Swaps data: the big get bigger in cleared swaps

First half of 2018 sees strong growth in cleared OTC derivatives volumes, and a reinforcing of the leaders’ positions, writes Amir Khwaja of Clarus FT

As the second quarter of 2018 ends, with escalating trade tensions dominating the news, continuing uncertainty in European politics and the Federal Reserve maintaining its rate-hike path, it is a good time to take stock of cleared swap volumes.

There is a fairly simple story of growing activity across most of the big cleared products: US dollar and euro interest rate swaps, as well as US and European credit derivatives, and non-deliverable forwards, all posted a big jump in volume compared with the first half of last year.

The exception is yen interest rate swaps, with volumes dropping for both the Japan Securities Clearing Corporation and LCH’s SwapClear. But in another respect, yen swaps confirms the trend – when it comes to market share, the biggest central counterparty in each product has tended to see its position reinforced over the past six months.

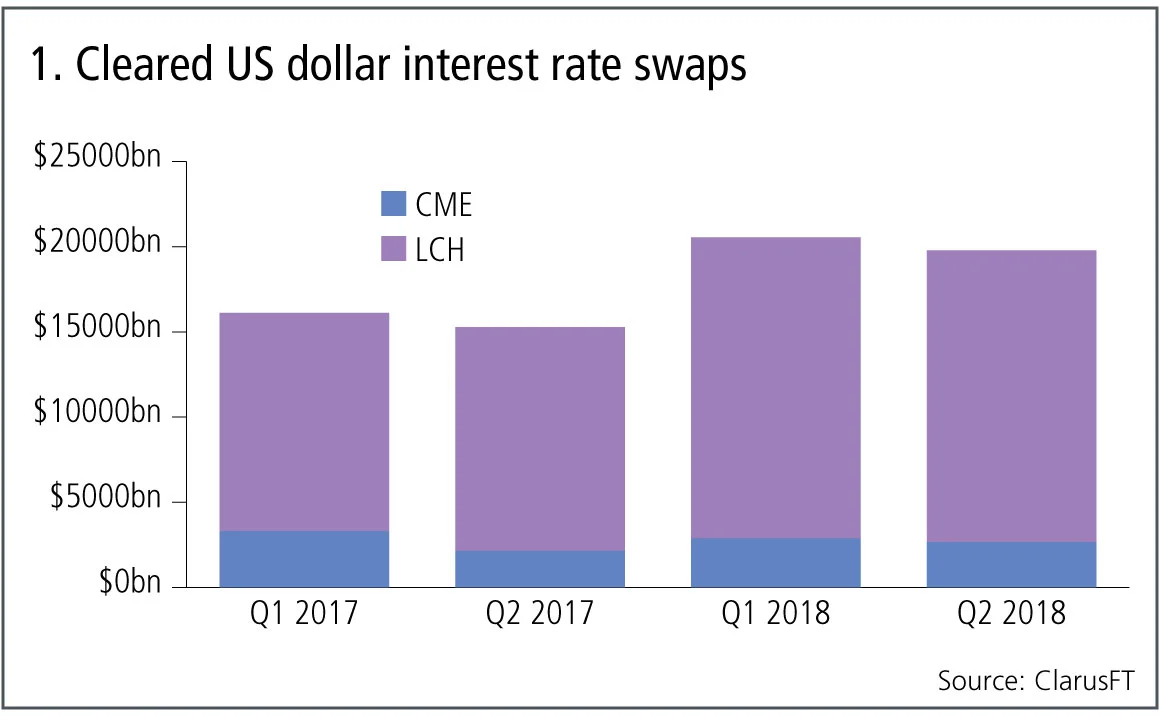

Cleared US dollar swaps

Let’s start with the largest product; cleared US dollar interest rate swaps.

Figure 1 shows:

- Volumes significantly higher in 2018.

- $20.5 trillion in Q1 2018 and $19.8 trillion in Q2 2018.

- LCH SwapClear with 87% share and CME with 13% in Q2 2018.

- LCH SwapClear up 38% in Q1 2018 from Q1 2017 and 30% in Q2 2018 from Q2 2017.

- CME over-the-counter down 13% in Q1 2018 and up 24% in Q2 2018.

- This year has brought two strong quarters, and we also know from underlying data that a number of days in the second quarter of 2018 saw record – or close to record – daily cleared volumes.

