This article was paid for by a contributing third party.More Information.

2020 SOFR ecosystem mid-year recap

By Anna Ellis and Bobby Timberlake, CME Group

After building tremendous momentum in autumn 2019, SOFR floating rate note (FRN) issuance saw a slowdown in winter, only to surge to new highs in Q1 and Q2 2020.

Already over $650 billion notional to date, from 50+ participants, the FRN market growth is expected to accelerate as several major deadlines are crossed.

While the latter half of 2019 had Federal Reserve policy uncertainty as the main driver of volatility, the economic fallout from COVID-19 and the Federal Open Market Committee (FOMC) aggressively cutting rates during March 2020 impacted the system and spilled over into repo rates which underlie the SOFR benchmark.

Hedging dips, futures bounce back

The prospect of extended zero rates at the short end of the yield curve, including overnight repo, put a damper on April and May hedging and repositioning, but June saw a quick rebound amidst continued economic uncertainty. Open interest stayed strong, trending in the 450-500,000 contract range, with daily volumes north of 40,000.

Source: CME Group

Building out the curve

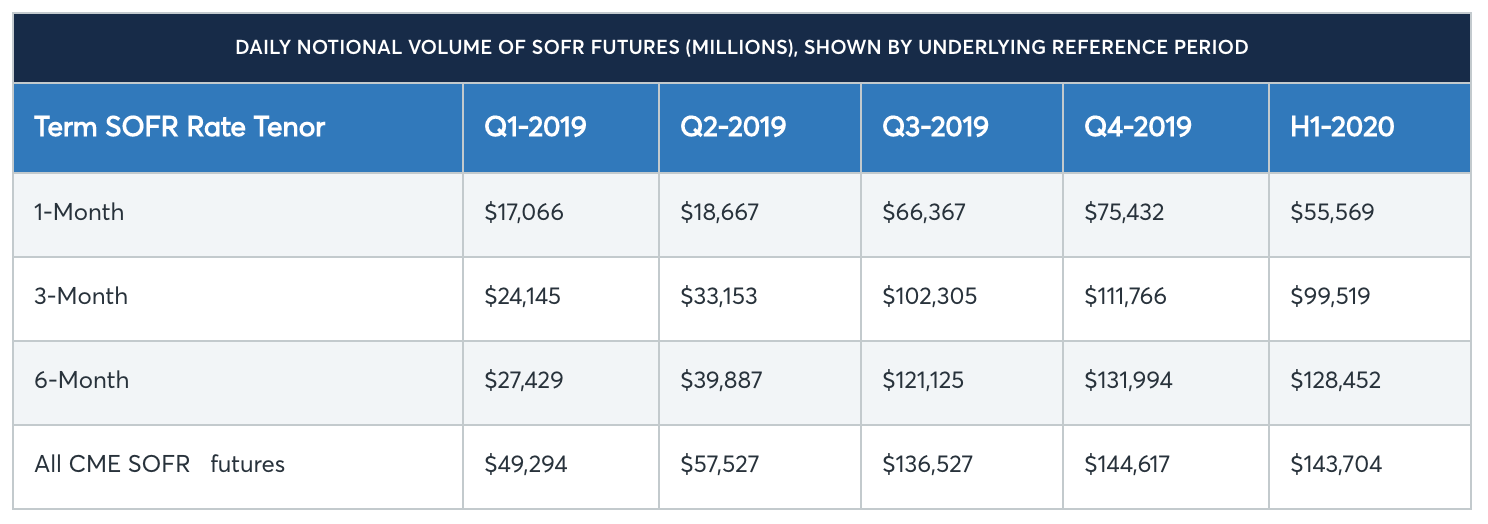

Open interest in both the One-Month and Three-Month SOFR futures contracts now extends into 2021, and with that, a term structure for overnight averages has begun to emerge. The increase in daily notional1 equivalent volumes into the hundreds of billions of dollars2 represents a growing market consensus on where SOFR is expected to trend in the near future.

As with the Eurodollar complex, this increase means more opportunities for direct hedging of upcoming reference periods, as well as a healthy market for Inter-Commodity Spread trading. The individual fixings, outright futures term structures, and basis spreads between them are all available in the Short-Term Interest Rate Analytics tool3.

Source: QuikStrike

Floating rate note issuance

Issuance of floating rate notes also saw a winter decline followed by a strong spring rebound, along with a shift in lead participants. New banks continued to dip their toes in the water, increasing the overall population but keeping average bank issuance on the smaller size. As of June 2020, banks and US Government Sponsored Enterprises (GSEs) each numbered around 250 active notes, with the FHLBs just over half that count.

Source: Bloomberg L.P.

Enter the GSEs

Throughout 2019, a growing population of banks and corporate issuers were responsible for about half of all SOFR-linked notes. However, the 11 Federal Home Loan Banks (FHLBs), representing over 7000 local financial institutions who provide US housing loans, reached as high as 60-70% of the notional total.

