This article was paid for by a contributing third party.More Information.

Managing portfolio uncertainty due to the Covid-19 pandemic

Market volatility and rising tail risk are the defining characteristics of the Covid-19 financial market. For capital market professionals, better understanding the impact of the pandemic on trading and investment portfolios has become even more critical. It’s no easy task to predict market movements and their impact on the profit and loss (P&L) of a portfolio at the best of times. During the uncertainty of the global pandemic, it’s almost impossible to effectively hedge or reallocate risk when the underlying distribution is unknown.

This is the challenge facing predictive stress-testing solutions.

The difficulties in selecting and adopting a predictive stress-test tool are many and varied. How can you define accurate future scenarios to model shocks for the full spectrum of risk factors? How can you generate accurate scenarios to analyse underlying tail risk? How can you limit the number of risk factors to a manageable set of data? And once these issues are resolved, how do you define a tool with minimum user configuration?

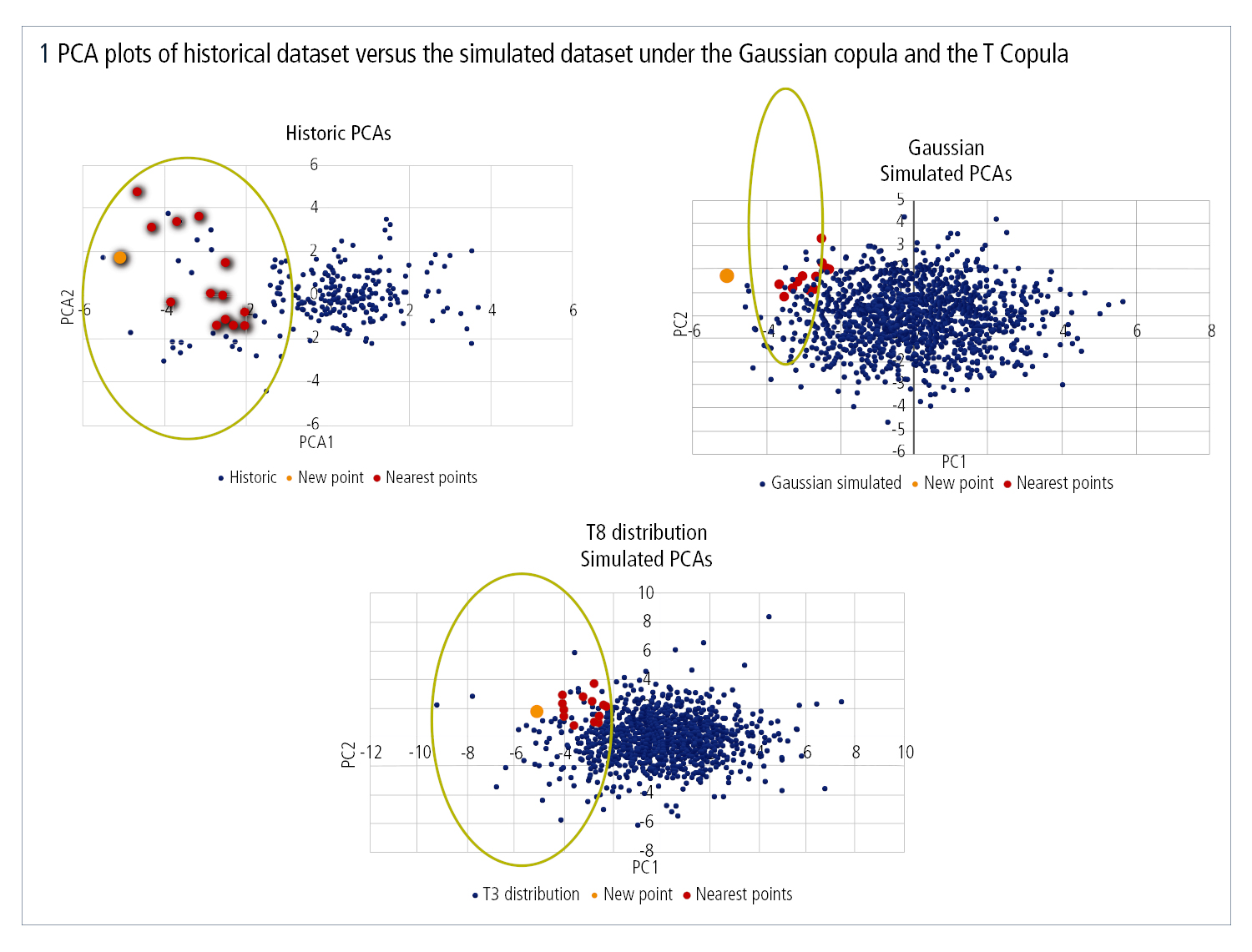

Capital market professionals have traditionally relied on modelling methodologies such as the Gaussian copula and the t copula to simulate future scenarios of a portolio’s risk factors. However, during extreme market conditions, the accuracy of both standalone approaches is hampered.

By itself, the Gaussian copula fails to capture the distinct skew and long tails of the historical dataset, while the t copula, due to its eight degrees of freedom, tends to create fatter tails and overstate the risk. These shortcomings are illustrated in figure 1.

According to Calypso Technology, a cloud-enabled provider of cross-asset front-to-back solutions for financial markets, a more accurate methodology is a combination of predictive and traditional stress-testing. It projects the user-defined scenario into the simulated scenario space (Gaussian or t copula) and then identifies a few scenarios closest to the user-specified scenario (k-nearest neighbours).

