This article was paid for by a contributing third party.More Information.

Turbulent markets put focus on evaluated pricing

Need to know

- Fixed income prices are experiencing volatility because of the rapidly changing global economic outlook.

- Accurate fixed income pricing – including evaluated pricing – is more important than ever.

- Refinitiv Evaluated Pricing Services provides enhanced transparency, expertise and data connectedness.

Fixed income volatility is expected to be around for some time, due to whipsaw-like changes in the global economy. Jayme Fagas, global head of valuations and transparency services at Refinitiv, explores why, in such an environment, firms need to have the right evaluated pricing to ensure they are pricing their portfolios at fair value levels and complying with regulations

Over the past three years, fixed income indexes have had to address significant market volatility as a result of global events. Just 12 months ago, interest rates were at record lows, while today central banks are boosting rates rapidly.

Economic growth projections are being rewritten more frequently than a British weather forecast, where four seasons are often experienced in a single day.

What is evaluated pricing?

In these turbulent market conditions, getting the bond pricing that underpins fixed income indexes to be as representative as possible is essential.

Most bond transactions are privately negotiated, so fixed income trading – and the indexes that track it – relies more heavily on evaluated pricing, unlike equities.

Evaluated pricing is an approach that combines the advantages of mark-to-market and mark-to-model to generate prices for fixed income instruments. It prices instruments on a mark-to-market basis where possible and will use methodologies and models to produce a fair value when required.

Models can have a range of inputs, depending on the fixed income instrument being tracked.

Pricing high-yield debt

A good example of recent trends is the high-yield bond market.

In 2021, this market saw a surge in issuance and interest from investors. In an economic environment characterised by very low interest rates and surging economic growth, returns on high-yield bonds – also known as ‘junk bonds’ – looked very attractive.

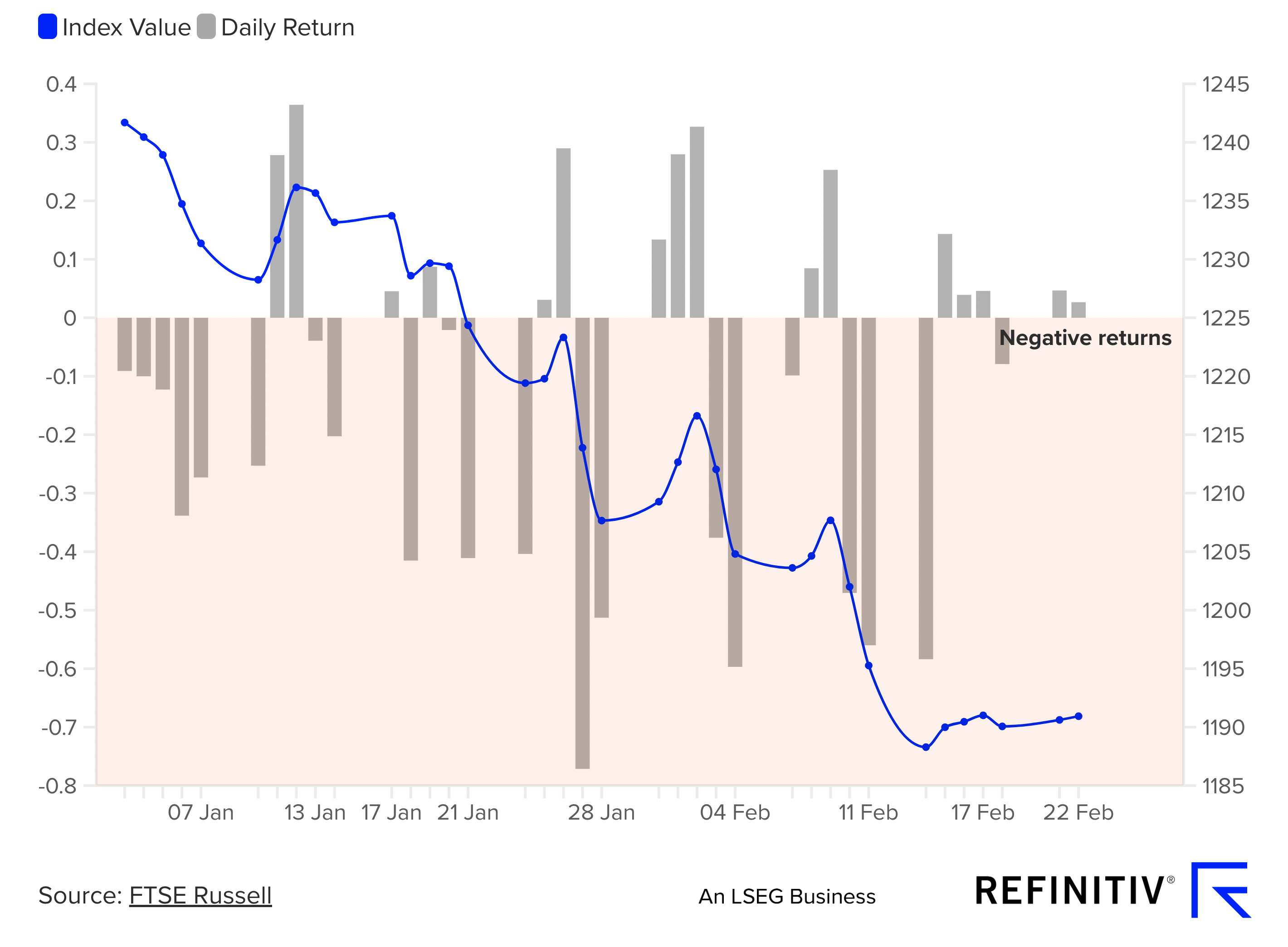

US high-yield indexes

In the first few months of 2022, the situation completely changed. With rising inflation and interest rates – and an unsettled economic outlook – high-yield debt looks much riskier.

