This article was paid for by a contributing third party.More Information.

New frontiers

Innovative investment opportunities are helping to mitigate risk and satisfy Solvency II capital requirements as insurers face continued economic uncertainty. Frederic Morlaye, managing director, insurance and capital management solutions, Global Markets at BNP Paribas, discusses investment options for insurers to successfully navigate current economic and regulatory market conditions

Insurers are facing a great deal of market uncertainty in their investment portfolios – what are currently the most pressing issues in this area?

Frederic Morlaye, BNP Paribas: Europe is still in a period of very low interest rates with limited opportunities because of the ample liquidity provided by the unconventional central bank quantitative easing policy, which creates issues for insurers’ investment strategies. Of course, there are spots of tension in the market – US interest rates, for example, have started to rise, but European insurers’ exposure to US markets tends to be very limited so they have not benefited from this trend.

Within Europe, there is also some tension coming from the economies of Italy and Spain, but this has not yet affected the core European market. As a result, the market is still very tough for investors as most asset classes remain expensive.

The current geopolitical outlook only adds to this environment – particularly recent global trade tensions. This has created uncertainty around prospects for growth and, as a result, the performance of asset classes that are correlated to growth such as equities, commodities, private equity and bonds.

How does the current regulatory environment for European insurers add to these difficulties in relation to investment decision-making?

Frederic Morlaye: Solvency II was a game‑changer when it came into effect in January 2016 because it introduced a European risk measurement framework for defining insurance companies’ capital requirements. This means that the more risk an insurer takes – either in underwriting or asset allocation – the more capital it needs to hold. For example, the standard equity solvency capital requirement for ‘type 1’ or developed market stocks is 39% of the initial investment.

These capital charges can quickly become substantial, and in the run up to Solvency II – and following its implementation – insurance companies have been very aware of that. Many insurers have made the decision to de-risk or reallocate assets as a result. The other side effect is that solvency requirements can vary by as much as 20 basis points per quarter, depending on market volatility.

How do insurers typically manage such swings in capital requirements? How can they be avoided?

Frederic Morlaye: Solvency II is a framework with many moving parts; insurers must find the optimal strategy to deal with these conflicting elements, and there are a number of options. Insurers have a pot of capital to allocate to underwriting and asset allocation, and they must find a balance under Solvency II to get the best returns while still being able to live with volatility. This volatility can be tackled by investing in lower-risk strategies or by hedging.

Has the use of derivatives increased in the insurance industry following the introduction of Solvency II?

Frederic Morlaye: That is definitely what we have seen. Prior to Solvency II, insurance companies were already using derivatives, but strategies were typically very vanilla – trading puts, collars and spreads with long maturities, for example. The purpose of this, particularly outside the more advanced UK market, was generally to avoid or mitigate asset impairment in the event of a market collapse. Following the implementation of Solvency II, many insurers have started to implement more efficient and more structured solutions in line with the need to post capital for equity investments.

How has the treatment of derivatives under Solvency II affected the type of hedging strategies used within the European insurance sector?

Frederic Morlaye: Over the past two years, insurance companies have designed their hedging strategies around the Solvency II framework. There are eligible risk‑mitigating instruments that insurers can use to reduce capital for asset allocation under Solvency II, and simple products such as puts, but there are some constraints.

For example, the put must have a maturity of more than one year to have full credit under the requirements – unless it is fully systematic. There can be no discretionary element to the derivative selection in that case.

In addition, strategies must be deemed sustainable and affordable by regulators. Sustainability means that the underlying derivatives market is liquid enough to consistently implement the actual derivatives strategy. Affordability relates to situations in which, for example, a market event would make purchasing puts very expensive – the regulator wants to ensure there is no incentive to suspend protection because it is too costly compared with the benefit it provides.

Do insurers now need more complex hedging strategies as a result of the capital requirements under Solvency II?

Frederic Morlaye: In the current regulatory environment, some of the more vanilla strategies – a single put, for example – may not be the optimal approach for an insurer from a cost-of-carry point of view. More elaborate strategies can balance cost with risk mitigation in other areas and ensure full compliance under Solvency II. For instance, BNP Paribas’ protected equity solutions are designed to optimise cost of carry, significantly reduce timing risk and address Solvency II capital requirements by substantially reducing the otherwise standard capital requirements for equities holdings of 39%.

These solutions include a customised hedging strategy to manage economic risk and provide capital relief. This purely systematic derivatives overlay – as required under Solvency II – contains two layers in the case of the equity solution. In the first layer, a call overwrite strategy using the Euro Stoxx 50 index is executed daily over a period of 15 business days. The calls are sold slightly out-of-the-money. The purpose here is to reduce the overall volatility, smooth out execution and timing, and enhance the performance of the solution. The premium harvested through the call is then used to systematically purchase long-dated puts that will provide risk mitigation in the event of market corrections. This part of the strategy is designed to address regulators’ affordability concerns under Solvency II.