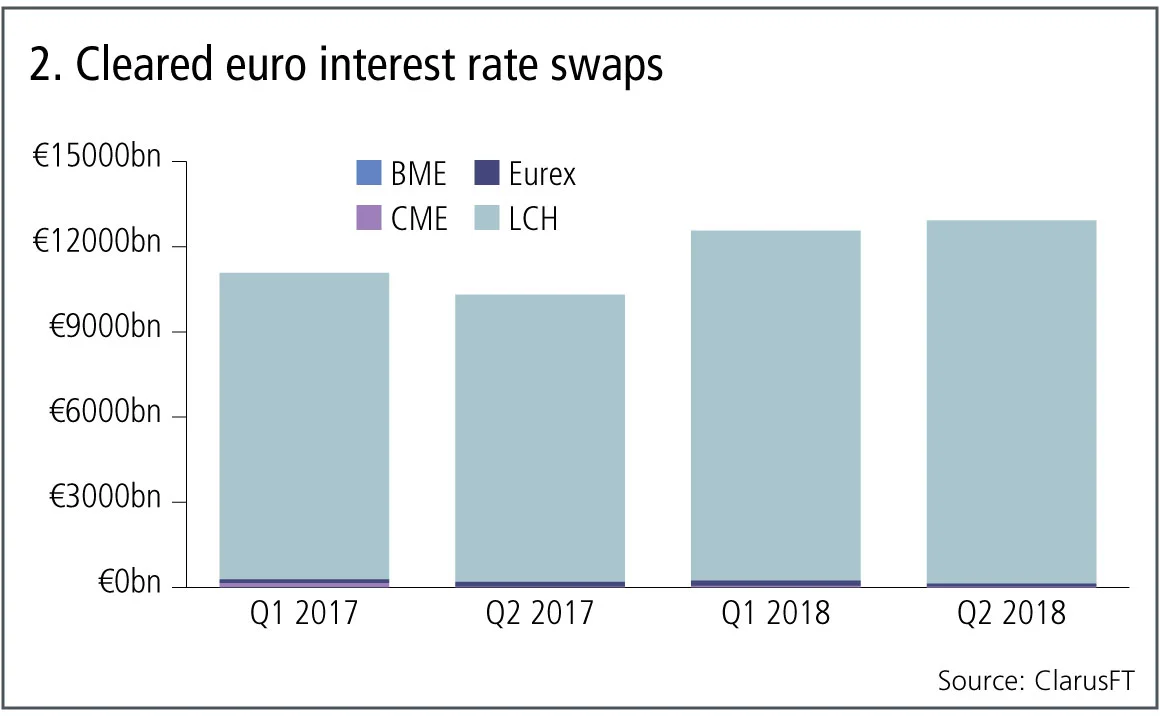

Cleared euro swaps

Next, the second-largest product – cleared euro interest rate swaps.

Figure 2 shows:

- Volumes again significantly higher in 2018.

- €12.6 trillion in Q1 2018 and $12.9 trillion in Q2 2018.

- LCH SwapClear with 99% volume share in Q2 2018.

- LCH SwapClear up 14% in Q1 2018 and 27% in Q2 2018.

- Eurex up 38% in Q1 2018 and down 36% in Q2 2018.

- CME OTC down 61% in Q1 2018 and down 24% in Q2 2018.

- BME with tiny volume in 2017, but little in 2018.

LCH SwapClear continues its long dominance in euro volumes with no evidence of any increase in market share at Eurex – despite some reporting to the contrary.

