Asia Risk Corporate & Institutional Rankings 2017: The winners

Standard Chartered and HSBC top the tables

Click for full rankings breakdown

Corporate rankings

For Raghavan Rajagopalan, global head of structuring at Standard Chartered, the themes that have shaped the corporate hedging environment in Asia over the past 12 months have been markedly different than the year before.

Whilst 2015 and the first half of 2016 were characterised by a series of events that sent equity markets into a tailspin and prompted excessive levels of currency volatility, this year has seen an unprecedented low level of volatility that has left treasury departments wondering whether they should hedge at all.

Against this backdrop, Standard Chartered’s commitment to understanding its customer’s needs and ability to structure cost-effective solutions has seen the bank retain its position at the top of the Asia Risk corporate rankings.

“Given the low-volatility environment and relatively stable currency markets such as Indonesia and India, clients have been reluctant to hedge in the forward markets, but have rather preferred more flexible option structures for hedging their US dollar exposures,” says Rajagopalan.

One structured solution that is becoming increasingly popular among Asian corporates is to use a call spread to hedge currency exposure. This type of structure offers protection for the client within the limits of an upper and lower strike price. The advantage of this product compared to a more vanilla hedge is that the client can enjoy any potential upside should the markets move below the lower strike.

“This gives clients the flexibility they need and doesn’t lock them into a fixed rate that a simple forward would do. Clients want to be able to protect themselves but also adjust this protection if prevailing market conditions change,” says Rajagopalan.

The challenge for banks offering such structures is to be able to do so at sufficient tenor whilst keeping prices low, since it is the promise of cost reduction that draws clients to the solution in the first place. Longer-dated solutions are a more efficient way of managing long-tenor currency risk without having to periodically undertake short-tenor rollovers.

“The market breadth and liquidity that we have in many of these markets enables us to recycle some of the risk via offsetting trades and warehouse the remaining risk on our balance sheet,” says Rajagopalan.

Call spread products have been particularly popular in Indonesia and Malaysia. In terms of other products and locations, Standard Chartered is particularly proud of a cross-currency swap that was offered to a client in Sri Lanka, which allowed them to hedge their US dollar exposure out to three years – “the first in the market,” says Rajagopalan.

HSBC, which placed second in the corporate rankings, has also leveraged off the strength of its franchise in order to allow corporates to more actively manage their cross-border currency risk.

“Our deep corporate franchise as well as our strong presence in all the markets across the globe has really helped us develop innovative solutions for clients by providing access to liquidity and thinking holistically across the bank,” says Selene Chong, head of corporate sales for Greater China at the bank.

HSBC’s ability to tap into liquidity and recycle risk across the bank came to the fore when it successfully executed a foreign exchange trade in the Vietnamese dong market to the tune of several hundred million USD.

“This was a huge amount to do in a market where daily liquidity may not even be a fraction of the trade and we were able to execute that over just a few days. Clients really appreciate that,” says Chong.

On being able to provide holistic solutions, both HSBC and Standard Chartered are very strong.

“It’s not just about risk management, interest rates, currency hedging – but about our ability to look at the financing needs and implications for clients as well, and wrap everything up as a holistic solution,” says Chong. “Our ability to connect internally and to leverage off expertise in different parts of the bank helps us deliver those solutions that best meet client needs.”

Standard Chartered has a similar approach when looking at the needs of its clients, with Rajagopalan noting that in the current competitive and complex environment it doesn’t make sense to look at things purely on a product level.

“We track clients holistically across the spectrum of products that we offer, not just within [global] markets but also outside [of this], bringing in international banking and corporate finance solutions as well,” says Rajagopalan. “We have been much more focused on working closer with the trading team to deliver first-rate solutions for our clients.”

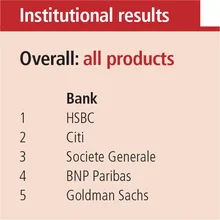

Institutional rankings

The low-volatility environment has also played an important role in the strategic investment decisions being made by the institutional clients of banks, with a corresponding rise in passive investment and exchange-traded funds. HSBC leads the rankings in the institutional space, with US banking giant Citi in very close second.

A key value proposition that HSBC has brought to institutional clients in the market is to quickly spot the rapid growth in passive fund management, whilst making sure that proper attention is still being given to those clients that need more hands-on management of their money.