As overall borrowing slowed in winter 2020, banks continued their steady march. Eventually 40 active participants plus another 11 international development banks issued SOFR FRNs. However, entering Q2, Fannie Mae and Freddie Mac significantly ramped up their borrowing, taking the lead first in monthly and then overall notional issuance.

Similar to the FHLBs, Fannie & Freddie’s sheer size meant issues in the $1-3 billion range, versus individual banks in the $50-500 million range. The major driver of this is a mandate from their regulator, the Federal Housing Finance Agency (FHFA), to end issuance of LIBOR-linked transactions extending beyond December 2021 as of June 30th:

Effective January 1, 2020, FHFA has prohibited the Banks from investing in products with maturities beyond December 31, 2021. Effective June 30, 2020, the FHLBanks will cease entering into all other LIBOR transactions with maturities that extend beyond December 31, 2021, with only very limited exceptions granted by FHFA. This date was extended from its original date of March 31, 2020, and this extension does not cover option-embedded products4.

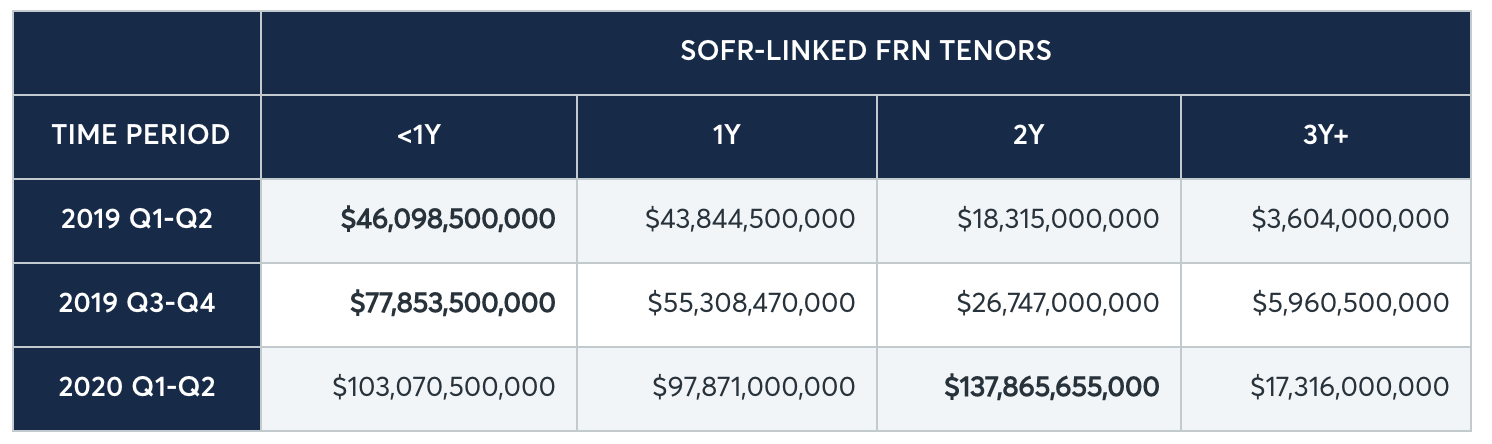

Source: Bloomberg L.P., compiled by CME Group

This mandate will be followed by Fannie & Freddie’s plans to stop accepting LIBOR-based adjustable rate mortgages by the end of the year. In between will be the Alternative Reference Rate Committee’s announcement in September of a process to build out term SOFR, and then the industry-wide shift to SOFR for swaps price alignment and discounting in October, creating a full schedule for market participants.

Terms maturing

As with SOFR futures, participants in the cash markets are venturing further out. While the latter half of 2019 saw a pickup in the 2-3 year tenors, the first half of 2020 saw 2-year notes taking the absolute lead, followed by 1-year notes. Additionally, individual issues at the 4-, 6-, and 7-year point were sold, indicating a growing comfort with longer-dated SOFR debt.

Between a more established term structure in futures, public sector encouragement to taper down the duration of LIBOR contracts, and a healthy balance of participants in each market, this trend in longer-dated SOFR transactions is likely to accelerate in the near future, in turn driving the need for hedging and risk transfer.

1 Notional shown for illustrative purposes only, computed based on the value of an equivalent money market instrument with the same dollar-value-of-basis-point (DV01).

2 CME SOFR Strip Rates: https://www.cmegroup.com/trading/interest-rates/sofr-strip-rates.html

3 QuikStrike STIR Analytics: https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html

4 FHFA Libor Transition announcement: https://www.fhfa.gov/SupervisionRegulation/LIBORTransition

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today’s uncertain global economy.

Follow us for global economic and financial news.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net