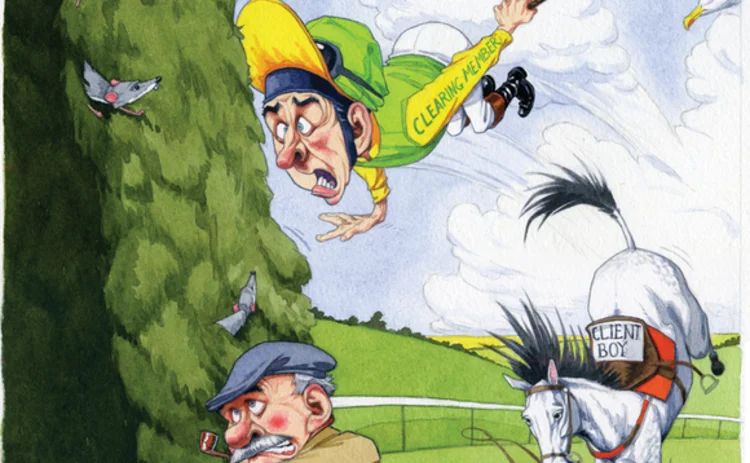

Client clearing poses acute liquidity risks

Many end-users are unlikely to have spare cash on hand to meet potentially huge central counterparty margin requirements. Clearing members suggest they could intermediate by providing collateral transformation services, but many participants argue the sheer size of buy-side obligations could cause severe liquidity stresses on the system. By Matt Cameron

Energy can neither be created nor destroyed: it can only be transformed from one state to another. A similar principle can be applied to risk. Regulators are putting the finishing touches on rules requiring a large portion of the over-the-counter derivatives market to clear through central counterparties (CCPs), a move they believe will reduce bilateral counterparty credit risk and make the financial system safer. For this structure to work, however, clearing houses must receive vast amounts of

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Clearing

Derivatives funding: smart solutions for a complex environment

Eurex’s cleared repo and GC Pooling offerings are helping market participants overcome challenges in the funding, financing and collateral markets

Taming the systemic risk Hydra: 10 years of mandatory clearing

Regulators, clearers and market participants reflect on a decade of the clearing requirement

Switching CCP – How and why?

As uncertainty surrounding Brexit continues and the impacts of Covid-19-driven market volatility are analysed, it is essential for banks and their end-users to understand their clearing options, and how they can achieve greater capital and cross…

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Clearing conundrum – Forging a solution for the bilateral market

Central clearing has had a beneficial effect on the over‑the‑counter derivatives market, but for some products the road to a cleared model has not been smooth. Capital, operational and margin costs of the non-cleared market have increased, while…

Clearing conundrum – Forging a solution for the bilateral market

Sponsored webinar: LCH

Asia clearing surge raises concerns over eligible collateral

Scarcity of high-quality liquid assets gives rise to liquidity risk worries, say banks

Buy side: central clearing 'a mess' as sell-side dialogue hits 'fever pitch'

Asset managers want to see futurisation of swaps get off the ground in Europe