Are there enough liquid assets to satisfy regulations?

Incoming rules will create demand for large quantities of liquid assets – principally government bonds – and will also require those assets to be locked away. It’s not clear there are enough bonds to go round, and nobody knows how the system will function when it’s less well lubricated. By Duncan Wood

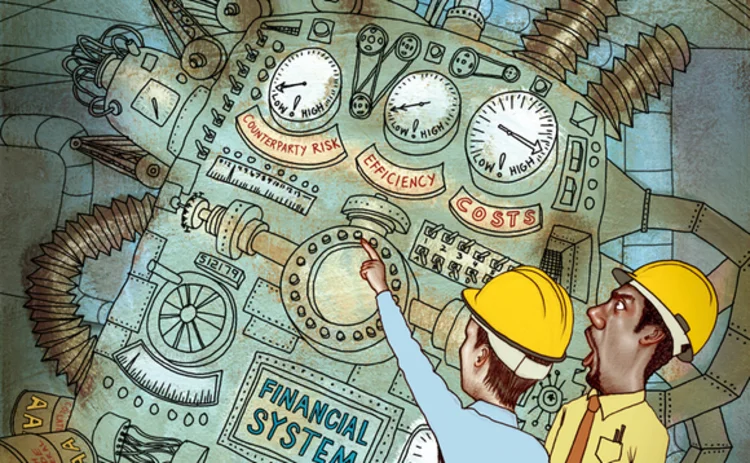

If the financial system is a machine - a rumbling contraption of cogs, gears, belts, levers and dials - then liquid assets are the grease that keeps it running. Regulators are now putting the finishing touches to three different sets of rules that will force market participants to hold more liquid assets, possibly amounting to multiple trillions of dollars - but will also prevent this grease from

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net