This article was paid for by a contributing third party.More Information.

Libor transition nears its end – Five topics you need to know

As the deadline to Libor cessation approaches, Liang Wu, executive director of financial engineering and head of cross-asset product management at Numerix, presents a series of market themes that warrant closer inspection

There is less than a year left before the expected cessation of Libor, with the exception of the most liquid USD Libor tenors, which will be published until June 2023. The interbank offered rates (Ibors) of other major currencies, however, appear to be on schedule for their discontinuation at year-end.

Globally, much transition progress has already been made. Trading volumes in the major risk-free rates (RFRs) are gaining momentum, and the markets anticipate seeing an even greater liquidity shift from Libor to RFRs this year. One significant development is that the International Swaps and Derivatives Association (Isda) 2020 Ibor fallbacks supplement and protocol for new and legacy derivatives contracts is now effective, and regulators and industry committees have stepped up communications to market participants regarding the need to transition away from Libor as soon as possible.

As progress in the Libor transition continues, there are several crucial issues market participants face in 2021. This article highlights the five top market themes that deserve examination, and my opinions as a financial engineer who has been deeply immersed in the decommission of Libor since the UK Financial Conduct Authority (FCA) announced in July 2017 that it will no longer compel banks to use Libor after the end of 2021.

1. 2021 is not really the end of Libor

On November 30, 2020, ICE announced its plan to extend the proposed end date for most US Libor tenors from December 31, 2021 to June 30, 2023. This proposal was then confirmed by the FCA on March 5, 2021. This reflects an approximately 18-month reprieve from the death of US Libor.

I view this as a welcome extension. It allows market participants with legacy contracts that have longer maturity dates more time to properly prepare for the termination of US Libor and to complete the Libor transition. Thus, it is helpful that institutions are not being forced to be 100% transitioned by the end of 2021. The majority of the longer-dated derivatives contracts will mature by the middle of 2023 anyway, so the extension is a good move that will benefit the market.

