This article was paid for by a contributing third party.More Information.

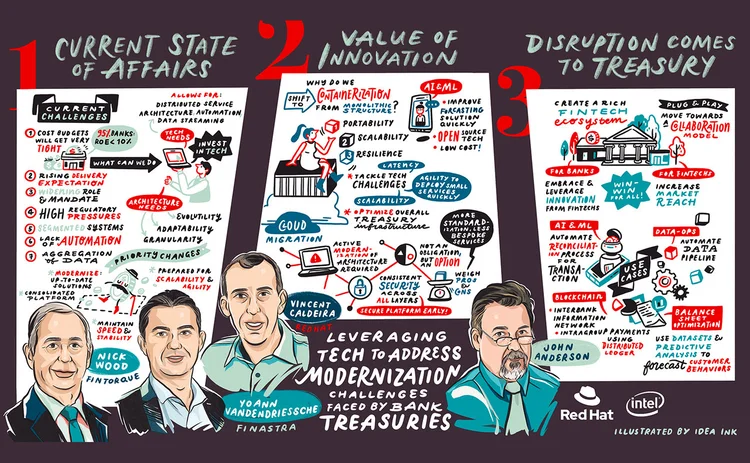

Leveraging technology to address modernisation challenges faced by bank treasuries

Bank treasurers and technologists convened for a Risk.net webinar in association with Red Hat to consider how technological innovation could help treasury functions meet rising expectations.

Confronted with unprecedented challenges, bank treasury operations must adapt – and modernise. Upgrading outmoded infrastructure and leveraging new technologies should be the first port of call for managers.

Right now, the role and mandate of a treasury is broader and more complex than ever before. Not only do they have to fulfil their traditional functions doling out funding and monitoring investment risk, they’re increasingly being called upon to manage capital and leverage constraints in response to regulatory and market pressures.

Senior executives are also pushing treasuries to generate more revenue, adding one more strategic objective to the list.

Many treasuries, however, are not structured appropriately to assume these new duties. Nor is their technology infrastructure fit for purpose. Embracing the opportunities afforded by a refreshed service-oriented architecture and the capabilities of cloud computing, without compromising on resilience, could go a long way towards meeting these challenges.

“Treasuries are really now at the point where they need to modernise and build new capabilities very fast and be very agile. At the same time, they cannot really afford to compromise their platform’s amount of resilience and capacity. Typically, this is the toughest challenge from the technology point of view because it is hard to be stable when you need to change fast at the same time,” said Vincent Caldeira, chief financial services technologist Asia-Pacific at Red Hat.

Caldeira explained that treasury platforms should adopt technologies that facilitate a distributed service architecture, which allow different systems to operate more independently from one another and scale separately. This will enable treasurers to decouple different services and make them self-sufficient, without compromising on capacity or stability – ideal for handling multiple complex tasks simultaneously.

Tailoring capabilities to functions

Capabilities can also be tailored to different functions more efficiently this way. For example, e-trading requires the rapid processing of quotes and orders – meaning speed is king. Liquidity management, on the other hand, is a volume-heavy process, placing the emphasis on data-crunching capacity.

“Once you have managed to breakdown your big monolithic block into a series of self-contained services, then you can put the technologies where it makes more sense,” said Yoann Vandendriessche, senior product directory, treasury and capital markets at Finastra.

Adopting ‘containerisation’, as this software trend is known, also opens up opportunities to better automate routine tasks. Finastra conducted a survey of treasurers, which found that around 65% of their time is spent on manual activities, meaning there’s huge scope for automation to ratchet up productivity and reduce costs.

Treasuries also need to build business agility through the ability to quickly react to new market conditions in real time. To this end, Caldeira recommended treasurers adopt event-driven data pipeline systems, which can ‘stream’ data instantaneously to decision and risk management systems, but also greatly ease the process of integrating with other departments – such as finance, compliance and risk management.

Migration to cloud

Cloud technology offers capabilities that can assist with all of these transformations, though it’s no silver bullet. One model recommended by Vandendriessche has a treasury retain ‘mission-critical’ functions in-house and migrate so-called adjacent capabilities to a cloud, so the bank can delegate non-core, yet demanding, tasks offsite and focus internal resources on those responsibilities key to the department’s success.

“It is very important to have in mind that the migration to cloud is not an obligation, but an option,” explained Vandendriessche.

Investing in new capabilities and innovating workflows, however, could be a tough sell against the backdrop of a grinding recession and elevated concerns about cyber security and operational risk. Cost budgets are predicted to tighten considerably, with one recent survey conduced by the International Monetary Fund revealing that 95% of banks in advanced economies believe their return on equity will be below 10% by 2025, and 20% saying it would be negative.

Identifying specific use cases for technology upgrades could be one way to get managers to open their wallets. “Bank treasurers wake up to the value of innovation when they see a use case that really delivered something tangible for them. For instance, if they want to improve their foreign exchange exposure reporting accuracy or their cash reporting accuracy, and they see it is possible to have a solution in six weeks rather than in some distant future, they will get very excited about [that],” said Nick Wood, managing director of FinTorque.

What should also appeal to senior management is that investment in a modern, robust treasury infrastructure today should prevent costs racking up tomorrow, handling security incidents and operational failures.

“Very often I see a huge investment into security tools for detection, for incident handling, but lesser investment into actually making sure that, when new services are built, security is built into the architecture of the platform to really limit the exposure [in the first place],” said Caldeira.

Treasurers should, therefore, consider technologies that are built to be robust – rather than those with protections grafted on afterwards. Platforms that are tough, resilient and flexible are needed to power the evolution of the treasury function and, when it comes to something so essential to a bank’s performance, managers may well ask: why compromise?

Listen to the Risk.net webinar Leveraging technology to address modernisation challenges faced by bank treasuries

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net