This article was paid for by a contributing third party.More Information.

Revolutionising liquidity management: harnessing operational intelligence for real‑time insights and risk mitigation

Pierre Gaudin, head of business development at ActiveViam, explains the importance of fast, in-memory data analysis functions in allowing firms to consistently provide senior decision-makers with actionable insights

In 2008, the global financial crisis underscored the significance of liquidity risk, prompting regulators to introduce liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) requirements. The 30-day time horizon was designed to provide regulatory bodies with the ability to intervene and reassure depositors during liquidity crises. However, recent events affecting regional banks in the US have brought to light the speed with which depositors can withdraw funds, often fuelled by social networks. This has shifted the focus to rebuilding trust and managing reputational risk as central drivers of every bank’s business development and risk management strategies.

The regulatory disclosure of capital and liquidity ratios, and the potential impact in terms of reputation risk, means that most institutions now aim for higher liquidity levels than required. The European Banking Authority report on liquidity measures showed that global systemically important banks maintain LCRs at 146%, while smaller institutions go even higher, reaching around 212%. In the US, the Comprehensive Liquidity Analysis and Review is tailored to each bank’s specific situation. It demands fluidity in communication and the ability to answer supervisors’ ad hoc requests in normal and stressed circumstances.

Overall, liquidity has now become a communication tool, requiring focus, timeliness and optimisation. Traditional asset-liability management (ALM) and liquidity forecasts provide accurate views of banks’ scenarios, and deploy cashflow models approved by the risk and supervisory committees. Yet the amount of data they produce is often overwhelming, which prevents traditional reporting tools from achieving operational efficiency.