There has been only one collapse of more than 25% over the past 30 years or so – and that was in 2008. However, there have been multiple instances of market corrections of up to 25%, including Black Monday in October 1987 and the dotcom crash of 2000. In such situations, a put strike at 80% – a common strategy among insurers – would pay out nothing. However, BNP Paribas’ strategy involves purchasing one-year puts daily, striking at-the-money for 50% of the notional, rather than purchasing a put for the full notional stroke at 80% of the market price. This strategy pays out in the event of smaller – more likely – market corrections, ensuring a better cost of carry and satisfying affordability requirements. As with the call element, the put strategy is executed on a daily basis to mitigate timing risk.

How do such strategies fit into a fund’s portfolio construction?

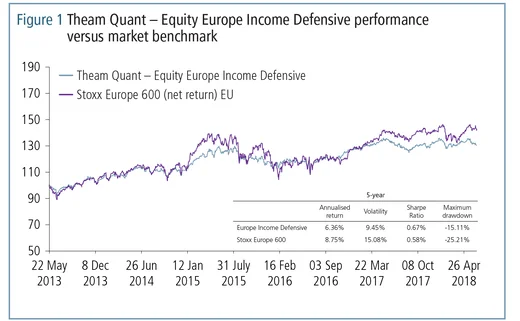

Frederic Morlaye: These hedging strategies need to be combined with core allocations that are consistent with the overall investment objectives of the insurers. To illustrate this, we can look at the protected equity solutions launched by BNP Paribas in 2013 through the Theam Quant – Equity Europe Income Defensive fund (BBG: TQEEPRA LX Equity). To date, it has attracted €1 billion of assets under management. The fund uses fundamental analysis to systematically select from the most liquid companies in Europe – those that pay high dividends and have the necessary financial leeway to consistently do so. This core allocation, combined with the previously mentioned hedging strategy, aims to provide a stable income from equities. It has delivered an annualised performance of 6.3% over the past five years, with around 40% less solvency capital than traditional equity funds.

BNP Paribas has since launched two more strategies offering similar new investment opportunities in asset classes that are usually treated punitively under Solvency II, namely in high-yield credit with the ‘Hype’ strategy – BNP Paribas High Yield Europe Defensive, (BBG: HYPE FP Equity) – and in a multi-asset alternative through the Theam Quant-Multi Asset Diversified Protected (BBG: TQMADPI LX Equity) strategy. All three strategies, while offering different opportunities to investors, are designed to be liquid and user-friendly, as well as satisfying capital requirements under Solvency II.

How does hedging affect the performance of investments?

Frederic Morlaye: In equities, for example, the performance of the fund has almost been on par with the market benchmarks since it was launched in 2013 (figure 1). However, these strategies are designed to be defensive, and the idea is not to beat the benchmark – the hedging comes at a cost here but substantially reduces the volatility of the returns. Again, these solutions aim to outperform when markets are down or volatile while offering insurance companies new investment opportunities with better risk/reward profiles in various asset classes.

The investments in the funds are subject to market fluctuations and the risks inherent in investments in securities. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay, with the funds described being at risk of capital loss.

For a complete description and definition of risks, please consult the latest available prospectus and key investor information document (KIID) of the funds. Investors considering subscribing to a fund should carefully read its most recent prospectus and KIID, which can be downloaded free of charge from the BNP Paribas website

Past performances or achievement is not indicative of current or future performance.

There is no guarantee that the performance objective will be achieved.

Creating new investment opportunities

The protected and defensive strategies of BNP Paribas are developed by the bank’s quantitative investment strategy (QIS) team in partnership with the insurance industry team.

“The QIS team has a global remit to design systematic strategies across all asset classes, and this team really masterminded the protection element of the strategies,” says Frederic Morlaye, managing director, insurance and capital management solutions, global markets at BNP Paribas. The insurance team, which is more industry-focused, has an in-depth knowledge of current trends, as well as a future outlook for the market. As such, its input is invaluable in designing these solutions, which he sees as “a new investment opportunity”.

“The resulting strategies can be tailor-made to suit specific client needs, but what really sets us apart is, I believe, the expanding range of Undertakings for Collective Investment in Transferable Securities – or Ucits – funds, through the Theam Quant Sicav. This provides insurers with off-the-shelf, liquid and transparent solutions – and new investment opportunities in asset classes that are usually punitive in terms of capital requirements.”

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net