ETRM systems emerge as the cockpit for business

In an increasingly complex marketplace, energy trading and risk management (ETRM) systems have become the flight deck from which firms pilot their entire business activity, says Sidhartha Dash (pictured), research director at Chartis Research.

ETRM systems have moved to the centre of the energy business, incorporating not just risk and trade management but also strategy, accounting, compliance and analytics in a holistic offering that is designed for a more complex multi-asset environment. The energy market has new participant pools (principally trading houses and asset operators), which have largely displaced banks and altered assumptions that could be made about available liquidity and funding profiles.

ETRM systems have moved to the centre of the energy business, incorporating not just risk and trade management but also strategy, accounting, compliance and analytics in a holistic offering that is designed for a more complex multi-asset environment. The energy market has new participant pools (principally trading houses and asset operators), which have largely displaced banks and altered assumptions that could be made about available liquidity and funding profiles.

While the financial markets for commodities have seen functional convergence, the underlying physical markets have evolved into more complex, segmented structures that require deeper specialist knowledge and tools. Or, it would be more accurate to say, the broader trading community has become more alert to embedded optionality in contracts, the value of managerial flexibility, the need to accurately price the economics of energy assets, and so on. Segment-specific modules are therefore being developed to feed into the overarching ETRM platform, which increasingly acts as a business nerve centre that can cope with volatile markets and new asset classes.

Physical, operational and commercial structures divide the energy markets into two distinct categories – networked markets such as electricity and gas; and energy commodities such as coal and oil. This is the taxonomy we will use throughout this article.

Contract and risk management oversight are crucial in complex markets, but ETRM systems are no longer just a trade capture or a risk management tool. They are expected to provide and support opportunity-spotting business analytics, have effective compliance and surveillance components, and enable adherence to specific regulatory initiatives such as the European Union’s Regulation on Wholesale Energy Market Integrity and Transparency (Remit) while integrating with accounting systems. Additionally, liquidity and collateral management are also critical concerns as the new market structures take effect.

This feature will focus on the evolving ETRM marketplace. The central thrust of the article is that the greater focus on physical assets and contract management for non-financial elements has enhanced and diversified the role of commodity and ETRM systems.

Overview

ETRM systems have co-evolved with the market structure in networked energy systems (electricity, gas, pipelines, and so on) and energy commodities (oil and coal). The solutions have changed, as have the nature of the products and the participant pool.

Banks and other traditional financial participants have reduced their roles in the energy markets and restructured their involvement, conceding a greater role to physical traders or trading houses that have significant physical and operational underpinnings. ETRM systems have altered to reflect this new reality and continue to evolve under the impact of regulatory, technology and market drivers.

The shift in the market participant pool (and their marginal drivers) has changed the analytics required on an ETRM platform. The level of integration needed with accounting systems has also been altered, alongside the nature of portfolio management, so that underlying products, plausible funding assumptions in risk models, and so on, are all now treated differently.

There are concerns about the working practices of some of these big trading houses, but it is undeniable that they have dramatically altered how market participants look at trading and how ETRM systems operate. Valuation and analytical components must now incorporate logistics data, cope with collateral optimisation and regulatory-driven liquidity requirements, while also delivering multi-asset risk analytics, valuation and economic analysis of a broad range of operational options and managerial flexibility. Thus we are seeing the expansion of the trading and risk concept to include strategic business decision-making activities covering short- and long-term options.

A changing energy market

There are a number of overarching trends in the increasingly complex and changing energy marketplace, which can be summarised as follows.

Both the network-based and energy commodities markets are focusing more on underlying physicals, including a sharper emphasis on optimisation, asset management and portfolio management. This trend impacts the entirety of the chain, from valuation, analytics, risk measures and market data, through to accounting and inventory management, logistics, portfolio management, trading systems, and so on. This is creating greater segmentation between different energy categories and more specialisation.

Networked-based markets are headed towards a regulatory framework that increasingly mirrors that of financial services in general and derivatives trading in particular. These regulations, such as Remit, are overlaying existing network operations-focused regulations, constricting and driving networks such as electricity and gas, and new asset pools such as renewables. Energy commodities are somewhat less regulated – though recent regulatory shifts evident in Markets in Financial Instruments Directive (Mifid) II and elsewhere may change this. Nevertheless, for now, the management focus for energy commodities (coal, oil, and so on) is still more on making the trading cycle more efficient and delivering integrated logistics, rather than on regulatory compliance.

