The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

Russian crude production has increased significantly over the past few years – so much so that by some estimates the country has now reclaimed its status as the world’s largest producer for the first time since the collapse of the Soviet Union in 1991. Russia produced an average of about 7.3 million barrels a day (b/d) of crude oil in 2002, according to US research firm Cambridge Energy Research Associates. And the Paris-based International Energy Agency (IEA) estimates that production hit 8 million b/d in early 2003 for the first time since 1991.

Ambitions

What’s more, the geopolitical tensions that followed the events of September 11 and the consequent cooling of relations between the US and the Middle East have led some analysts to predict that Russia could overtake Saudi Arabia, not just in terms of production volumes but also as the world’s most strategically important oil-producing country.

For instance, Grigory Yavlinsky, a leading Russian opposition politician, said late last year that increased co-operation between the US and Russia could “sideline” the Organisation of the Petroleum Exporting Countries (Opec) as the main determiner of oil prices.

The first sign of Russia’s new ambitions came during a stand-off with Opec over production levels in late 2001 and early 2002. Saudi Arabia, the leading Opec member, cut its production from 8.5 million b/d in January 2001 to about 7 million b/d in early 2002 in an attempt to manage prices. But Russian production, which had remained relatively steady at between 5.5 million and 6 million b/d for much of the second half of the 1990s, began to climb from 2000 onwards. Analysts attribute the rise to higher oil prices, low rouble costs encouraging investment and increased political stability after Vladimir Putin replaced Boris Yeltsin as president in January 2000.

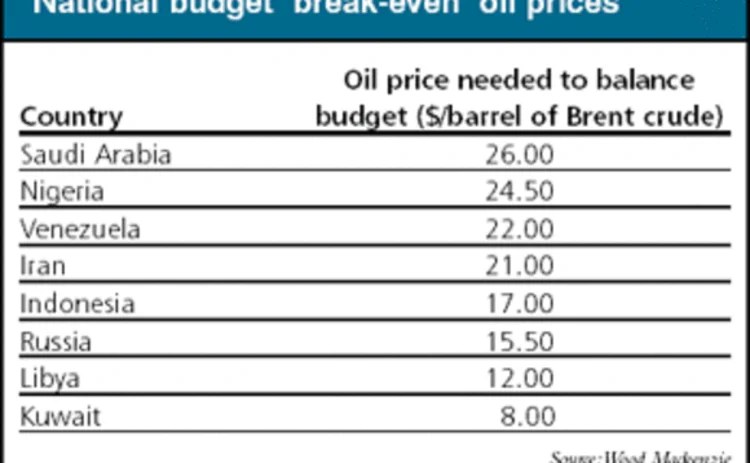

The underlying economic conditions in Russia mean it can effectively “have its cake and eat it” in the short to medium term, said a report by Edinburgh, UK-based consultants Wood Mackenzie released in December 2002, Russian Oil in a Global Context.

The report says Russia can afford to increase its output and its share of the global export and run the consequent risk of a fall in prices due to overproduction, because due to its economic circumstances and lower living costs it is able to bear lower oil prices than many of its main Opec rivals (see table). Russia can, therefore, rely on Opec nations to cut production to manage prices before it does so – a driver that the report says has encouraged the country to continue its aggressive output growth.

But this competition has yet to translate into lower crude prices. As EPRM went to press, prices were dipping significantly as the war in Iraq began favourably for allied forces. New York Mercantile Exchange (Nymex) crude futures closed at a four-month low of $26.91 a barrel (bbl) on March 21, down from $35/bbl a week before. But Adam Sieminski, an analyst at Deutsche Bank in London, speaking at EPRM’s annual European energy conference in London in March, says any sustained production war between Russia and Saudi Arabia could drive prices down to $15/bbl or less.

Opec v. Russia

However, other factors suggest that predictions of an end to Opec dominance of the oil markets are premature. In an article, 'Axis of oil', in the March edition of US-based political affairs journal Foreign Affairs, David Victor, director of the programme on energy and sustainable development at Stanford University in California, and Nadejda Victor, research associate in the department of economics at Yale University, argue that Opec’s ability to set market prices is much greater than is implied by its production volumes.

Opec suppliers have two major factors in their favour, says the article: switching on and off production is relatively inexpensive, due to the sophistication of the cartel’s member countries’ infrastructure; and Opec member governments are generally able to exert strong control over production decisions through state ownership of oil companies.

Conditions in Russia are far less flexible and favour increasing exports to full capacity, the article says. Russian oil fields as a whole are significantly less developed than those in Opec countries, meaning that tapping new wells requires high levels of investment. Moreover, the focus of Russia’s oil industry is in inland Siberia, more than 2,000 miles from its main target markets in western Europe. This means that building new pipelines requires far bigger infusions of capital than in, for instance, Saudi Arabia. Hence, once capital is invested in the pipelines, firms looking to get a return on their investment have a strong incentive to pump oil at full capacity.