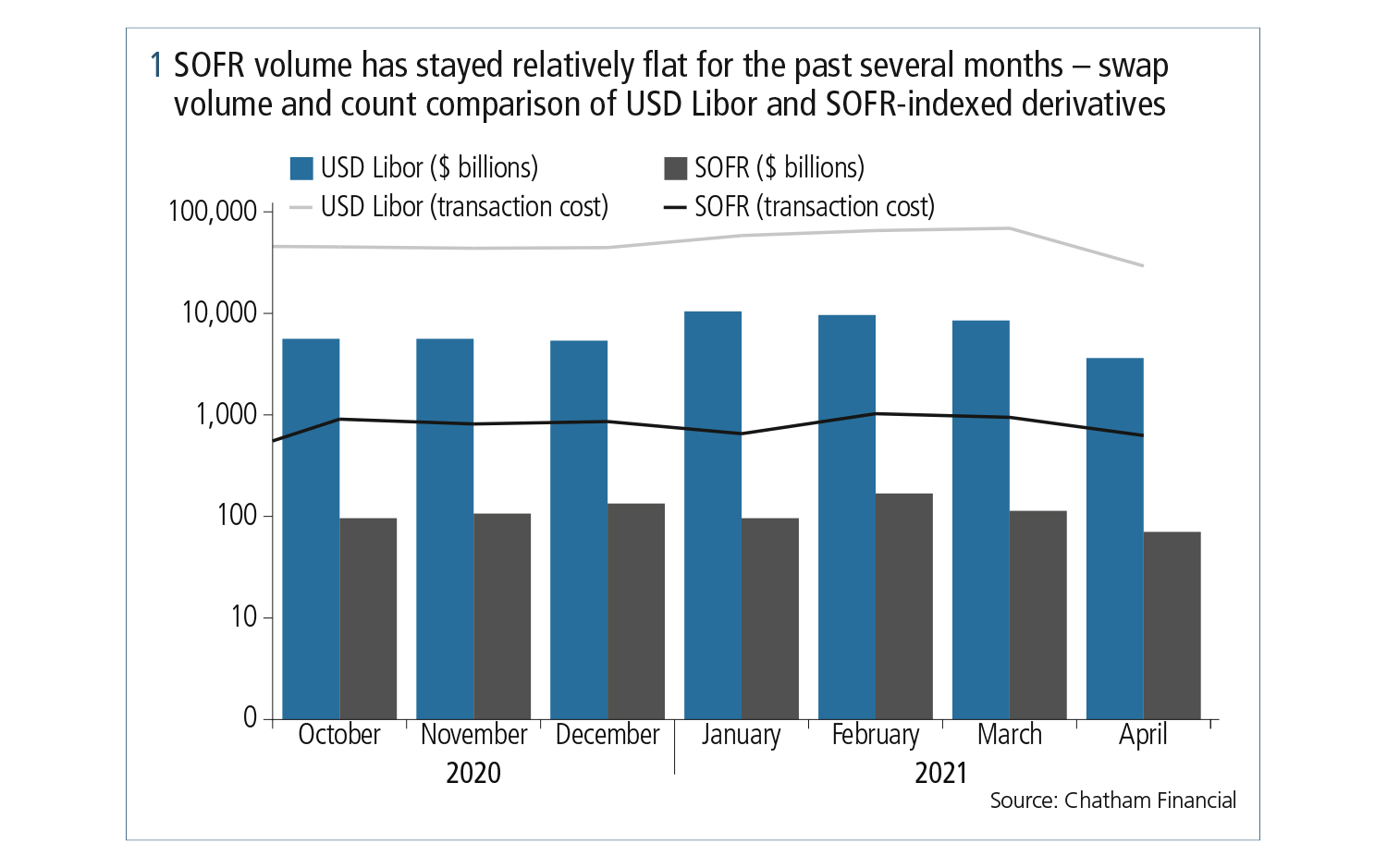

However, it must be acknowledged that secured overnight financing rate (SOFR) trade volumes have been flat since regulators granted USD Libor the 18-month extension, with traders blaming poor liquidity and the industry’s reliance on new fallback language, according to a recent Risk.net article (see figure 1).

What is important is that regulators are emphasising that, despite this buffer period, market participants should not be under the illusion that the 18-month extension allows them to execute new trades of Libor-based derivatives until June 2023. It has to be very strongly messaged to market participants that the end-2021 deadline still holds for new products. Now might be the time to re-examine whether your firm has all of the curve analytics and models in place to handle the Libor transition and beyond.

2. Looking forward to a forward-looking SOFR term rate

The market has long anticipated a forward-looking SOFR term rate. However, according to the Alternative Reference Rate Committee’s (ARRC’s) latest progress report, a term SOFR rate is unlikely to be published in 2021. Does this change things for market participants?

SOFR does not currently allow for predictive, forward-looking rate calculations – three, six or 12 months out – which is a deviation from Libor. While a SOFR compounded in advance rate offers an alternative, I believe a term SOFR rate could be quite useful to the market. It is also worth noting that, while the first forward-looking term rates based on the sterling overnight index average (Sonia) have been available since January 2021, ARRC acknowledged that the flat liquidity of short-dated SOFR derivatives contracts has made it difficult to publish a term rate, and the market shouldn’t anticipate one by mid-year or even by the end of 2021.

The Libor transition doesn’t necessarily need to wait for a forward-looking term SOFR rate. You can argue that trading in the current derivatives market on SOFR has been picking up and is growing gradually so, from that perspective, the derivatives market, as it is now, is not counting on a term rate. Nonetheless, I wouldn’t want to lessen the potential usefulness of a term rate, especially a forward-looking one, because it could be very important for certain contracts to be linked only with a forward-looking term rate in practice, instead of some other form of the overnight rate. It would be extremely helpful because a forward-looking term rate would be very much like the current Libor and could ease the transition for products similar to Libor-based products. For example, availability of a forward-looking term structure for SOFR may be necessary to transition some cash products from USD Libor to SOFR to ensure certainty of cashflows in the beginning of each payment period.