The new business requirements

It is not only the energy markets themselves that are changing but also the participant pool. As trading houses and other physical operators replace banks as the dominant energy trading entities, they are bringing a different set of requirements and demands upon ETRM systems. These include:

• Greater emphasis on supply chain and logistics risks.

• Tradeable elements in the operational parts of the chain, including a greater emphasis on valuation and risk analysis of the value of managerial flexibility and operational choice.

• Embedded market and credit risk in commercial contracts.

• Greater focus on contract portfolio risk.

• Greater focus on asset management and risk management of energy asset portfolios.

• An ability to integrate with accounting and inventory management systems.

• Integrated physical and financial data and risk overviews.

• A market and derived data system that is capable of handling complex physical contracts.

The physical and financial worlds collide

One of the key issues is the complex interaction between different kinds of data. Many network assets are poorly approximated by standard data structures. Representing the history of an electricity network, or that of the states of a gas distribution network, is challenging. Specialised data storage infrastructures that appropriately capture their graph-oriented nature in a multi-dimensional format are important. The important factors to consider in this area are as follows.

Combining physical and financial data is not easy. Nor has it gotten easier as the more liquid and standardised elements of the commodities markets have become ever more ‘financialised’. On the one hand, ETRM systems need to deal with the market, credit and operational risks of financial products such as futures, forwards and derivatives, while also taking into account the underlying physical product. The underlying data structures required are significantly different. Good energy risk management is about managing the risks emanating from both fields. This requires risk management integration and an ability to aggregate and communicate the risks via appropriate data structures and mapping mechanisms.

One has to remember that all assets and instruments involved in energy trading rest fundamentally upon the performance of physical assets, whether they are power plants, warehouses or pipelines, and thus risk management for a energy trading business is highly dependent on the underlying effective physical optimisation, scheduling, operations of electricity and gas network or optimal storage or logistics of physical fuel, depending on the business context. ETRM systems must be able to handle this interconnectedness between risk measures, business and the underlying physicals. Creating appropriate mapping to risk primitives is absolutely critical in accurately capturing energy trading risk in one’s portfolio.

Valuation, pricing and risk management processes in ETRM systems must be capable of handling strategic and operational changes in a flexible manner. This marks a significant departure from standard capital markets-oriented methodologies and frameworks. Physical delivery details, including timelines and warehousing information, become vital. Additional parameters that might be critical include geographical and physical constraints, network structure, delivery grades, and so on. From a data management perspective (as previously mentioned) there is a requirement to capture and manage the physical details of energy assets and map them to risk primitives. This is not trivial given the breadth, diversity and interlinkages in the energy markets. But, even more challenging is how to define and support the non-trivial complexity of the data structure types that need to be managed. Not only is physical data more complex than the equivalent financial data but the physical’s data history and time series framework has several added challenges (more interlinkages and markups, greater sparsity, greater likelihood that data has been interpolated or ‘derived’, greater requirement for volumetric or liquidity adjustments, and so on). There is a variety of possible extra dimensions in which data will need to be captured. If this is not performed, risk aggregation and portfolio measurements will not accurately and effectively reflect the underlying positions.

Integrating assets such as power plants, warehouses and long-term commercial contracts with embedded optionality is structurally difficult if it is not supported in the main pricing library or the physical asset capture system. Logistics and locality are also significant factors that must be included in risk analysis. These drivers are key in the ongoing evolution of the development of holistic ETRM systems.

Generational assets (and other physical assets such as pipeline and warehouses) have operational constraints that preclude closed-form solutions but still need to be incorporated into risk management strategies. For example, the following attributes need to be considered: minimum up and down times; ramp-up/down times; minimum-run capacity; the maximum number of starts (and start-up costs); varying heat rates; the weather, and so on.

Generational variables are dependent on network infrastructure dynamics, such as demand and grid availability, as well as commercial and regulatory requirements. The growth of renewables in particular is pushing companies towards adding new analytical and operational data frameworks. Modelling volatile, on/off power sources such as wind or solar can be challenging. In addition, as more utilities switch to natural gas for power generation, companies will need to deal with issues of operational convergence.

ETRM must support strategy

Energy trading, transaction and risk management systems must now support strategic decision-making and need to do this via asset optimisation, valuation and analytical tools (that effectively model and price the true economic costs of managerial flexibility).

