Technical paper/Central banks

Inflation ist normal

Der Neueste Stand - Inflationsderivate

Structural modelling of subprime mortgages

With the economy still suffering from the waves of the credit crunch, triggered by a housing price slump, Yong Kim provides a structural model of subprime mortgages based on housing market risks. Given the enormity of the subprime mortgage market failure…

The contractual trust arrangement

Technical papers

Modellierung von Inflation

Der Neueste Stand: Inflation

The true cost of no-cost mortgages

Banks offering no-cost mortgages have been accused of hiding the real cost of the loan from borrowers. But as Andrew Kalotay and Jinghua Qian explain, lenders can also run into problems if they fail to calculate correctly the prepayment behaviour of…

Modelling South African swap spreads

Sponsored Statement

Banca Aletti

Quant Analysis

CBA Vita

Quant analysis by StructuredRetailProducts.com

FinecoVita

Quant analysis by StructuredRetailProducts.com

Banco Santander

Quant analysis by StructuredRetailProducts.com

Caring competition

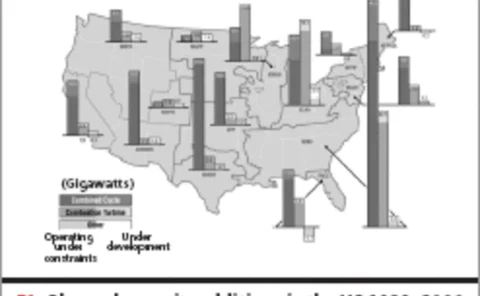

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Mediolanum Vita

Quant analysis by StructuredRetailProducts.com

Time to adapt copula methods for modelling credit risk correlation

In an evolving market, a new standard for the price quotation of credit products that models correlated changes in credit spreads as well as default times is needed, argues Darrell Duffie.

Creating an op risk loss-collection framework

To meet the Basel II advanced measurement requirements and improve op risk management, firms must establish robust loss databases. Ulrich Anders and Jürgen Platz of Dresdner Bank in Frankfurt outline such a framework.

On the slide

market trends

Fallacies about the effects of market risk management systems

This paper takes another look at allegations that risk management systems have contributed to increased volatility in financial markets, with the particular example of the summer of 1998. The paper also provides new evidence on the potential effect of…

Pro-cyclicality in the new Basel Accord

Could Basel II worsen recessions? By backtesting the proposed capital rules to the last recession, D. Wilson Ervin and Tom Wilde argue that the increased risk sensitivity of loan portfolio regulatory capital in the new Accord could have unwelcome…