that might only occasionally trade structured products, MarketDirect allows constant access to product designs and payoffs to suit their own timetables, without constantly having to contact sales desks asking for price quotes.

The MarketDirect platform supports full straight-through processing, allowing for efficient pricing, trading and settlement all the way from the trading desk to the back office. Unlike some of its competitors, MarketDirect is not delivered via a web browser, but sets up point-to-point connections via the internet, directly linking the client with the RBS infrastructure. This can be an advantage in terms of data transfer security and price generation speeds.

“The screens are intuitive and easy to use, in addition to giving us very fast feedback on our trading ideas,” says one broker.

“We particularly like the fact that we can access both primary and secondary markets with one tool,” adds a private banker. “Once we have designed a product, we can top up or trade in and out with very tight bid-offer spreads.”

The secondary market area currently lists around 40,000 existing products, depending on availability and access rules in various jurisdictions. By switching to the primary market section, the user can tailor, price and execute its own product directly from the same screen. The ‘blotter’ window can then be used to track all primary market quotes and trades with the corresponding term sheets.

One feature that has attracted widespread interest is the ability to hedge currency risk on all trades conducted on the platform. Having designed a product – simply by ticking the ‘quanto’ box and selecting a currency – a new payout is generated with hedging costs included.

Private banks and brokers in markets such as Poland have been quick to take advantage of the rapid price generation on global baskets, while stripping out all of the various currency exposures, therefore designing products for the domestic market denominated in zloty.

Even for those clients that are comfortable with some foreign currency exposure, quantos can be used to simply hedge out a specific currency risk.

For bonus certificates, platform users can also click on the ‘cap’ function, which allows them to give up some of the upside in order to improve the payoff by selling vanilla call options. Investors can, therefore, quickly compare the yield on bonus certificates that they generate with or without the cap.

The cap function is also available for CPNs, allowing clients to give up some upside and use the income generated by the sale of the options to boost the participation in the performance of the underlying. CPNs have an additional ‘Asianing’ feature that can be added while designing a product. By clicking the Asianing box, the client can instantly convert a product to include Asian-style options, where the payoff depends on the average price of the underlying asset over a certain period of time, as opposed to at maturity. Asian options are generally cheaper than vanilla options because of the averaging feature, so a larger number of options can be bought than with vanilla options, therefore boosting the payoff.

In addition to the primary market, RBS also offers a wide range of products in the secondary market. As well as single-stock payoffs, there are sector plays including financials, automobile and automotive parts, aerospace and defence, beverages, chemicals, construction materials, electricity, telecommunications, food and drugs, gas and water, utilities, retailers, household goods, industrial engineering, leisure goods, and life and non-life insurance.

There are several underlyings available for each sector. For example, in the oil and gas sector, MarketDirect has 22 underylings, including Petrobras, BP, Shell, ENI and Gazprom. Investors enjoy the flexibility of access to a wide variety of their favoured underlyings, with rapid price generation on a full range of tenors and target yields, with multiple currency risks instantly hedged out.

The time and money invested in building the infrastructure required to create this sophisticated platform now enables RBS to enhance client experience and deepen the relationship. The sales team is able to focus on value-added services and solution-driven transactions while the platform handles flow and commoditised products.

“Just as with the foreign exchange trading business, that has an extremely high level of automation but where personal relationships continue to be very important, the MarketDirect platform forms one part of a deeper client relationship,” says Kronseder.

The aim is to build an ecosystem around the platform, for example, with educational tools helping client advisers of private banks to familiarise themselves with the full range of possible payoffs.

At the brokerage houses, there is a lot of pressure to become more efficient and keep client charges as low as possible. Very rapid and efficient pricing and trading on more simple payoffs give brokers more time to come up with more complex trading ideas.

There is very heavy investment in new computer infrastructure right across the global structured products industry. Electronic pricing and trading platforms look certain to play a bigger role in the market, including in the US, where some of the sophisticated systems originally developed in the Swiss market are being introduced.

Adopting new technology is going to be vital in order for private banks, brokers and asset managers to keep their competitive edge. Since its launch 18 months ago, RBS MarketDirect has rapidly built up a client base with more than 1,000 individual users and has created an easy set-up process allowing new clients to trade within days.

The information contained within this article is intended for professional investors only and is not suitable for retail investors. The contents of the RBS MarketDirect platform are not intended to, nor do they, provide any financial, investment or professional advice in respect of any products shown on the platform. The products described in the platform may not be suitable as an investment instrument for every user. Further, the purchase of these instruments may entail risk. The prices and values of all products may fluctuate and, depending on the product features and performance of the underlying, investors may lose some or all of their investment. Investors will be also subject to the credit risk of the relevant issuer within The Royal Bank of Scotland Group. RBS plc is authorised and regulated in the UK by the Financial Services Authority and RBS NV is authorised by De Nederlandsche Bank and regulated by the Netherlands Authority for Financial Markets and regulated in the UK by the Financial Services Authority for the conduct of UK business.

Click here to view the article in PDF format.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net