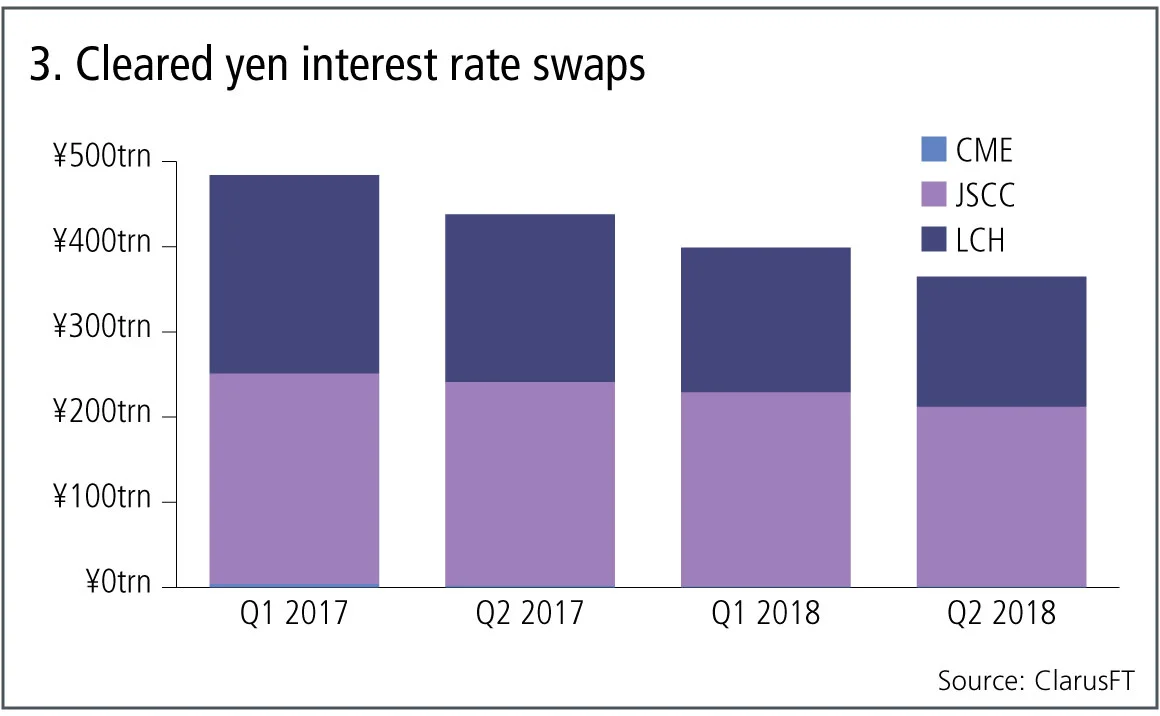

Cleared yen swaps

And now, looking at cleared yen interest rate swaps.

Figure 3 shows:

- Volumes for yen on a downward trend.

- ¥400 trillion in Q1 2018 and ¥365 trillion in Q2 2018.

- JSCC with 58% share and LCH SwapClear with 42% in Q2 2018.

- JSCC down 8% in Q1 2018 and down 12% in Q2 2018.

- LCH SwapClear down 27% in Q1 2018 and 22% in Q2 2018.

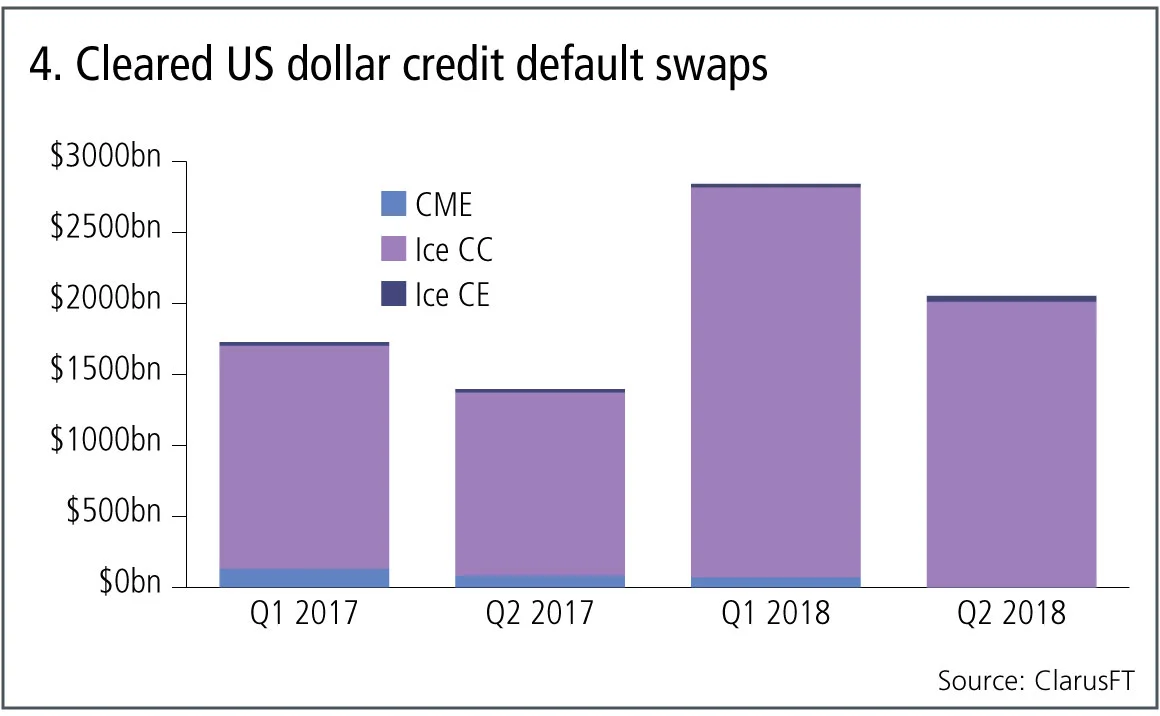

Cleared US dollar credit default swaps

Let’s now switch focus to credit derivatives and the volume of credit indexes and single names in US dollars.

