This article was paid for by a contributing third party.More Information.

Data quality in focus as UMR deadlines stretch

The uncleared margin rules (UMR) are seen by many as key to accurate and fast margin calculations. IHS Markit explores how firms can quickly assess proposed trades, calculate initial margin accurately and effectively handle the margin exchange workflow to manage portfolio margin

Many individuals have taken the opportunity to adjust routines and reset goals amid Covid-19 lockdowns and working from home. Similarly, the delay for imposing the UMR on smaller entities announced by the regulators in April presents an opportunity to recalibrate.

Impacted firms can assess their understanding of the changes that are needed in workflows, margin calculations and the backtesting of initial margin (IM) models.

The UMR regime has been rolled out in phases since 2016 and an estimated 1,000 firms are due to be caught in the next waves, depending on their aggregate notional amount of non-cleared over-the-counter (OTC) derivatives. Due to the Covid‑19 pandemic, regulators agreed to temporarily halt implementation for a year, delaying the fifth and sixth phases until September 2021 and 2022, respectively.

However, even with the delay in implementation, the complexity of the rules and the amount of work involved in changing collateral requirements spare no one.

“There is a huge focus on operations, but perhaps an area that requires more focus is the quality of data,” says Sage Patel, Asia‑Pacific head of pricing, valuations and reference data at IHS Markit. “Data is not only essential to the UMR subject, but also to Basel IV, the Fundamental Review of the Trading Book, credit valuation adjustment, the accounting rules and International Financial Reporting Standards adopted in each jurisdiction here in Asia. Hard-coded data underpins all of those regulations.”

“The reality is that there are varying best practice processes that are taking place and defining organisations’ investment strategies. Firms need valuation points that not only cover all the regulatory themes but also carry confidence for organisations to validate,” he adds.

The global regulatory agenda covering the OTC derivatives market participants recommends the implementation of margin requirements for non-centrally cleared derivatives. While counterparties are familiar with the variation margin (VM) concept – which is paid daily from one side of the trade to the other, to reflect the current market value of the trade – IM rules and operations are new to many market participants.

IM is held to cover the losses that could arise in the period between the defaulter’s last VM payment and the point at which the surviving party is able to hedge or replace the trade.

The UMR requires counterparties to post mandatory IM in segregated custody accounts to back their bilateral trades. Companies subject to the rules must calculate margin amounts using a standard grid or a regulator-approved internal model – such as the International Swaps and Derivatives Association’s (Isda’s) standard initial margin model (Simm).

Risk sensitivities, which are used as inputs to Simm, must be provided in a standard template. Generating this template is one of the biggest challenges with using the model.

Market observers consider UMR instrumental to driving the requirement for accurate and fast margin calculations. There is a need to quickly assess the impact of proposed trades, calculate accurate IM for completed trades and seamlessly manage the margin exchange workflow to efficiently manage portfolio margin.

Bring confidence to data

In line with what the regulators and the varying collateral teams across jurisdictions are demanding under the UMR, organisations must have the capabilities to provide not just an evaluation to a specific asset, but also be able to give the comfort to backtest and validate the financial models used to calculate the pricing and margins of all asset classes. Such proficiencies are also something of great value given the volatility in recent times.

The peak of volatility in early 2020 put many firms’ margin models to test. As fears about the market impact of Covid‑19 intensified in March, central counterparties hiked the margin for cleared swaps, driving further discussion on the margin for non-cleared trades. Many phase five and six firms are worried some pain points will be magnified once new IM call and funding requirements are added to the mix.

The significant skews to how pricing is behaving in the Asian markets are essential for firms to look at as the region has garnered attractions for non-Asian clients to maximise their yields under today’s shift in geo-economics and low interest rate environment in their home countries.

However, the nature of the markets in Asia – a lack of cross-border execution, transparency and available sources for pricing – may pose some challenges to firms trying to understand the local nuances. Organisations need to understand how the pricing is behaving in a local market so firms can determine the strategies of trading and entering into new markets.

“What we are seeing now is an increased interest in the more exotic instruments in the derivatives market, which is a big challenge for any IM calculations that are taking place,” says Patel. “There are very different risk sensitivities that are applied to derivatives, which make it more challenging to understand and obtain the data.”

The challenge is also coupled with the fragmentation and breadth of the Asian markets. While the UMR regime is consistent across jurisdictions at a high level, regional variation in in-scope firms and assets, calculations and netting rules could present numerous complexities for firms operating and trading internationally.The key to navigating these is having trustworthy back-end solutions based on data and valuations with local market nuances.

“It’s about giving confidence to how the data is behaving. IHS Markit publishes a price that can be used for evaluation, margin control, and so on. Our pricing data helps understand how real the price point is, how the price point is behaving in normal times versus volatile markets, whether it is reflective of the behaviours of the trading market how it is behaving versus the inventory an institution is having – however diverse it can be,” says Patel.