3. Ibor fallbacks – Having curve analytics and models at the ready

On January 25, 2021, Isda announced that new fallbacks for derivatives linked to key Ibors were now in effect. On March 5, 2021, Isda also confirmed that the spread adjustments to be used in its Libor fallbacks will be fixed as of that date, which provides clarity on the future terms of derivative contracts that will incorporate these fallbacks. These announcements ease a good amount of transition risk for the market. However, they may also present a technology hurdle to market participants that have yet to address the modelling challenges and technicalities of fallbacks.

The core issue now is that the spreads are permanently fixed for the Ibors; market participants will need to take those as inputs to comply with the Isda Ibor fallback methodology in their derivatives valuations. This is attracting a lot of attention because this means market participants will have to pursue technology upgrades or even consider transitioning their internal systems to ensure their fallback mechanisms can be triggered now that the fixed spread adjustments are effective.

This presents another issue, which is when institutions plan to execute system or analytics upgrades. With spread rates fixed, institutions need to quickly handle their current legacy contracts to make sure fallback mechanisms can kick in before the end of 2021. This provides a sense of urgency to have transition upgrades in place. Taking the first steps now to ensure you have the correct curve framework will ensure a much smoother and more seamless transition to handle not only vanilla products, but non-linear derivatives as they come into play.

4. Keeping an eye on cross-currency markets volume in 2021

The cross-currency markets have yet to embrace SOFR; at the end of 2020, only small volumes were traded. Could 2021 be the year when there is a big boost in trading in the cross-currency markets as SOFR becomes more established as a standard RFR?

Trading volumes for cross-currency markets are trending upward, and I believe we will see the further development of the cross-currency markets between different alternative reference rates, such as SOFR versus Sonia, SOFR versus euro short-term rate (€STR), and SOFR versus the Tokyo overnight average rate (Tonar). Currently, cross-currency trading using SOFR is a fairly empty market, but I foresee this market growing in 2021. However, just as we cannot predict the growth rate in the SOFR market alone, we cannot predict the rate at which the cross-currency markets on SOFR will grow.

Typically, there are two major types of trades – one between developed market currencies, where basis swaps are generally traded, and the other between emerging markets and developed markets, which normally trade cross-currency swaps.

I would like to note that the cross-currency swap markets have yet to embrace RFRs. However, despite the slow movement, I am optimistic the cross-currency markets will move to using RFRs for cross-currency swaps and that it will become a market standard by 2022.

5. Exploring a market need for a credit-sensitive alternative to SOFR

There is demand in the US, particularly from regional banks, for a credit-sensitive rate that is an alternative to SOFR. A big question among market experts is whether the derivatives market needs a credit-sensitive rate.

If we are talking about the derivatives market alone, the prevailing view is that a credit-sensitive rate is not necessary. One overnight rate (SOFR) that is close to the RFR is good enough because, in situations where either a new contract is directly linked to SOFR or an existing contract is managed according to the Isda Ibor fallback – basically a compounded SOFR rate plus a static spread – you can always hedge the volatility of the SOFR rate dynamic without introducing the credit component. So, if we’re just talking about hedging the SOFR risk out of a portfolio using SOFR derivatives as they are now, that is sufficient, and you don’t need the credit premium aspect.

In terms of the cash market, if it is operating under the assumption that future issuance will be based on a SOFR rate plus a static spread, then you don’t need a credit-linked SOFR rate. However, if there is a need to mimic a Libor-like product in the future issuance of cash products, that is a problem because SOFR doesn’t have a credit component, but Libor does. So, from that perspective, if you want to identically mimic your current business by just switching to a different rate, that might be a complication.

This presents two issues. One is to create a variation of the SOFR rate so it has dynamic credit information within it, and the other is to create a completely alternative rate that has a credit component but is not a SOFR rate. In terms of the latter, it already exists.

Ameribor is a credit-sensitive alternative rate to SOFR. While the big banks and the clearing houses all switched to SOFR, some smaller, regional banks still value having a credit-linked rate for conducting their type of business. So, I can see Ameribor having its own market that is independent from SOFR. I also believe the existence of an Ameribor market may not present any drawback to the SOFR market, at least for now.

Libor Risk – Quarterly report Q2 2021

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net