Feature/Technology

Plugging the gaps

The various post mortems into the causes of the financial crisis have highlighted weaknesses in bank risk management practices. In particular, many banks approached risk on a silo basis, with little attention given to firm-wide exposures. Are banks…

Fit for forex

A variety of online trading and analytics platforms are being offered by banks to their clients. Risk looks at the functionality and benefits of some of these systems. By Ryan Davidson

Unblocking the euro pipeline

Last month brought a huge EUR48.4 billion of new corporate bonds, more than half the total amount of supply one investment bank predicted for the whole year in the euro market. Matthew Attwood looks at the drivers of the trend, and finds that in one…

Q&A: David Pagliaro & Peter Jones

Two S&P executives explain how the rating agency's ABSXchange platform for structured products and the VSS valuations service benefit investors in today's unpredictable markets

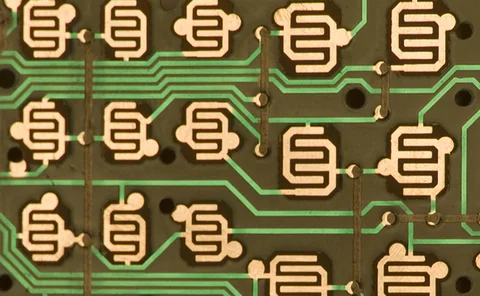

Systems for best practice - Oiling the cogs

Technology

Software Survey 2009

Software Survey 2009

Lean machines

Technology

A model approach

Technology

Bypassing Basel

Risk management

The Rubik's cube of risk

The financial crisis has emphasised the need for integrated risk management and closer collaboration between trading desks and the middle office, covering market risk, collateral management, limits and counterparty risk exposure calculation. How well are…

Buy-side backlash

Trading costs

Industry tackles valuation anxieties

The methodologies and processes used to value illiquid securities in hedge fund portfolios have become a hot topic for managers and investors alike. Hedge Funds Review examines some of the challeges and issues facing managers and administrators

IT spending set to fall below $1bn

As hedge fund managers square up to the most precipitous market challenges in their history, the industry is likely to have to contend with the prospect of less cash, fewer assets under management and slashed technology budgets.

Market graphic - The 2008-2010 credit cycle

Default rates are on the way up, but by how much? Ulf Erlandsson and Graham Rennison, quantitative analysts at Barclays Capital, use data on credit conditions to predict default rates and economic growth rates over the next two years of the cycle

Counting on the counterparty

High-profile banking failures have led to uncertainty over the ability of credit derivatives counterparties to honour their side of the trade. Contingent credit default swaps, or CCDS, are designed to mitigate this risk. But will plans for a central…

Regulatorisches Chaos

Leerverkäufe

Die Lehren aus der Katastrophe

Katastrophenrisiko

Go east

Once on the periphery of risk management technology, Asia has become the focus for research and development of risk and trading systems. Various technology vendors have bolstered their activities in the region, but what is driving the move? Clive…

È tempo di un nuovo modello?

Modelli di capitale economico