Tools designed to handle logistics, manage supply chains and optimise ancillary services in networked markets or value the operations of assets such as gas storage facilities or power plants are rapidly being added to ETRM systems. However, asset valuation or logistical optimisation tools are not beneficial by themselves. They must be integrated into the whole risk management and analytical framework of a firm. Links and updates to market data, risk models, accounting, pricing and valuation will all need to be made to ensure a streamlined process.

Vital cross-asset, multi-model functionality

Vendors in the ETRM space are creating integrated cross-asset, multi-model platforms that are flexible and can integrate different aspects of the value chain. This is particularly critical since various market segments (for example, gas, oil, power, etc.) tend to overlap and interact.

Traditionally, energy trading risk systems focused on trade capture, trade processing, clearing and collateral management, hedge accounting/hedge analysis and regulatory reporting. Portfolio and asset risk management has generally been a sideshow in comparison. This is changing, and risk analytics is becoming more integrated into energy trading firms’ business procedures and strategies. This involves ETRM solutions increasingly taking on a broader set of duties.

Models need to be flexible enough to change with the evolving regulatory and market environment. In the past, many risk management concepts and frameworks have been carried over from financial and capital markets, but these are not always appropriate to the energy markets. Logistics, operational and risk, emanating from the supply chain, need to be considered in order to provide accurate risk measures. These non-financial risks will be more difficult to measure for purely financial-based risk management systems. The market and derived data frameworks supporting the risk systems now need to incorporate relevant data structures.

As well as being flexible enough to incorporate non-traditional elements into ETRM systems, energy traders also need to ensure their solutions are sufficiently flexible to manage different categories of products; that is, cut across the physical and financial barriers and effectively incorporate financial products as well as physical products. This flexibility will be required for firms to introduce true enterprise portfolio management and for them to manage physical and financial instruments together, in order to provide an enterprise-wide view of energy trading and business risk. Firms must be able to introduce new asset types, with relative focus on financials/physicals changing over time as the business strategy evolves.

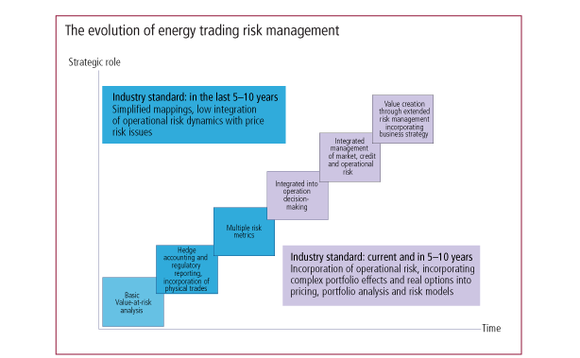

To summarise, the evolution of ETRM systems is leading to them becoming business cockpits and a core part of business strategy, rather than just an element in the trading or treasury activities.

Liquidity profile and funding model changes

The embedded liquidity assumptions in many traditional models and methodologies, which were inspired by financial markets, have proven to be unreliable as new types of traders (with different liquidity and funding constraints from financial participants) have moved in. This requires the development of new approaches to value and to analyse a broad range of energy assets while using more realistic liquidity and funding assumptions.

Conclusions

The genie is out of the bottle and cannot be put back in. Risk and trading platforms need to change and evolve in order to handle the underlying physical and logistical challenges of real-world products, which span networked assets such as pipelines or electricity and energy commodities such as oil or coal.

Risk management frameworks will increasingly intersect with asset management. ETRM systems must therefore be able to process valuation, risk, accounting, forecasting, market data, regulatory reporting and myriad other tasks as the lines blur between risk, regulation and business-driven strategy (see figure).

The ETRM platforms that incorporate physical capabilities and decision-making tools across the value chain will be the winners. But it is Chartis Research’s view that the whole industry segment is a winner with C/ETRM solutions increasingly expanding into new areas that would once perhaps have been the responsibilities of an enterprise resource planning solution or business intelligence tool.

There will always be a segment of the market that will focus on pure-play financial and highly liquid instruments and investors that use futures or exchange-traded funds, but even some of these users will want to converge elements of their ETRM systems (particularly data) in holistic solutions.

ETRM systems have grown to become the central nervous system of firms, with asset optimisation models seamlessly extracting contract and transactional details from a sophisticated accounting system that is capable of holding a broad set of details on complex assets such as power plants, pipelines, networks and long-dated structured contracts. They are useful, evolving tools that will occupy an increasingly central position in the marketplace for utilities, trading houses, pipeline operators and other energy market participants.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net