In this rapidly changing environment, getting the evaluated pricing right is more important than ever.

High-yield bonds need to be individually evaluated, mostly on a price basis using the lead underwriter as primary source of information. This is a process that requires considerable expertise – particularly when individual high-yield bonds are not traded very often.

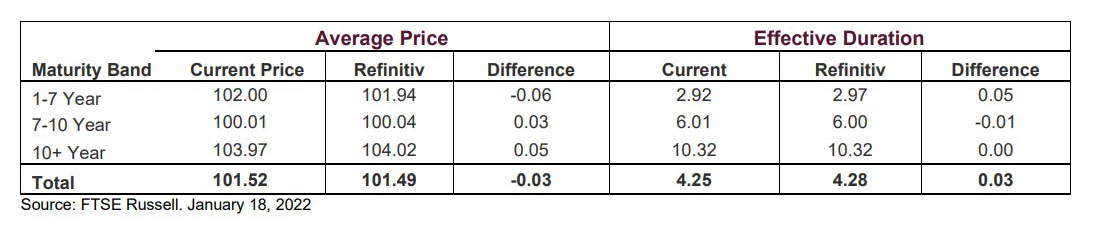

Earlier in 2022, FTSE Russell moved to Refinitiv Fixed Income pricing to support the FTSE US High-Yield Market Index, as well as the indexes that derive their membership from it.

The FTSE US High-Yield Market Index is a US dollar-denominated index that measures the performance of high-yield debt issued by corporations whose country is assigned as Australia, Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the UK or the US, according to FTSE’s methodology.

Projected impact of the price source change for the FTSE US High-Yield Market Index

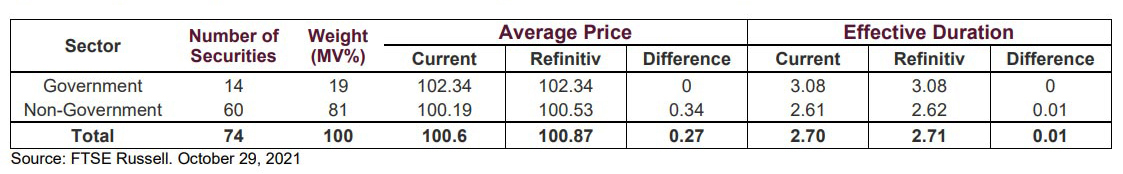

At the same time, FTSE Russell also moved to Refinitiv Evaluated Pricing for the FTSE Dim Sum (Offshore CNY) Bond Index, which measures the performance of offshore Chinese yuan ‘dim sum’ bonds that are issued and settled outside Mainland China.

The index covers fixed-rate securities issued by governments, agencies, supranationals and corporations.

Projected impact of the price source change for the FTSE Dim Sum (offshore CNY) Bond Index

“In evaluating the potential to change the price source on our indexes, we carefully considered both quantitative and qualitative assessments, reviewing these within the rigour of our governance processes,” says Marina Mets, managing director at FTSE Russell, also a London Stock Exchange Group company.

Mets added: “The quality, accuracy and transparency of the Refinitiv Evaluated Pricing Service fixed income data was found to be very strong and very comparable to the other evaluated pricing offerings we assessed. The review ended with FTSE Russell deciding to use Refinitiv Fixed Income pricing – including the Refinitiv Evaluated Pricing Service – for these indexes.”

Delivering high-quality pricing

To ensure quality, Refinitiv-evaluated pricing data is subject to an extensive range of controls. Refinitiv Evaluated Pricing Services collates data from numerous trusted sources, including exchanges, issuers and underwriters. This data is checked and maintained by the Refinitiv global teams of data analysts and experts, who actively monitor data quality and continually improve processes. Many of these staff speak local languages and are closely connected to local markets.

One of Refinitiv Evaluated Pricing Service’s strengths is its global reach – its ability to collaborate and co‑ordinate between geographic locations.

Another strength is transparency – customers can speak directly with the team generating the prices. Those relationships are considered true partnerships by Refinitiv Evaluated Pricing Services.

High-quality news and financial information sources

Refinitiv Evaluated Pricing Services has access to high-quality news and financial information of the companies being monitored, including through the Refinitiv Eikon Terminal, and news from Reuters and International Financing Review, as well as credit default swap curves, central bank information, company financials and other sources.

It also has deep connections with market participants and ongoing access. The evaluators themselves have high-quality skill sets and substantial subject matter expertise.

This deep expertise means that, sometimes, Refinitiv will be the only vendor in the marketplace providing a price for some fixed income instruments that are very difficult to value.

In addition, Refinitiv Fixed Income data is available through a range of delivery platforms and benefits from the proprietary Refinitiv identifier system, PermID.

In today’s volatile fixed income trading environment, it’s important for firms to be able to trust their sources for evaluated pricing. Refinitiv Evaluated Pricing Services has a wide range of information sources and deep subject matter expertise. For firms seeking robust evaluated pricing this is a winning combination.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net