“We have expanded our digital solutions to better service clients, especially given the rise of these passive mandates. This has allowed us to redeploy resources towards clients’ active and alpha mandates, which has leveraged our core strength of being a highly rated and very liquid finance provider capable of developing bespoke and strategic solutions for these clients,” says Tony Shaw, head of institutional and wealth sales for Asia-Pacific at HSBC.

A large part of the bank’s value proposition comes from being able to tweak these digital solutions according to customer needs, rather than hand everyone the same offering.

“Digital needs differ from client to client. Our ability to tailor digital solutions for customers is critical,” says Shaw.

Given the low volatility and current uncertainty in markets, one strategy that has been finding favour with a lot of clients is a ‘barbell’ strategy, in which portfolios are made up of defensive low-beta assets and aggressive high-beta assets, so that whichever way the markets move the investor stands to derive some benefit.

It has also become very popular for Asian clients to try to offload some of the volatility in their books in their search for yield and this provides the perfect opportunity for global banks that can find buyers willing to take the other side of the trade. With volatility being so low, there is no shortage of takers of Asian volatility in the US.

Cyrille Troublaiewitch, head of multi-asset for Asia at Citi, says: “Asia is still very much a US-based region, and so the fact that we have a global franchise means that we can easily recycle the volatility that Asian clients want to sell.”

Two structures that have proved particularly popular this year for transferring volatility from Asia to the US have been callable bonds issued in Taiwan but denominated in US dollars (Formosa bonds), which allow Asian clients to offload interest rate volatility, and knock-out options on equity structures.

“To be able to offer the right level of pricing and the right level of liquidity to the client

you need to be an active player in the underlying itself. Having a strong US franchise with a very local Asian business helps us to win clients among institutional investors,” says Troublaiewitch.

Low volatility and a competitive environment has created challenging conditions for banks in Asia, which have had to focus on adding value for their customers in order to continue to win market share. HSBC reports that it has seen significant traction across the forex, fixed income and equity asset classes in Asia, which Shaw attributes to the growing sophistication of the bank’s digital solutions and its commitment to customers.

“We grew in a period of time when the Street was contracting, ensuring that we remain a pre-eminent institutional house in the Asia-Pacific time zone,” says Shaw. “[Our digital solutions have] allowed us to maintain market share and service our clients in these markets to the standards that they are accustomed to whilst allowing us to redeploy both intellectual and financial capital towards their structured and financing needs in less flow-sensitive markets.”

Much of the bank’s growth was seen in north Asia, where liquidity injections from central banks in countries such as Japan, Korea, Taiwan and China put pressure on already thin margins and encouraged investors to look for new opportunities for yield. This led to many more cross-border trades. The story in the comparatively high-yielding South-east Asia region, on the other hand, was much more domestically focused. HSBC remained highly active there, but opportunities for growth were limited.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Rankings

TP ICAP: leveraging a unique vantage point

Market intelligence is key as energy traders focus on short-term trading amid uncertainty

GEN-I: a journey of ongoing growth

GEN-I has been expanding across Europe since 2005 and is preparing to expand its presence globally

Bridging the risk appetite gap

Axpo bridges time and risk appetite gaps between producers and consumers

Axpo outperforms in the Commodity Rankings 2024

Energy market participants give recognition to the Swiss utility as it brings competitive pricing and liquidity to embattled gas and power markets

Hitachi Energy supports clients with broad offering

Hitachi Energy’s wide portfolio spans support for planning, building and operating assets. Energy Risk speaks to the vendor about how this has contributed to its strong Software Rankings performance in 2024

Market disruptions cause energy firms to seek advanced analytics, modelling and risk management capabilities

Geopolitical unrest and global economic uncertainty have caused multiple disruptions to energy markets in recent years, creating havoc for traders and other companies sourcing, supplying and moving commodities around the world

ENGIE empowers clients globally to decarbonise and address the energy transition

In recent months, energy market participants have faced extreme volatility, soaring energy prices and supply disruptions following Russia’s 2022 invasion of Ukraine. At the same time, they have needed to identify and mitigate the longer-term risks of the…

Beacon’s unique open architecture underlies its strong performance

Recent turmoil in energy markets, coupled with the longer-term structural changes of the energy transition, has created a raft of new challenges for market participants