Another factor working against Russia is that ongoing privatisation and competition in the country’s oil markets have weakened the state’s grip on the sector compared with other energy sectors, such as natural gas and electricity, where one company – Gazprom and Unified Energy Systems respectively – still dominates each market.

In a recent survey of the world’s biggest oil firms by trade publication Petroleum Intelligence Weekly, ten Russian firms appeared in the top 50, only two of which – Rosneft and Slavneft – have majority state ownership. In contrast, all 11 Opec countries have a single, fully state-owned entity, making it far easier for the state to control production levels and, consequently, prices.

Wood Mackenzie identifies several areas of uncertainty that will determine the future importance of Russian oil exports. One is the level of production growth. Wood Mackenzie says it agrees with an increasingly held view among analysts that Russian crude production can reach about 9 million b/d by 2005 and 10 million b/d by 2010.

Another issue is that the potential for this production growth to translate into export sales depends on two factors: the level of domestic demand and the available capacity in the oil export infrastructure. Wood Mackenzie says that despite forecasts of increased Russian economic growth, domestic oil demand will be limited by increased efficiency in oil usage and an upgrading of the country’s refinery system, potentially increasing the level of exports to about 7 million b/d in 2010 from about 5 million b/d today, or about 11% of estimated world exports from 8% today.

But in order to reach these estimated production levels, Wood Mackenzie says about $100 billion of investment will be required over the next eight years – and this may not prove easy to attract.

Western oil firms have suffered major losses from past investments in Russia. In 1997, one of the first major players in post-Soviet Russia, BP, lost almost all its $500 million investment in Russian oil company Sidanco when that firm went into bankruptcy. Other companies have also experienced problems after a rush of initial investment in the early 1990s. Oil company Amoco, which merged with BP in 1998, abandoned a $100 million investment in the Priobskoye field in Siberia, saying its partner in the investment, Russian oil giant Yukos, kept changing the terms of the deal.

However, investment conditions seem to be changing for the better. The World Bank estimates that Russian companies invested about $10 billion in the oil industry in 2001, compared with $1.5 billion in 1999, and western oil services firms such as Halliburton and Schlumberger have since been hired to repair and upgrade wells.

And Russia received a major boost in February 2003 when BP re-entered the country’s oil sector with a proposed $6.75 billion investment, the biggest ever by a foreign company, to create Russia’s third largest oil company in conjunction with Russian firms Alfa group and Access-Renova. “This is a major step into a country with massive oil and gas reserves and immense potential for future growth,” said BP chief executive John Browne in a statement to mark the announcement.

Caution

But it remains to be seen whether the BP deal will open the floodgates of foreign investment into Russia. Some investors are still sounding cautionary notes.

For example, in December 2002, when the Russian government auctioned its stake in oil company Slavneft, foreign bidders were discouraged by the government from participating, the auction itself lasted only a few minutes, and three of the four bids came from the same source, Invest Oil, a foreign-registered joint venture of Russian oil firms Sibneft and Tyumen. Rival company Rosneft, which was also barred from the process, declared the result a “farce” and is appealing to the government, according to Russian media reports.

Wood Mackenzie warns that while the Russian government is well aware of the need for foreign investment, any transfer of the ownership of Russian oil companies to foreign firms could be politically unpopular. If Russia is to fulfil its potential as the dominant non-Opec player, says the firm, it will need to resolve the political dilemmas implied by the increased international investment that will be necessary in the next two decades.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Energy

ETRM systems 2024: market update and vendor landscape

This Chartis report evaluates energy trading and risk management systems that provide front-to-back, asset class-specific and geography-specific coverage, and considers the full energy trade lifecycle

CTRM systems 2024: market update and vendor landscape

A Chartis report on commodity trading and risk management systems that considers its different applications and addresses the market and vendor dynamics to determine the long-term and structural impacts of the overarching market evolution on the…

Energy Risk Commodity Rankings 2024: markets buffeted by geopolitics and economic woes

Winners of the 2024 Commodity Rankings steeled clients to navigate competing forces

Chartis Energy50

The latest iteration of Chartis’ Energy50 ranking

Energy trade surveillance solutions 2023: market and vendor landscape

The market for energy trading surveillance solutions, though small, is expanding as specialist vendors emerge, catering to diverse geographies and market specifics. These vendors, which originate from various sectors, contribute further to the market’s…

Achieving net zero with carbon offsets: best practices and what to avoid

A survey by Risk.net and ION Commodities found that firms are wary of using carbon offsets in their net-zero strategies. While this is understandable, given the reputational risk of many offset projects, it is likely to be extremely difficult and more…

Chartis Energy50 2023

The latest iteration of Chartis' Energy50 2023 ranking and report considers the key issues in today’s energy space, and assesses the vendors operating within it

ION Commodities: spotlight on risk management trends

Energy Risk Software Rankings and awards winner’s interview: ION Commodities