Figure 4 shows:

- Volumes significantly higher in 2018.

- $2.8 trillion in Q1 2018 and $2 trillion in Q2 2018.

- As March is the index roll month, Q1 volume is inflated by roll -volumes.

- Ice Clear Credit dominates with 98% share.

- Ice Clear Credit up 75% in Q1 2018 and 56% in Q2 2018.

- CME shutting down its service in Q2 2018.

Cleared credit derivatives volumes showing even higher growth than cleared interest rate swaps, though a much smaller market with $2 trillion to $20 trillion in gross notional over a quarter.

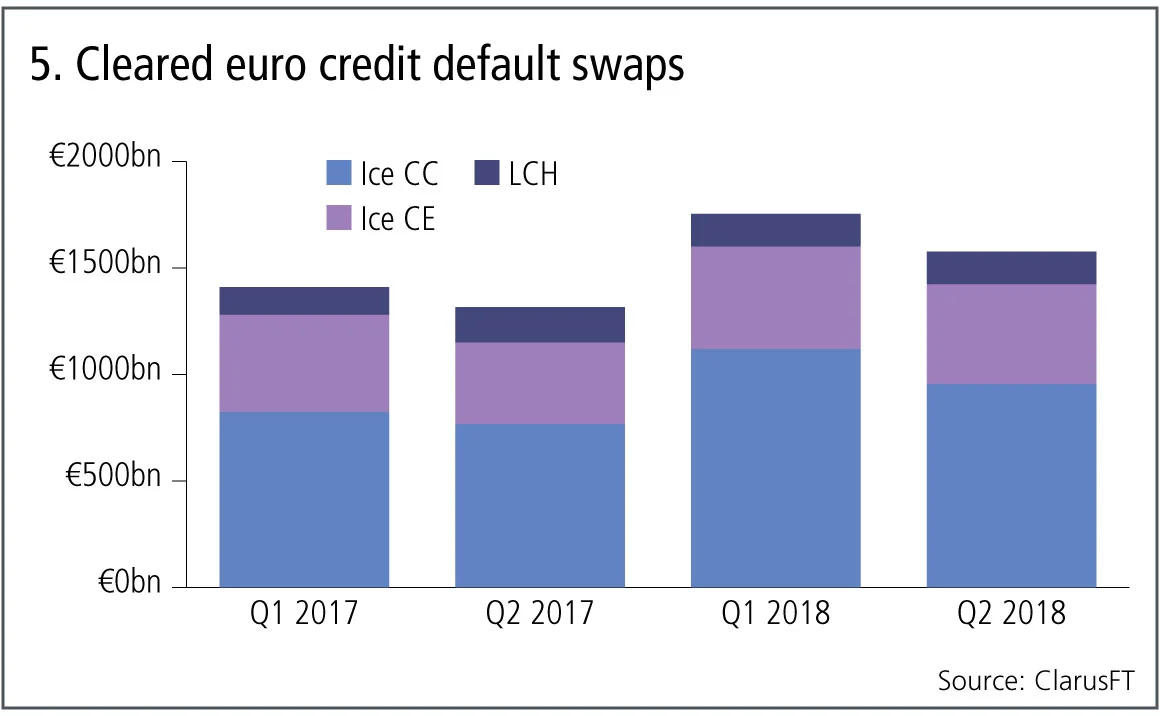

Cleared euro credit default swaps

Next, let’s look at the volume of credit indexes and single names in euro.

Figure 5 shows:

- Volumes also significantly higher in 2018.

- €1.75 trillion in Q1 2018 and €1.6 trillion in Q2 2018.

- Ice Clear Credit with 60% share, Ice Clear Europe 30% and LCH CDSClear with 10%.

- Ice Clear Credit up 36% in Q1 2018 and 24% in Q2 2018.

- Ice Clear Europe up 6% in Q1 2018 and 22% in Q2 2018.

- LCH CDSClear up 17% in Q1 2018 and down 8% in Q2 2018.

