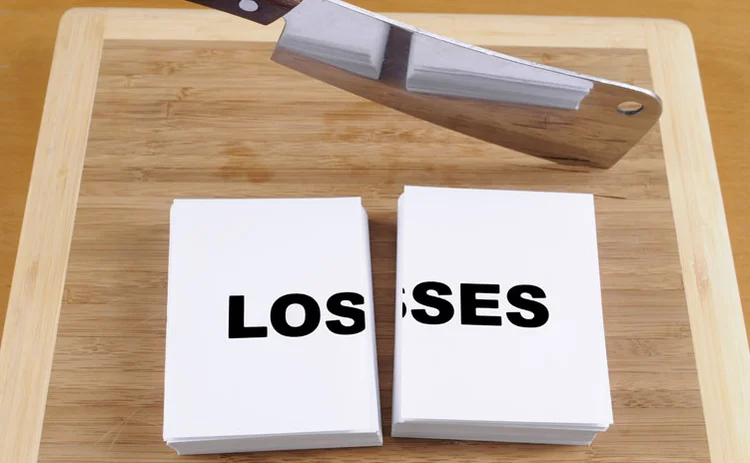

Knight Capital losses spur focus on algo risk management

Losses suffered by Knight Capital as the result of a rogue algorithm have again focused attention on the risks involved in automated trading. With algos expected to be used more widely in over-the-counter markets in the near future, how are market participants and regulators seeking to keep machines under control? Clive Davidson reports

When a rogue algorithm racked up $440 million in losses for Knight Capital on August 1, other firms involved in automated trading looked in the mirror. “Management wanted to know whether the same thing could happen here,” says the head of electronic trading at one large UK bank, wearily. “So we reviewed the controls, double-checked our monitoring processes and came to the conclusion that it couldn’t.”

Knight Capital probably thought the same. The firm was no algorithmic novice, nor was it

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Trading platforms

Electronic trading of corporate bonds still work in progress

Industry members discuss the growth of electronic trading of corporate bonds

A range of investable indices to meet client needs in alpha and beta generation

Sponsored video: Societe Generale

Japan FSA threshold for trade execution 'extremely high'

Only banks with ¥6tn in derivatives must trade swaps electronically

QIC first Australian buy-side firm to execute on a Sef

Money manager looks to access all liquidity pools

Market hits back at Hong Kong plans to bar retail access to dark pools

SFC proposals to keep retail investors on the lit market come under fire

Korea clearing structure in question after HanMag trading error

Korea trading snafu casts doubt on KRX's default fund structure

Prop shops to rival dealer market-makers on broker Sefs

Impartial access rules for Sefs allow firms to gatecrash interdealer market

Australian dark pool rules shift liquidity back to the lit market

Decline in broker-dealer dark pool volumes after Asic introduces requirements for price improvement

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- Top 10 op risks: third parties stoke cyber risk