China’s first global multi-asset index embedding ESG criteria

China Minsheng Bank explores its joint initiative alongside Societe Generale – the Minsheng multi-asset ESG global allocation index – and its objective to provide investors across several regions with balanced returns from assets with ESG criteria embedded

The recently launched quantitative index – the Minsheng multi-asset ESG global allocation index (MSMEGA) – from China Minsheng Bank (CMBC), in partnership with Societe Generale, is the first of its kind on mainland China. Of particular note is that environmental, social and governance (ESG) considerations are reflected in the index’s composition. It is also mainland China’s first ever global multi-asset index with ESG criteria embedded.

The index itself comprises two types of assets: fixed income and equities. The fixed-income allocation, which serves as the defensive allocation, includes government bond exposures to the US, European Union and Japanese markets.

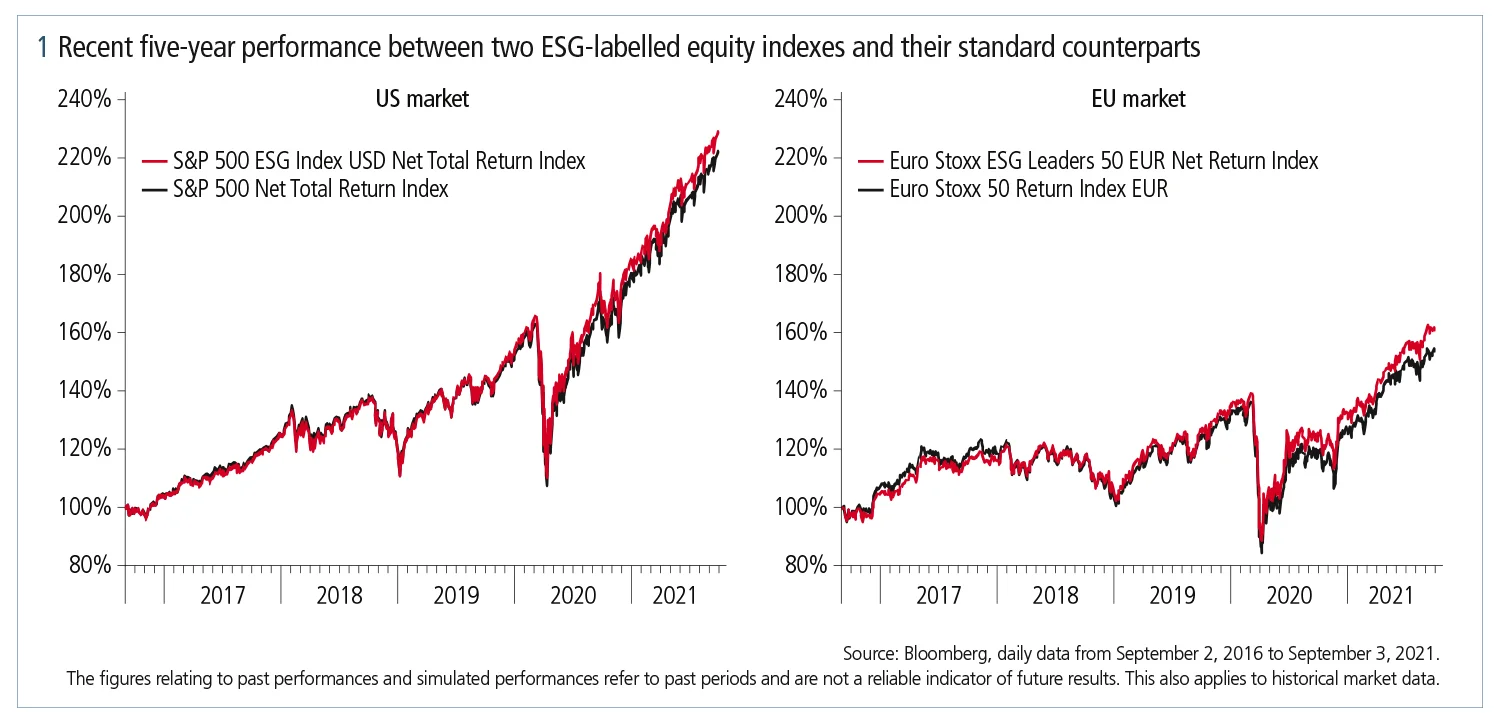

For the index’s equity portion, its creators selected the most representative indexes, some with ESG criteria embedded, from each of the three developed markets previously mentioned. Thus, by construction, the index encompasses underlyings with ESG investment angles – a first in the Chinese market. As a cutting-edge investment product for mainland investors, it is also in accord with the central government’s agenda to make the overall national economy transition towards sustainability. Such goals are clearly based on Beijing’s recent initiatives and policies to that end.

No better time for products embedding ESG characteristics in China

In recent times, ESG investments – referred to more broadly as sustainable investments – have gained traction among global investors. As of 2020, assets under management for socially responsible investments had reached $35.3 trillion globally – a figure expected to reach $49 trillion by 2025.

Chinese regulators and financial institutions have also focused on initiatives fostering the transition towards sustainability for the better part of the past year. In the past eight months, for example, initiatives such as green bonds and other related products have cropped up on mainland China and have been well received by both institutional and younger retail investors. Simply put, there is no better time for products embedding ESG characteristics in China than the present.

Market necessity ultimately drives market behaviour, and the mainland’s current macroeconomic backdrop is a key impetus for the index’s creation. Moreover, according to a senior product manager from CMBC’s Financial Market Department: “ESG investment, more than just setting the guidelines to develop a sustainable financial industry, has also brought significant enhancements to the performance of our products”.

Enhancing CMBC’s edge in quantitative index products

CMBC, a commercial bank dedicated in recent years to quantitative index strategy research and development in mainland China, is highly regarded for its product offering and innovation capacities based on its earlier flagship indexes. These include the MStar, MStarG and MStar Plus series. The offering of the MSMEGA series will complement CMBC’s existing product line-up with an ESG angle in delivering diversified returns to investors.

The MSMEGA index’s methodology entails allocations divided between equity and fixed income assets from each of the above three developed jurisdictions. Based on market signals, which will be routinely refreshed on a monthly basis, asset allocations for equities and bonds within a specific market will be determined and, where needed, adjusted to reflect market circumstances.

These days, the wealth of many Chinese investors is derived from onshore sources. MSMEGA index with broad allocation could be attractive to those Chinese investors seeking to not tether their financial futures exclusively to mainland markets, and also to derive strong returns from overseas. Additionally, a key selling point is that the index diversifies an investor’s currency exposure and avoids overconcentration in onshore equities.

Risk management is another key focus of the index. “We have observed increasing unpredictability of short-term trends in asset prices – especially in the past few years,” the senior product manager from CMBC’s Financial Market Department says, adding: “Therefore, together with Societe Generale, we have developed a daily monitoring mechanism on top of the regular monthly signals.”

The daily signal overlay not only enhances the reactivity of the strategy to changing market momentum, but also reduces the likelihood of large drawdown in its performance.

CMBC and Societe Generale stress the endeavour is a systematic, momentum-based allocation effort: the index’s ultimate objective is to help investors get balanced, and hopefully higher, returns from assets, with certain ESG criteria embedded spreads across several regions.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net