Technical paper/Commodities

Purchase timing

Managing purchase timing risk is a constant issue for wholesale power buyers. Pavel Diko reviews products that reduce this risk, proposes a lookback option that can eliminate it completely and outlines a hedging strategy for the option writer

Gas portfolio and transport optimisation

Deciding which instruments to use to balance gas flows is not easy. Gido Brouns and Alexander Boogert discuss how to achieve gas portfolio optimisation by integrating this with the various gas transportation options available

Trading opportunities in the Nymex frac spread

This article examines the long-term relationship between natural gas and propane futures. Using a technique known as 'frac' spread trading, Mbodja Mougoué and Steven Slack illustrate the opportunities that can occur from using the price fluctuations in…

A fair-value enterprise

Cutting Edge: Liability management

Commodity options optimised

In 2005, John Crosby introduced a very flexible framework in which it is possible to price derivatives, including exotics, on almost any underlying commodity. In this article, he shows how pricing can be done approximately 30 to 400 times faster than the…

Hedging weather exposure

Volumetric weather risk is usually levered by the commodity price, resulting in cross-commodity exposure known as a quanto. Hedging such exposure with quanto instruments is costly. Victor Dvortsov suggests a simple strategy that allows efficient hedging…

Calibrating inflation

Cutting Edge: Inflation Models

Nuclear fusion R&D

In 50 years, nuclear fusion may be a major source of energy, but until then extensive research and development is needed. To justify the current and future R&D expenditure, a cost-benefit analysis designed specially for this sector is required. David…

A matter of principal

Developing term structure models can be tricky, as unknown factors and non-observable variables can affect futures prices. But principal components analysis is useful in tackling these problems. Here, Delphine Lautier uses PCA to pin down price movements…

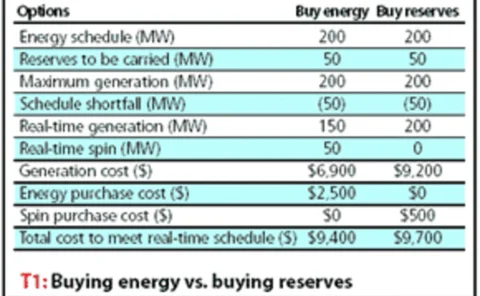

Real-time trading

Rankings 2005

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Correlated defaults: let's go back to the data

Estimates of asset value correlation are a key element of Merton-style credit portfoliomodels. Many practitioners have access to asset value data for a large universe of listedfirms, so estimation is within reach. Alan Pitts describes a statistical…

An integrated framework for the governance of companies

Cases of insolvencies, losses and internal frauds have been increasing of late. As a result, the question is asked more and more often whether such cases could have been avoided with better governance of companies or a clearer organisational handbook. In…

Constructing an operational event database

Michael Haubenstock of US bank Capital One outlines a framework for an event database, formulated with current US regulatory guidance on the subject in mind. The text is an abstract from The Basel Handbook, which has just been published by Risk Books.

The one-year lag

market graphics

Trading techniques

Rankings 2004

Mark up the scorecard

Sergio Scandizzo and Roberto Setola explore the application of a scorecard approach to the measurement of operational risk, assessing both its reliability as a risk-management tool and the practicalities of its implementation.

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals.

Creating an op risk loss-collection framework

To meet the Basel II advanced measurement requirements and improve op risk management, firms must establish robust loss databases. Ulrich Anders and Jürgen Platz of Dresdner Bank in Frankfurt outline such a framework.