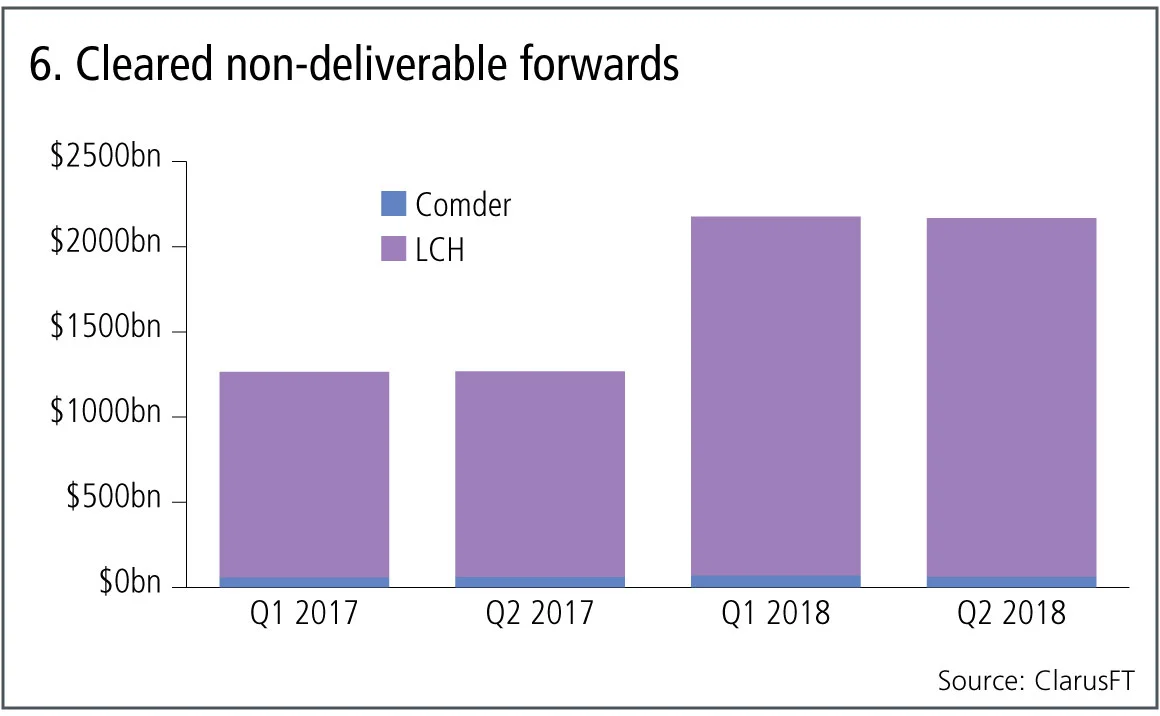

Cleared non-deliverable forwards

Finally let’s look at cleared non-deliverable forwards.

Figure 6 shows:

- Volumes again significantly higher in 2018.

- $2.2 trillion in Q1 2018 and Q2 2018.

- LCH ForexClear dominant with 97% share.

- LCH ForexClear up 74% in Q1 2018 and 74% in Q2 2018.

- Comder up 22% in Q1 2018 and 4% in Q2 2018.

Cleared non-deliverable forwards volumes are exhibiting the highest growth rates of any of the products we have covered today.

In fact, with the exception of yen interest rate swaps, all the other major cleared OTC derivatives we have looked at are significantly up in 2018 compared with 2017. In each case, the bulk of volume growth has been captured by the clearing house with the largest share in that product, and there is no visible material change in market share.

It will be interesting to see whether the upcoming quarters maintain the growth trend.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: Tech glitch gives customers unlimited funds

Also: Payback for slow Paycheck Protection payouts; SEC hits out at AI washing. Data by ORX News

Op risk data: Lloyds lurches over £450m motor finance speed bump

Also: JPM trips up on trade surveillance; Reg Best Interest starts to bite. Data by ORX News

Georgios Skoufis on RFRs, convexity adjustments and Sabr

Bloomberg quant discusses his new approach for calculating convexity adjustments for RFR swaps

In a world of uncleared margin rules, Isda Simm adapts and evolves

A look back at progress and challenges one year on from UMR and Phase 6 implementation

Op risk data: Morgan Stanley clocked in block trading shock

Also: HSBC deposit guarantee gaffe; Caixa hack cracked; reg fine insult to cyber crime injury. Data by ORX News

Digging deeper into deep hedging

Dynamic techniques and gen-AI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

How AI can give banks an edge in bond trading

Machine learning expert Terry Benzschawel explains that bots are available to help dealers manage inventory and model markets

Op risk data: US piqued by Pictet tax breach

Also: US Bank’s Covid failings; South Korea’s short-selling clampdown. Data by ORX News