ETF strategies to manage market volatility

Money managers and institutional investors are re-evaluating investment strategies in the face of rapidly shifting market conditions. Consequently, selective genres of exchange-traded funds (ETFs) are seeing robust growth in assets. Hong Kong Exchanges and Clearing (HKEX) explores the top product trends in the ETF market emerging from recent market volatility

The inverse universe

Inverse products are increasingly used by investors to capture opportunities and manage risks during market downturn.

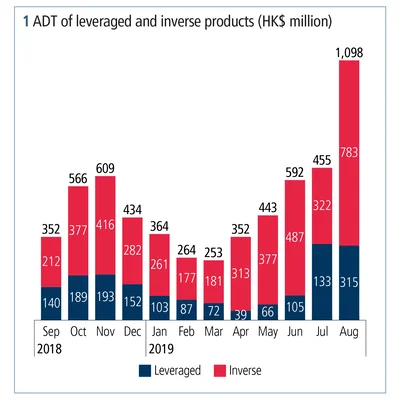

The inverse products market is fast expanding due in part to recent market volatility. In Hong Kong, the monthly average daily turnover (ADT) of inverse products surged more than 141% in one month to HK$783 million in August 2019, pushing the monthly ADT of leveraged and inverse products (L&I products) to a record high of HK$1 billion (see figure 1).

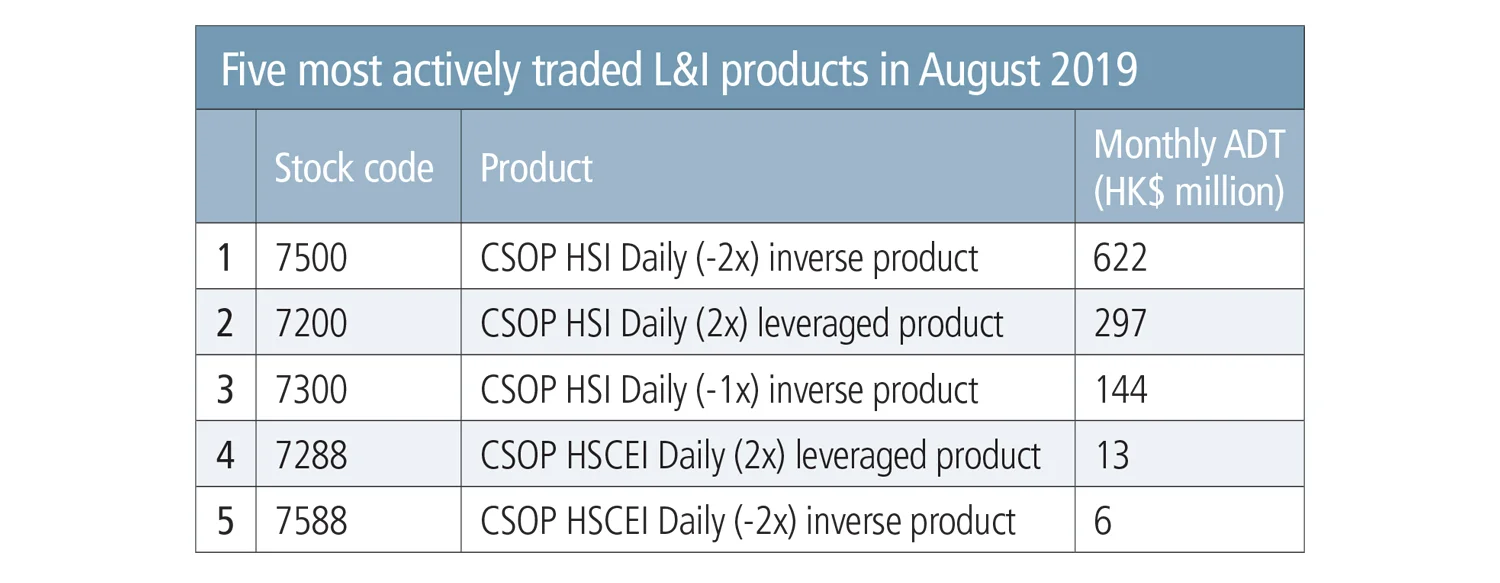

Investors have shown a preference for higher leverage multiples – especially when volatility spikes. In August, when deepened trade tension had a conspicuous impact on equity markets, -2x inverse products accounted for 57.2% of total ADT in Hong Kong‑listed L&I products, and two out of the five most actively traded L&I products in terms of ADT were -2x inverse products (see table).

Compared with other derivatives products, L&I products offer a higher degree of flexibility. Melody He, managing director at CSOP Asset Management, notes: “Many institutions have mandates that restrict them from using derivatives; the operational and risk management costs associated with derivatives trading are also quite high. Therefore, institutions are increasingly using -2x inverse products to hedge the market. Not only is the settlement the same as stocks, but clients investing in the exchange-traded product do not need to worry about monthly rolling, margin calls, collateral and extra transaction costs/slippage.”

“Typically, institutions use -2x inverse products tactically to express their views. For example, a -2x inverse product benchmarked against the Nasdaq Index might be used to hedge risk before the market opens in the US,” she says.

-2x inverse products were introduced to Hong Kong investors six months ago after the Securities and Futures Commission approved a rule change to expand the multiples of inverse products. In response to growing investor interest, two new -2x inverse products were launched in September, both benchmarked against a major US equity index.

Shifting investor preference

Unstable market conditions have been driving capital to fixed income. Globally, fixed income products are the most popular type of ETF, collecting US$59.5 billion in the second quarter of 2019, according to BlackRock. Meanwhile, commodities ETFs are another area to watch for potential gains and rebalancing opportunities. As demand for safe-haven assets increases, gold prices have surged 17%1 year-to-date, outperforming other asset classes. Owing to rising gold prices and capital inflows, the market cap of gold ETFs listed in Hong Kong grew more than 36% since the start of the year to HK$1.1 billion at the end of August.

Notes

1. Bloomberg, as of September 18, 2019

Investors should note that exchange-traded products can include counterparty risk, market risk, tracking errors, trading at discount or premium and liquidity risk. They should also understand how the performance of L&I products is likely to be affected when they are held for more than one trading day, as there will be a compounding effect. Learn more about exchange-traded products.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net