The importance of an ecosystem

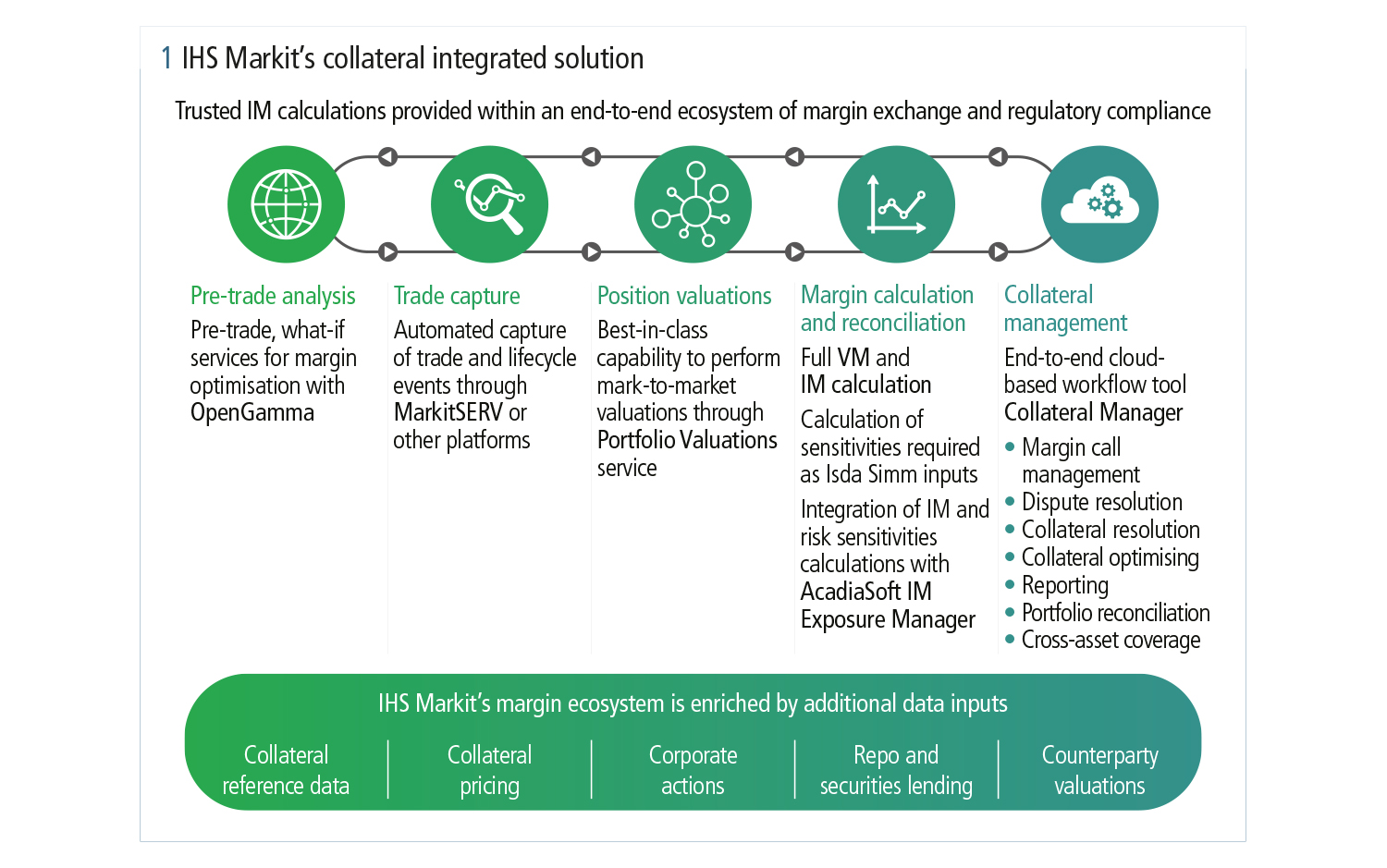

Given IM’s strong implications on market participants’ funding, legal, operational and compliance processes, it is important to have an end-to-end solution to manage collateral workflows and technology systems.

“The delay allows organisations to really look at their vendors on the table and select according to their needs. For resource efficiency and integration, the goal is to look at a vendor that provides an ecosystem that fulfils all the components of the UMR,” says Patel.

IHS Markit, for one, has partnered with several vendors to create an ecosystem for addressing margin requirements while increasing efficiency across the enterprise.

“The partnerships are about making sure that there is connectivity to the entire workflow, to provide an ecosystem that is needed within the collateral space,” says Patel.

The solution provider’s IM Calculation Service operates seamlessly with Collateral Manager, its cloud-based solution for collateral management (see figure 1).

The end-to-end IM management is coupled with its third-party integrations with vendors such as AcadiaSoft and OpenGamma.

In January 2019, IHS Markit began partnering with AcadiaSoft, a provider of margin automation solutions, to connect the firms’ platforms for managing IM. Both companies would exchange data in areas including margin and custodial agreements, risk sensitivities calculation and margin reconciliation data.

In May 2020, IHS Markit teamed up with OpenGamma, a margin optimisation provider, to unite the former’s post-trade derivatives calculation service and the latter’s pre-trade margin analytics.

As market participants approach the new deadlines, IHS Markit is also offering phase five and six institutions complimentary health assessment on their UMR readiness.

“Understanding which phase your institution sits in is of paramount importance. Organising internally and going through the detailed needs that you have for a vendor selection is another one,” says Patel. “It is time to make sure you are able to execute and deliver within the timeline we are aware of right now.”

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net