This approach defines risk factor shocks based on macroeconomic shocks, uses those shocks as input to calculate value-at-risk (VAR), and analyses the tail risk under each scenario. The process uses a seven-step approach, combining user configuration with an accurate identification of the scenarios to be analysed. This ensures the focus is squarely on selected extreme market conditions.

Furthermore, the parameters can be adjusted at each of the seven steps to further define specific scenarios, identify systemic risk factors, expand a single point estimate, and use factor shocks as a starting point to generate a distribution to focus on the tail risk.

Calypso applied the seven-step approach to a cross-asset portfolio (comprising equities, interest rate swaps, cash foreign exchange, forex options, equity derivatives, cross-country swaps, swaptions, forex forwards, equity swaps, and credit default swaps), 300 daily returns corresponding to stress periods over the past 12 years, and six systemic risk factors (Equity SPX Index, 6m Libor, 10y swap rate, DXY, WTI and VIX).

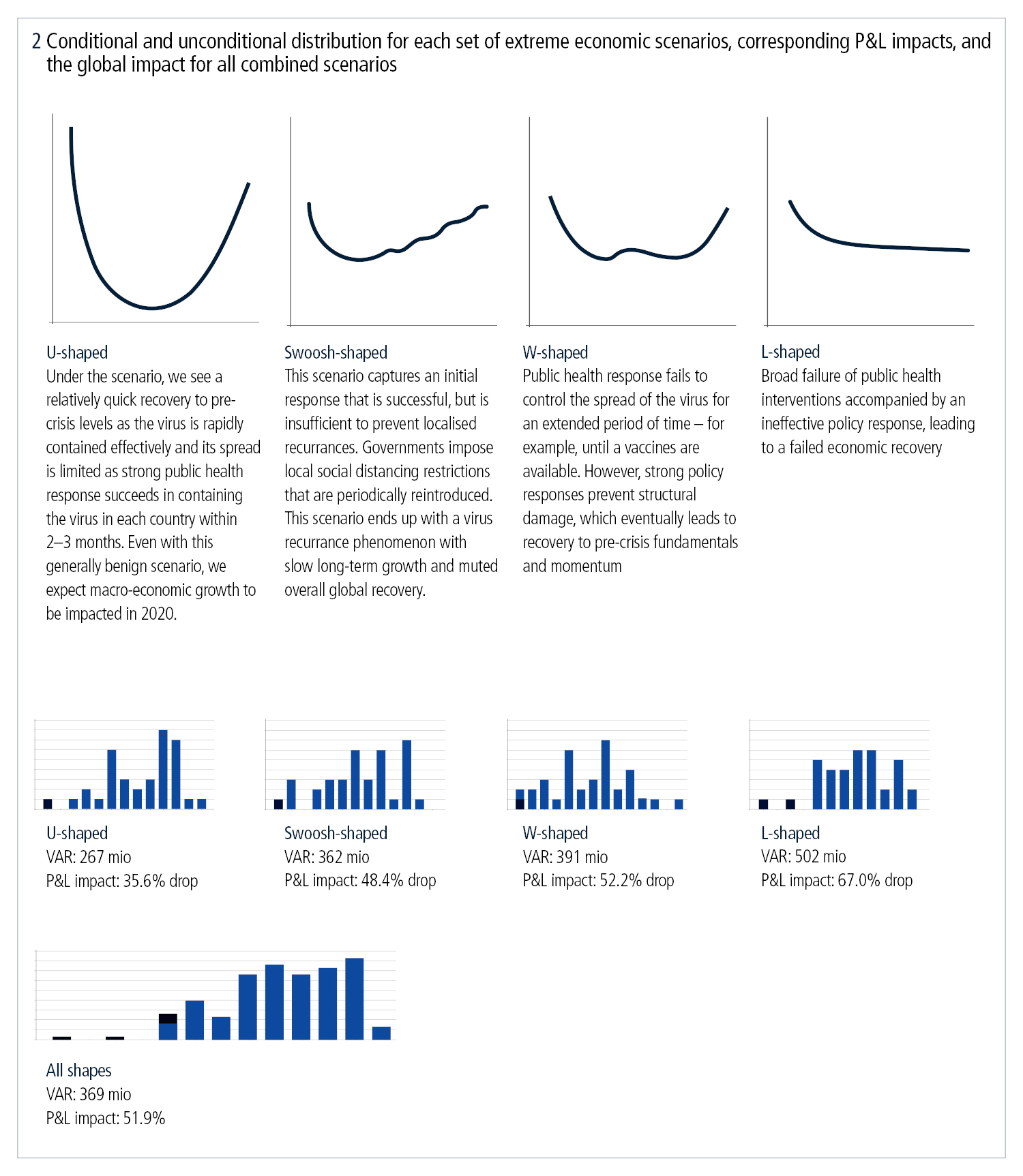

It found that the P&L impact ranged from 35.6% to 67% and VAR from 267 million to 502 million based on four scenarios capturing different economic outcomes as part of the ongoing pandemic. The scenarios are based on a published McKinsey article.

The views depicted in figure 2 present the conditional and unconditional distribution for each set of extreme economic scenarios, the corresponding P&L impacts, and the global impact for all combined scenarios.

Considering figure 2, there’s no question that the Covid-19 impact on portfolios is significant. Just as with its impact on life outside of finance, the best way to deal with the challenge is to accurately measure it, identify potential outcomes, and deliver this information to financial institutions. With today’s advances in risk modelling, risk managers can go from guessing the impact to accurately evaluating it and preparing their teams to deal with the challenges that are sure to remain with us for some time.

For more information, visit www.calypso.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net