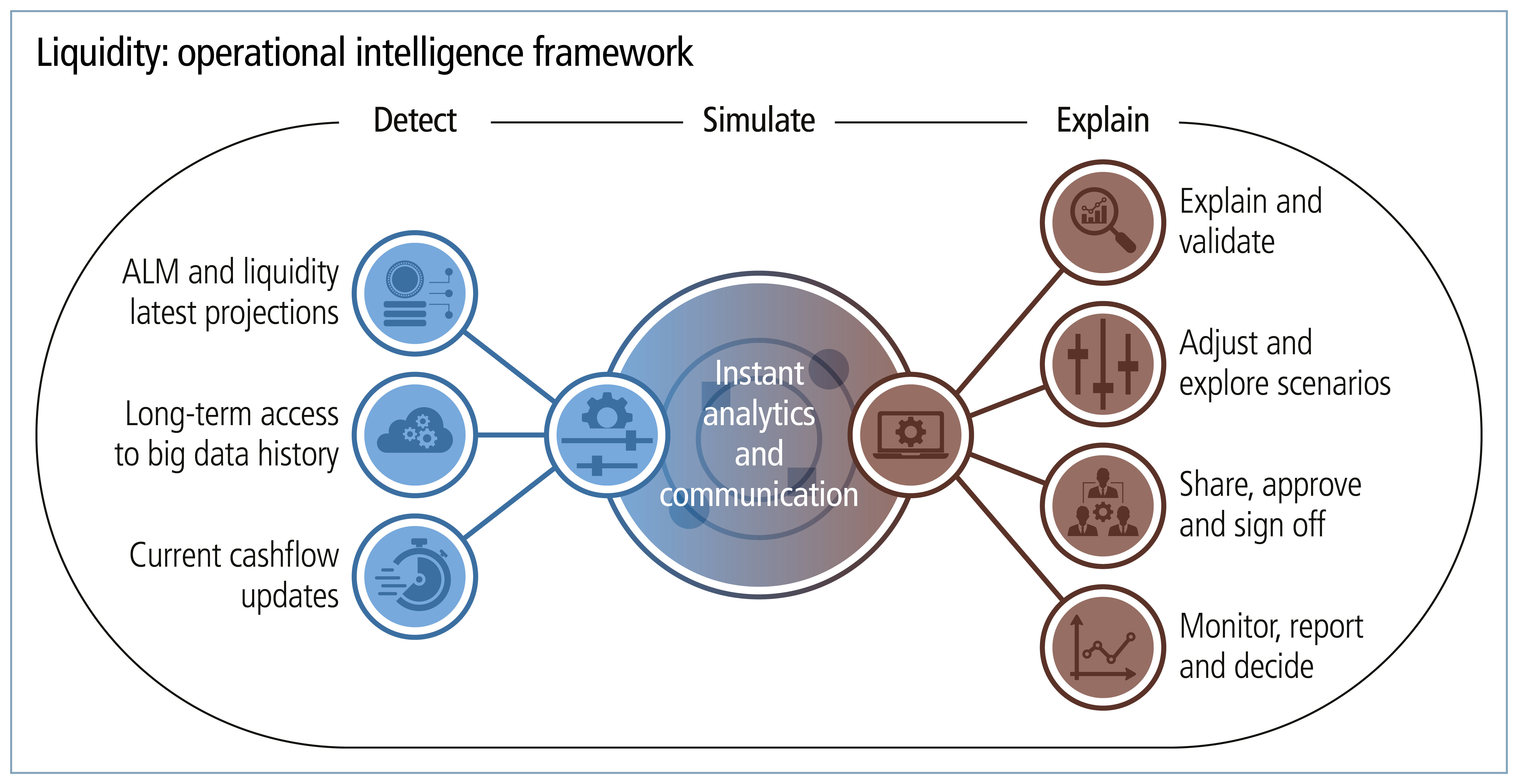

This is why many institutions are turning to new technologies – known as operational intelligence platforms. These tools provide instant insights into all analytical dimensions required by different teams and the classifications in use by each department, from the top of the house all the way to cashflow-level data. Also, beyond the simple exploration of cashflow projections, it supports additional stress tests, allowing users to immediately understand the impact of new transactions or the effect of a change in assumptions about deposits outflows, early or late payment on large transactions, bond issuer downgrades, interest rate stress and more.

This instant insight allows business, treasury, risk and finance teams to work together on a unified view of risk and performance indicators – to pre-empt problems as they arise and identify business opportunities. To achieve this, current treasury data can be shown side by side with the latest forecast. This way, cashflow received earlier than expected, for instance, immediately frees up liquid assets. As a result, asset inventory can be tracked, optimising the cost of collateral management and reducing funding costs.

Moreover, when transaction data is adjusted or short-term cashflow assumptions are modified by users, the impact on all analytics is instantly published to the rest of the team, offering three key benefits:

- Monitoring and analysing limit breaches and outlying positions. Instant transparency prevents operational liquidity issues from ballooning into reputation risks.

- Empowering business, treasury, risk and finance teams with instant analytics to optimise liquidity usage, increase liquidity standards and simultaneously improve revenue and margins.

- Identifying risks and opportunities by leveraging instant clarity on treasury positions.

One of the key challenges is the sheer size of the datasets required to operate. While day-to-day operations tap on current production data sitting in different systems and locations, most analyses also refer to historical reference points and trends stored on the enterprise data lake. To deliver this operational intelligence framework, the platform manages current and recent production data in-memory, and keep access to historical data stored in the cloud, to display all analytics side by side on the same dashboards. They also manage large populations of users, using data versioning and different performance optimisation techniques.

A few technologies on the market today – such as Atoti, developed by ActiveViam – provide fast, in-memory data analysis functions, serving as a universal semantic layer between data and different teams of users. With this level of agility, users can operate efficiently, in a timely manner, to provide decision-makers with actionable insights.

Overall, the operational intelligence platform acts as a communication hub between teams, consolidating a single source of truth. When it comes to liquidity optimisation, instant answers to the business, treasury, risk and finance teams allow them to report and manage risks as they emerge, anticipate and navigate stressed situations, and identify business opportunities.

About ActiveViam

Founded by industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across front office, treasury, risk and compliance teams. That is why the company pioneered the use of high-performance analytics in finance, helping the largest financial institutions make better decisions, explain results with confidence and simulate the impact of their decisions.

ActiveViam's mission is to deliver instant answers and train-of-thought analysis on terabytes of data in the most cost-effective way, allowing its customers to explain results with confidence and optimise their business operations. It is a pure player specialising in risk data analytics and operational intelligence in a fast-moving industry, operating in a regulated environment in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris and Frankfurt.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net